Are home prices headed for another drop?

Loading...

US home prices could be headed for another dip, now that a temporary tax credit offered to buyers is ending.

In fact, even before the special tax incentive ended this spring, average home prices were already dipping after a relatively stable period in 2009. They've fallen about 3 percent in the past year.

Where prices head next depends on a kind of tug of war between two forces. An improving economy should lend support to the housing market, while a tide of mortgage defaults and foreclosures will exert downward pressure on home values. For now, the consensus view is that modest declines in home values lie ahead.

Why is the housing recovery so weak?

The short answer is that housing cycles can take a long time to play out. High unemployment and foreclosures have increased the number of sellers and kept many potential buyers on the sidelines. The Obama administration goosed demand for a while with a tax credit of up to $8,000 for first-time home buyers, but it's now expiring.

Government policies and the recession have had a big effect on the market. In April, about half the buyers of previously owned homes were first-timers, and 33 percent of all sales involved distressed properties such as bank-owned homes.

The Federal Housing Finance Agency's index of home-purchase prices, which has fallen 3 percent over the past year, is down 13 percent from its 2007 peak.

How low could prices go?

The worst declines have already happened, most housing analysts say.

"We have [the FHFA index] dropping another 4 percent and then turning around in 2011," with home prices rising modestly after that, says Patrick Newport, a housing analyst at IHS Global Insight in Lexington, Mass. "That's our educated guess."

The declines could be worse, he adds, if growing numbers of Americans choose to walk away from mortgages that are deeply "under water," with balances larger than the value of their homes.

Currently, more than 7 million mortgage borrowers are in a "negative equity" hole of 10 percent of more of the home's value, according to the data firm CoreLogic.

Still, a May online survey by Harris Interactive found that 59 percent of mortgage borrowers say they would not consider walking away from their homes no matter how deeply under water they are.

One force putting a floor under prices is affordability. Prices have fallen far enough in many markets to lure people to buy rather than rent.

Do price trends vary a lot by region?

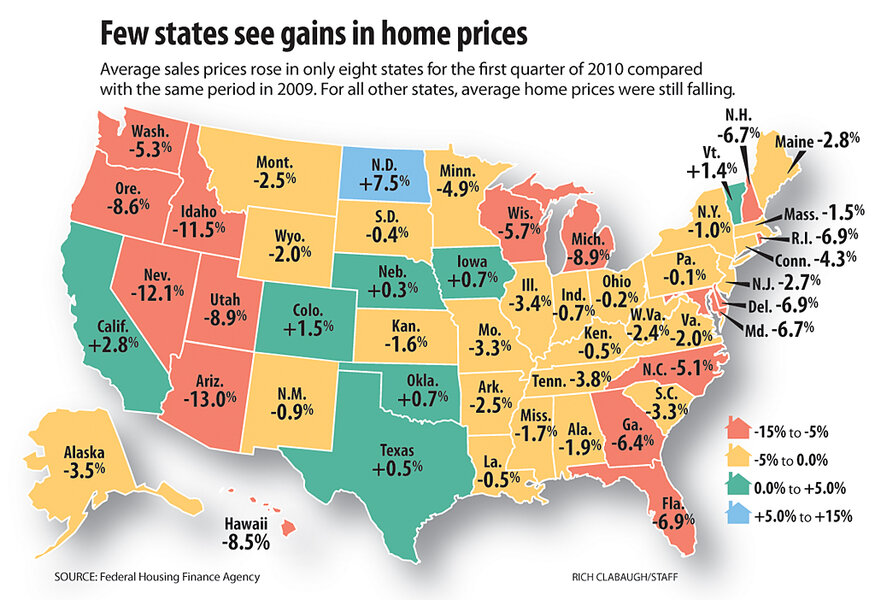

Yes. That's true whether you're comparing states or metro areas within states. As the map shows, prices rose in some states in the past year. The deepest problems remain concentrated in Western boom states, Florida, and Michigan.

The timing of price changes differs by geography, too. California and Florida have seen similar price declines since the recession began, but more of Florida's drop occurred over the past year. Idaho looks bad on the map, but its price declines in 2008 were not nearly as bad as those in neighboring Nevada.

Will government efforts to reduce foreclosures help?

That's still unclear. The Obama administration has ramped up efforts to get lenders to consider writing down the principal on loans, but the rate of redefault on modified loans tends to be high.

The Center for Responsible Lending predicts that 9 million homeowners, or nearly 1 in 5 mortgage holders, could go through foreclosure between 2009 and 2012.

The "shadow inventory" of homes – including those where borrowers have become delinquent but are not yet in foreclosure – could take three years to work through, researchers at Standard & Poor's said in February.

What else will affect home prices?

Jobs, jobs, jobs, and also mortgage rates. The recovery appears to have picked up enough momentum that the economy is adding jobs rather than losing them. The bigger the labor market gains, the better it will be for the housing market.

One worry is that Europe's debt crisis will slow the global recovery that's under way. That's a trouble spot to watch, but most forecasters don't expect a US relapse into recession.

Demand for homes hinges not just on buyer incomes, but also on credit conditions.

The Federal Reserve recently ended one temporary program designed to prop up the housing market – its buying of US mortgage bonds. But Europe's troubles have actually had a beneficial effect on US interest rates. A typical 30-year fixed-rate mortgage was 4.78 percent as of May 27, according to the firm Freddie Mac. Credit, however, remains relatively tight.

Related:

Home values headed to new lows?