Global climate investment hits plateau

Global investment in renewable and energy-smart technologies hit a plateau in 2012, according to a new report.

The scaling back of subsidies designed to spur investment in Europe, the low price of natural gas in the United States, and a reduction in wind power spending in China have helped offset new investments elsewhere, according to the Climate Policy Initiative (CPI) report, released Tuesday. In 2012, investments in climate finance stood at $359 billion, just shy of the $364 billion investment seen in 2011.

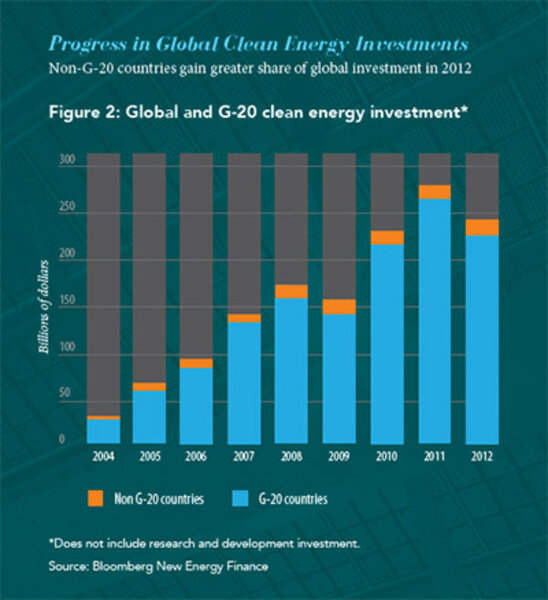

An earlier analysis suggested an actual slowdown in clean-energy investment. A joint report from Bloomberg New Energy Finance and the Pew Charitable Trusts found that clean energy investment declined 11 percent decline in 2012 to $269 billion. (The Bloomberg data did not include research and development investment.) While Bloomberg's 2012 figure is significantly lower than 2011, it is five times that of 2004, which supports CPI's suggestion that investment appears to be leveling off following a decade of steady growth.

While the global annual averages offer an important perspective of aggregate investment, they offer little insight into regional shifts.

“We are seeing some markets start to plateau while others start to take the lead,” says Johanna Lewis, an assistant professor of science, technology, and international affairs at Georgetown University in Washington. “In the solar industry, for example, you see China playing an increasingly prominent role while European countries are stabilizing and in some cases on the decline.”

Global averages also hide shifts in investment. “You certainly don’t see plateaus globally in solar and wind power deployment,” Professor Lewis adds.

In fact, 2012 saw a record level of capacity addition around the world bringing the year-end total to 648 gigawatts, according to the Bloomberg/Pew report. China alone installed 16 GW of wind power. Solar deployment increased globally by 6 percent to more than 31 GW, the report found.

Also, a steady decline in production costs means that those deploying, say, a solar system get far more photovoltaic panels for their buck than they did a few years ago.

Last year may represent a blip on the screen rather than a long-term trend, says Phyllis Cuttino, director of Pew’s clean energy program. “I would say the outlook for the clean energy economy has been one of rapid expansion globally.”

“We have a historic amount of clean energy production – 88 gigawatts – around the world” as of 2012, Ms. Cuttino says. “Even in places like Germany or Spain where there has been a pull back of subsidies there is still long-term growth.” [Editor's note: This paragraph was changed to make clear the clean-energy total referred to last year.]

And not all investments are created equal, says William Pizer, an environmental policy professor at Duke University. “The main question is not just how much we are spending, but what are we getting for it.... The issue for the public sector resources specifically is whether or not the limited public resources that we have are being spent as effectively as possible."

One of the net gains of public investment is the additional incentive it gives for private investment, according to the CPI report. "Public policies, resources, and money are the ‘engine room’ of the climate finance system, and can alter the balance between risk and return in ways that drive the supply and demand for finance."

Public investment can stimulate private investment, Professor Pizer agrees. "In the simplest case, there may be a lack of familiarity by the private sector with a particular sector or region where a public sector investor can really catalyze private sector investment with a small amount of resources by breaking down the barrier of unfamiliarity with that type of opportunity."

Additionally, public investment in the form of subsidies can help to push interested investors that don't have quite enough capital to fund a transition, Pizer says.