Fighting recession has become a new kind of warfare

Loading...

| Washington

It's been five months since then-Secretary of the Treasury Henry Paulson publicly warned of a growing crisis in credit markets. Since then, successive American administrations have fought a deepening recession with the intensity and mountains of cash usually reserved for war.

Today lawmakers talk easily of numbers that a year ago would have sounded preposterous. The bank rescue announced this week could cost upwards of $2.5 trillion. The stimulus deal? That's $789 billion more.

Already the list of bailouts sounds like a roll call of past battles: AIG, Fannie Mae, Freddie Mac, GM, Chrysler. Almost 400 financial institutions now have received a federal infusion from Treasury's existing $700 billion recovery fund.

History tells them to react forcefully and fast to the downturn, say administration officials, and that's what they're trying to do. What they are fighting is not just the current downturn, but the possibility of years – perhaps a decade – of sluggish growth, of factories more idle than necessary, of unemployment that remains stubbornly high.

"The financial crises we face today are more challenging than anything our system has faced in the past ... It's going to require that we do extraordinary things," said Secretary of the Treasury Timothy Geithner at a Senate Banking Committee hearing on Feb. 10.

That may be so. But many in Congress remain uneasy about the process, unsure of the course of action, and concerned about simply handing the White House a blank check in these difficult times.

"We're talking about denominations that are daunting, ones that we've never talked about, ever before. And so the magnitude of the request is overwhelming in many ways," Sen. Christopher Dodd (D) of Connecticut, chairman of the banking panel, told Mr. Geithner.

To show how concerted the US campaign has been so far, consider what has happened to the Federal Reserve. Since August, the Fed – lender of last resort to the US economy – has tripled the size of its balance sheet by pumping cash into some tottering institutions, extending credit to others, and setting up entities to back securitized student loans and other consumer debt.

Plus, it has cut its benchmark lending rate essentially to zero. If fighting the recession is analogous to waging war, than Fed chief Ben Bernanke may be playing the shock-and-awe role of Gen. George Patton.

"This is unprecedented in the history of central banking," says Richard Sylla, a New York University financial historian, of the Fed's recent moves.

Normally a nation that piled on so much debt so quickly would be punished by international markets. The value of its currency would plunge, and the cost of servicing its debt would skyrocket.

That hasn't happened with the US, at least so far, because of its sterling record over centuries of meeting debt payments, says Professor Sylla. In fact, the US might be the only country that could make this approach work.

But it shows a willingness on the part of the nation's leaders to do whatever it takes to get out of the current mess, says Sylla. He teaches a class on the history of financial crises, and he says the ones that turned out well were those where there was bold political leadership.

So far, he gives the US administration response to the crisis, including both Bush and Obama officials, a "B+".

"I see a willingness on the part of our leaders to say, 'if this is not enough, we'll do more,' " says Sylla.

Unintended consequences?

But there may be unintended consequences to such bold actions, as well. Look at Chrysler and GM, who have already received billions in government loans, and soon will be back in Washington for more.

The auto firms' restructuring plans are due to federal authorities on Feb. 17. The US will review them and judge whether they are realistic enough to earn Detroit's "tottering two" further taxpayer support.

The point is to see if the companies "are in a position where they're going to be viable businesses without government support over time," Geithner told the Senate.

The problem is that from a political standpoint the government may find it impossible now to back away from propping up the auto industry, says Michael Bordo, a professor of economics at Rutgers University in New Jersey.

"Once you've created these goodies it is very hard to break free of them," says Professor Bordo.

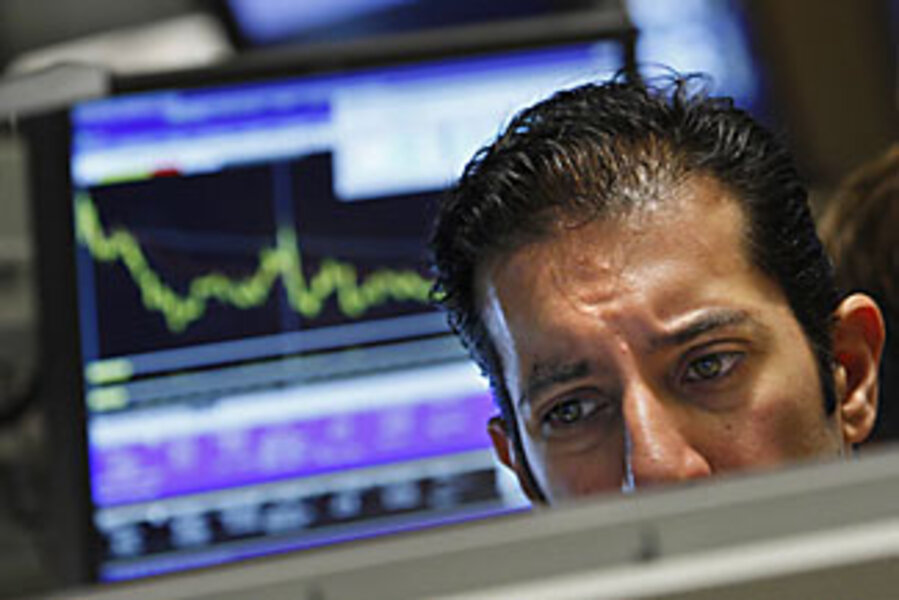

The administration may be doing its best to avoid using the word "nationalization," due to its negative political implications. But Geithner's presentation of the Obama team's new financial rescue plan has been criticized for its vagueness. The Dow Jones Index plunged 4.6 percent on Feb. 10, the day it was announced.

"They don't want to give the impression that clearing up the banks will take trillions, and that you almost have to give them a blank check to do it," says Bordo.

And the debt is indeed daunting. The total cost to the taxpayer of all the anti-recession actions taken by Washington in the last five months is yet unknown. Much will depend on such things as how the US handles any so-called "toxic assets" it takes off the hands of banks, to get credit flowing through the system again.

Numbers off the charts

Yet the potential liabilities incurred by the Federal Reserve, the Treasury, and the Federal Deposit Insurance Corp., added together, already equal $8.7 trillion, according to Sen. Richard Shelby (R) of Alabama. If you round the stimulus up to $1 trillion, you get a total possible cost of $9.7 trillion.

"Those numbers are large. But the ultimate risk to taxpayers is a small part of that," said Geithner in response to Senator Shelby's arithmetic.

The enemy the US ultimately may be fighting here might be, in Franklin Roosevelt's old phrase, "fear itself." The problem could be that banks, consumers, and industry may be paralyzed into inaction because we don't know the future, said Robert Shiller, a professor of economics at Yale, in a recent Council on Foreign Relations seminar on history and the financial crisis.

"What I think ... was damaged in the Great Depression and is damaged now is the sense that this is a good time for anything," said Professor Shiller.

Thus Washington's goal must be to restore confidence, said Shiller. Fiscal stimulus might not necessarily do that, he added. In Japan in the 1990s, fiscal stimulus worked for a while, but when it ended, people just hunkered down again, and the economy slumped into Japan's "lost decade."

In the end, one thing is certain: This all will end. That is NYU's Sylla's point of view, in any case – one that allows him to retain some measured calm about the current situation.

"My historical perspective shows me that every previous crisis did in fact come to a conclusion," he says.