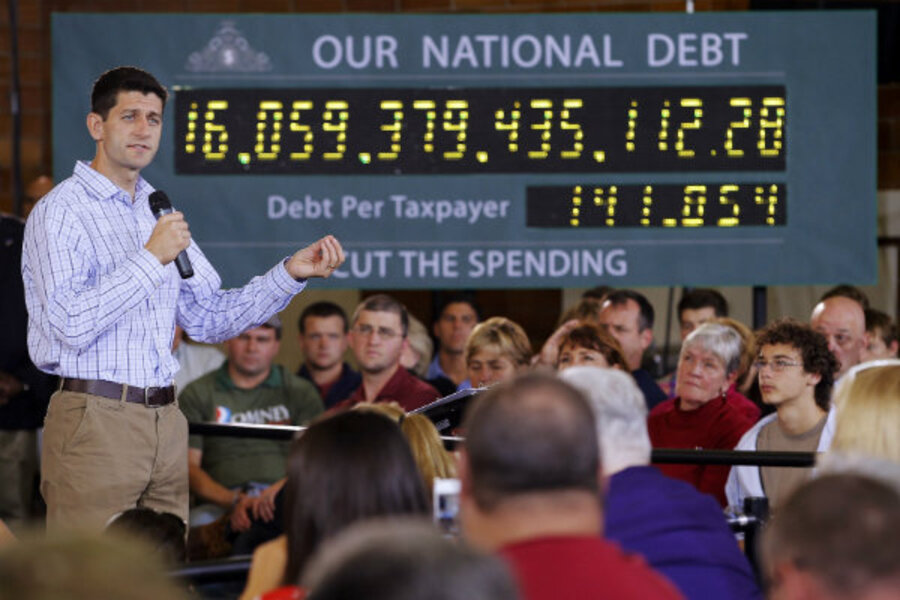

The only way to get the US debt under control is to curb spending. Americans are not undertaxed. As the economy recovers, we’ll pay the same proportion of our national paycheck (just over 18 percent) in taxes as we’ve done on average for the past 50 years.

Our problem is too much spending. Inflation-adjusted federal spending per household has jumped 36 percent over the past decade, to more than $30,000 a year. And spending is literally out of control. Two-thirds of it goes to programs such as Medicaid for the poor, and Medicare and Social Security for older people. These “entitlements” don’t even require annual congressional votes.

The fix? First, put all programs, including Medicare, on a real long-term budget that has to be voted on each year. That would impose real control over what is now autopilot spending.

It’s true that Congress could always increase this spending. But lawmakers would have to do so openly, and the do-nothing default setting would be to stick to the budget – today the default is automatic increases in spending.

Second, to slow unsustainable entitlement spending, some of us who are baby boomers or seniors will have to accept some belt-tightening. Taking every penny of Social Security and Medicare we’ve been promised will only force our kids and grandkids deeper into the quagmire of national debt. That’s just not right. So if we are well off, we need to agree to a smaller Social Security check and higher Medicare premiums.

And third, once we get spending on track again, we need a federal balanced-budget amendment with a spending limitation to stop Congress from overspending – just like the amendments that force states to put their houses in order.

Sending more money to Washington is not the answer. It will simply be spent as it always has been. Spending control is the only solution.

Stuart M. Butler is director of the Center for Policy Innovation at The Heritage Foundation.