Where did the mammoth US budget deficits come from?

What’s the cause of the federal government’s huge budget deficits? That’s a question that is harder to answer in the particular than you might think. The general problem is obvious: Uncle Sam has been spending more money than he takes in. The specific reasons as to why this state of affairs exists are a mix of human decisions, economic circumstance, and the cumulative effect of time.

Context is important here. So let’s start with 2001. That year, the Congressional Budget Office looked out over the decade to come and saw ahead nothing but blue skies and black ink. It predicted that between 2001 and 2011 the US would run budget surpluses totaling $5.6 trillion.

That didn’t happen. Instead, the US racked up $6.1 trillion in deficits over that period. CBO’s prediction was a whopping $11.7 trillion off the mark. How did things go so wrong?

CBO has gone back and studied that, as it happens. In a paper published earlier this year, the group’s economists tried to pull out and compare the reasons for the multitrillion swing.

One big problem was that CBO isn’t magical. Unblessed with the ability to predict the future, it didn’t accurately foresee the economic troubles of coming years, including the crash of the Great Recession. This meant that less tax money came in than anticipated. Overall, CBO says that about $3.3 trillion of its $11.7 prediction error can be attributed to “economic and technical changes” to projected revenues.

Then there were the tax cuts. President George W. Bush instigated most of these, but President Obama also pushed through Congress a payroll tax cut intended to pump money into a moribund economy. Tax cuts accounted for a further $2.8 trillion of the $11.7 trillion discrepancy. (Yes, the big kahuna here is Mr. Bush’s 2001 reduction in income-tax rates, which alone accounts for about $1.2 trillion in revenue foregone over the decade.)

Finally, there are the increases in outflows unpredicted by CBO. Between 2001 and 2011, increased discretionary spending amounted to about $3 trillion. This category includes defense spending related to the wars in Iraq and Afghanistan, homeland security upgrades in the US, spending on food stamps and other hard-times safety net programs, and other general budget categories that are supposed to be approved annually by Congress.

Mandatory spending – a category that includes the Medicare prescription-drug program approved under Bush, the TARP bank bailout, and Mr. Obama’s economic stimulus package – went up by about $1.4 trillion during the period in question. (This type of outflow is called “mandatory” not because we had to do it, but because it results from formulas established by Congress instead of appropriated dollar totals.)

Charles Blahous, a former economic official in the Bush White House who is currently a Hoover Institution research fellow, has rolled all these numbers together into a simple pie chart. His answer to the question “where did the $11.7 trillion go?” is this: 27 percent went away due to projection inaccuracy; 24 percent went to tax cuts; and 49 percent can be accounted for by various forms of increased spending.

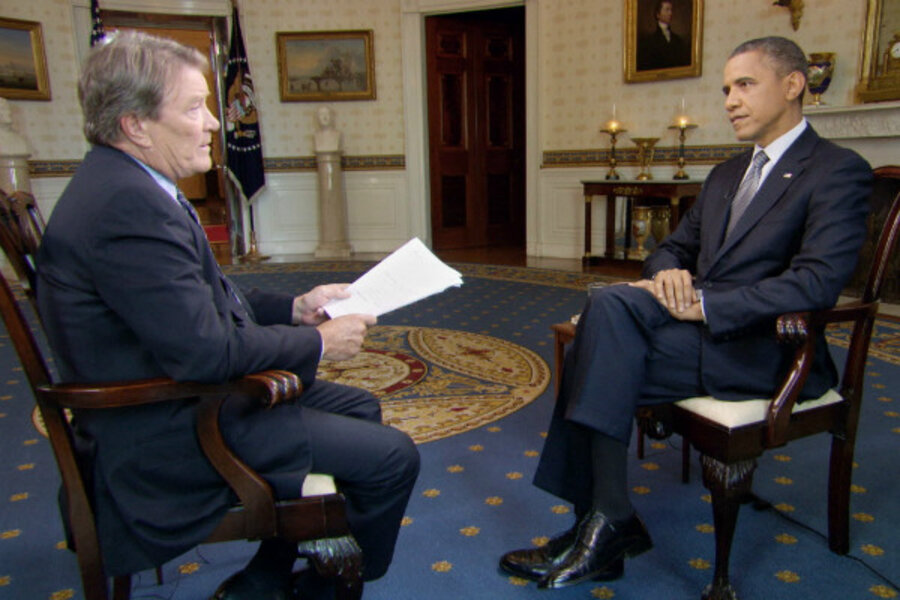

Yes, yes, but who’s to blame? It’s election season, after all, and accusations as to which party is responsible for most of this damage are as thick on the ground as October leaves after a windstorm. Asked why the debt has increased during his four years in office during a “60 Minutes” interview last week, Mr. Obama pointed a finger at his predecessor:

“Over the last four years, the deficit has gone up, but 90 percent of that is as a consequence of two wars that weren’t paid for, as a consequence of tax cuts that weren’t paid for, a prescription-drug plan that was not paid for, and then the worst economic crisis since the Great Depression.”

That answer is not accurate. Obama appeared to be talking about numbers that reflect the cumulative debt since 2001, not just his term. According to a White House-produced chart on the national debt, if you take the 10-year period of 2001 to 2011, Bush policies accounted for 55 percent of that figure. Obama-initiated policies such as the stimulus accounted for 11 percent, while the recession took care of the rest.

(The White House chart puts the total debt at $12.7 trillion, not $11.7 trillion, as does the CBO. The White House uses different underlying economic assumptions.)

But even that chart is something of an apples-to-mangoes comparison. Bush was president for eight years, and Obama for three. This is where the passage of time comes in – Bush’s tax cuts in particular had more time to accumulate and thus appear as a bigger part of the overall picture than the later-arriving Obama stimulus package.

Washington Post fact checker Glenn Kessler has looked at this in depth, and made his attempt at adding up who is responsible for the $1.3 trillion 2011 deficit alone. His rough estimate is that economic factors accounted for about 46 percent of this single-year shortfall, while Obama policies accounted for 44 percent, and Bush-era policies for about 10 percent.

Splitting up deficit causes by administration may be politically interesting. It’s possible, though, that it’s effectively pointless, in that it doesn’t lead to a better understanding of the choices that will confront US policymakers in years to come.

A more useful way of looking at things could be to reslice deficit numbers into cyclical and structural figures. The cyclical deficit is caused by stuff that varies from year to year, like food stamp spending, which is driven by unemployment. The structural deficit is welded into the structure of the federal budget like steel beams. It reflects chronic problems that only worsen, such as the rising cost of health care.

According to CBO, about $367 billion of the $1.3 trillion 2011 deficit was caused by cyclical stuff. Some $928 billion was structural. This is the part we really need to worry about, according to such budget watchdog groups as the Concord Coalition.

The most important of these structural factors should come as no surprise. They are the aging of the baby boom population, which will drive up the number of people enrolled in Social Security and Medicare; and the continued increase in health-care costs, which makes Medicare, Medicaid, and other government health-care programs more expensive on a per-person basis.

Population aging accounts for 64 percent of the cost growth of Social Security, Medicare, and Medicaid through 2035, according to a Concord Coalition analysis published earlier this year. Thirty-six percent is due to rising health-care costs.

“Borrowing our way through this is not a viable option because the rising cost of Social Security, Medicare and Medicaid is not a temporary blip. It gets bigger with time. Incurring permanently rising debt would result in staggering interest costs and ultimately a total debt burden that would crush the economy,” concludes the Concord Coalition analysis.