Tesla posts first profitable quarter in three years

Loading...

For the first time in three years, Tesla Motors was profitable.

The electric car manufacturer posted a profitable third quarter on Wednesday, easing some tensions among investors about the company’s viability. Despite the recent downgrade of Tesla shares by Goldman Sachs, the company ended the quarter with $176 million in positive cash flow.

"Things are looking good," Musk said in a conference call. "It's not to say there could be some darkness ahead... [but] it's overall looking quite promising."

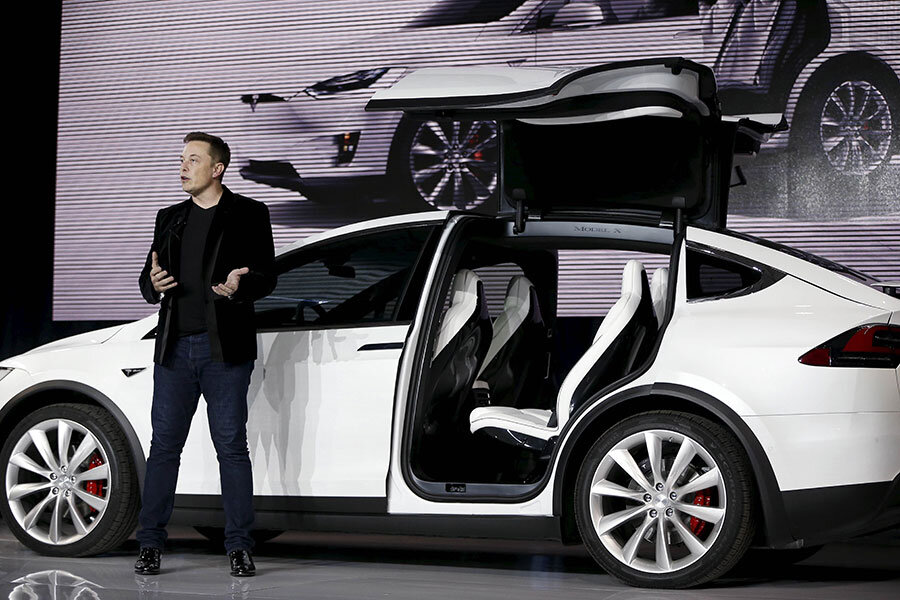

Following the announcement, CEO Elon Musk said that the company will not need to raise more capital for its more affordable Model 3 sedan. In previous quarters, investors expressed concerns that the company would not be able to meet delivery projections for the new line.

The company has recorded consistent net losses in the previous 12 quarters. That’s because, in many ways, Tesla still has a start-up mentality, writes The Car Connection's Richard Read:

While Tesla's losses might sound alarming, they're probably to be expected for a company that is still, to many minds, a start-up. As the saying goes, you've got to spend money to make money, and Tesla is spending like crazy in the hope that its investments will pay off down the road. (Based on the very strong demand for the Model 3 sedan, that may be a safe bet.)

Translation: the numbers aren't so good now, but once Tesla has its facilities in order, the financials could level out. Until then, it will have to make do with fairly modest sales revenue and funds generated from sources like stock sales, which pumped $1.7 billion into the company's coffers in May.

Tesla’s investments appear to have paid off for now, but there’s a caveat. The company buoyed third quarter profits by selling $138.5 million in clean-car credits, but those are likely to add little revenue in the fourth quarter. Meanwhile, it’s still unclear whether Tesla’s purchase of SolarCity would make or break the company’s finances.

Shareholders from both companies are expected to vote on the proposed deal on November 17. Since most of the company’s capital spending will occur next quarter, Tesla may end the year with negative cash flow, analysts say.

"It was a kitchen sink effort to get the third quarter to look good ahead of the deal vote," CFRA Research analyst Efraim Levy told Reuters.

This report includes material from the Associated Press and Reuters.