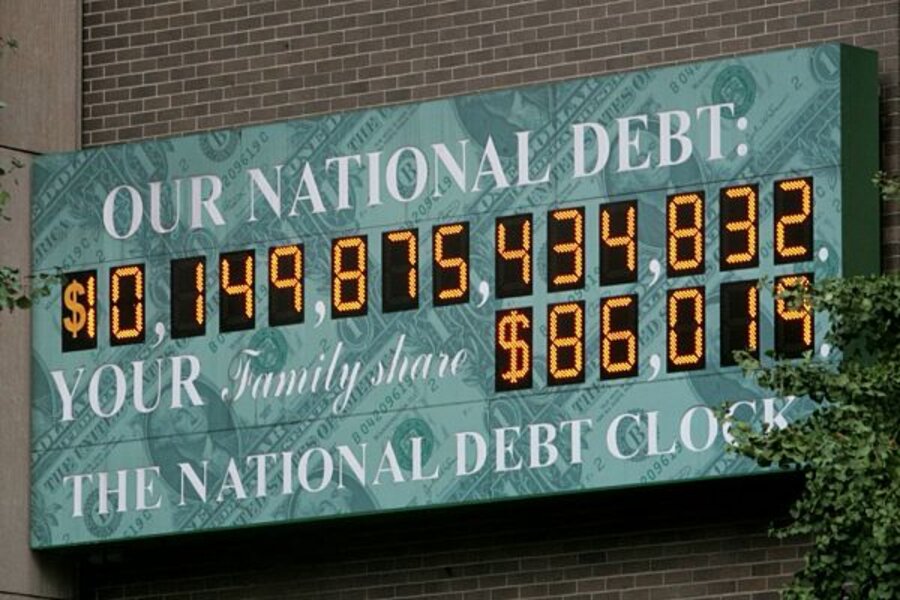

Governments can go broke. Guess who picks up the pieces.

The idea is to push slimy packages of derivative debt onto people who don’t know what they’re doing. Serving lumps to chumps, in other words. Like a high-school cafeteria.

Sometimes the victims are German banks. Sometimes they’re hedge funds. And sometimes…yes…the victims are all of us.

Here is how it works. The lowly householder can’t pay his mortgage, so the mortgage company takes the loss. The mortgage company goes broke so the banks take a loss. The bank takes a loss so another bank, the one that bought its derivative debt bomb, goes broke. And then, the feds step in and take the debt over. And then they add trillions more – claiming to protect everyone from everything…

…the guy who hasn’t saved for his retirement gets Social Security. The guy who hasn’t got health insurance gets Medicaid or Medicare or some sort of freeby medical help. The bankers get bailed out. GM gets bailed out. Farmers get subsidies. Poor people get food stamps. Lobbyists get contracts….

…and then the little government that is paying for all this can’t go on…so a bigger government bails it out…

…and then, investors buy the big government’s bonds…because they’re safer…even though they’re all in the same boat…

…and then the boat sinks! That’s Fab Finance. More about it below….

In the meantime, here’s a news item, from the Daily Press…

Government workers out-earn private sector workers.

That is part of the reason why the state, cities, counties and school boards are agonizing over how to bring their budgets in line with reduced tax revenues. Those budgets bear the pressure of salary scales for government workers that exceed those of the average private-sector worker/taxpayer.

This month, the federal Bureau of Labor Statistics released its annual look at compensation by region, by employer, by occupation, by just about any way you want to slice or dice it. Here’s what it shows for Hampton Roads, as of July 2009:

The average full-time state and local government worker in our region earned $23.46 per hour. The average private sector worker made $18.87.

You might pass that off as an artifact of differences in the labor force of the two – that the private sector has, for example, more low-end service jobs. And there’s an element of that. But the BLS handily provides numbers by occupation, so you can line up apples with apples.

And when you look many of them, government workers have the advantage. Take secretaries and administrative assistants. In Hampton Roads, they make an average of $16.86 per hour in government offices, compared to $13.72 in the private sector. In our area, health workers get $29.63, on average, in government jobs and $23.80 in private industry. The one place government workers are at a disadvantage is in the top managerial ranks.

But wages don’t tell the whole story – about compensation, or about why governments are in financial distress.

It’s the benefits. The paid leave. The health insurance. And especially, the pensions.

The BLS estimates that nationally, private industry pays $8.03 per hour in benefits while state and local governments pay $13.65 per hour. Add together pay and benefits on that national scale, and government work earns a 45 percent premium over the private sector.

The private sector is de-leveraging…as near as we can tell. Private businesses cut their payrolls. They trimmed expenses. They protected their profit margins – generally.

But the public sector figures it has a different role to play…a countercyclical role. While the private sector eases off, the public sector puts the pedal to the metal.

That’s been the story for the last year and a half. The government pays more. Hires more. And floats deeper in the water.

Walter Wriston once commented that the “government can’t go broke.” But that just shows you why the banking sector is in such trouble; Wriston ran Citibank…

The trouble with most people in economics and finance these days is that they study too much math and not enough history. If they read more history they’d know that governments go broke all the time. They’d probably get a hint about why governments go broke too – they pay too much; hire too many people; give away too much money on bread and circuses; and they get involved in too many costly foreign wars.

What’s new?

Nothing really. But the fab finance is an innovation. Now, with the debt spread among so many unaware debtors…we can all go broke in a much bigger way.

Add/view comments on this post.

------------------------------

The Christian Science Monitor has assembled a diverse group of the best economy-related bloggers out there. Our guest bloggers are not employed or directed by the Monitor and the views expressed are the bloggers' own, as is responsibility for the content of their blogs. To contact us about a blogger, click here. To add or view a comment on a guest blog, please go to the blogger's own site by clicking on the link above.