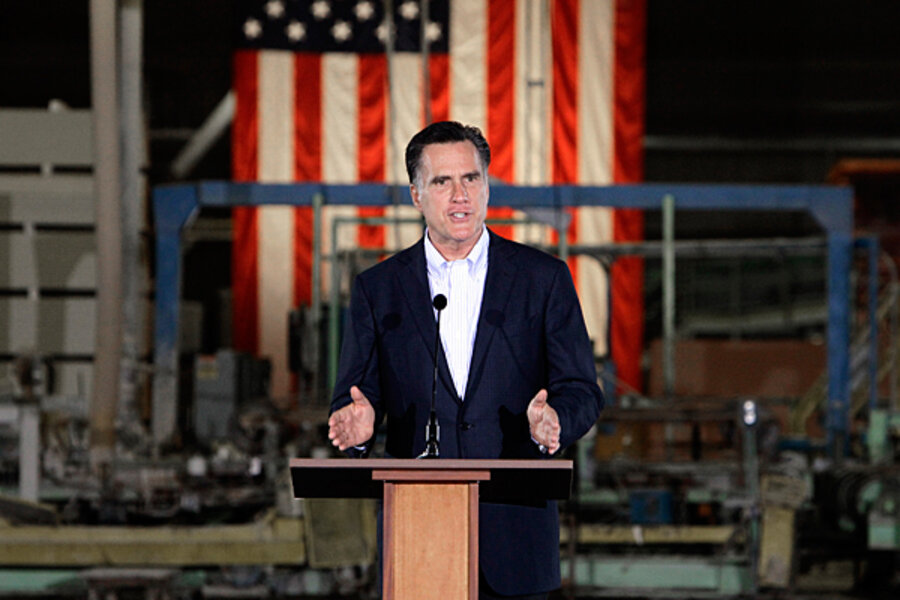

Romney tax return shows he paid $3 million. His tax plan wouldn't bump that.

Loading...

| New York

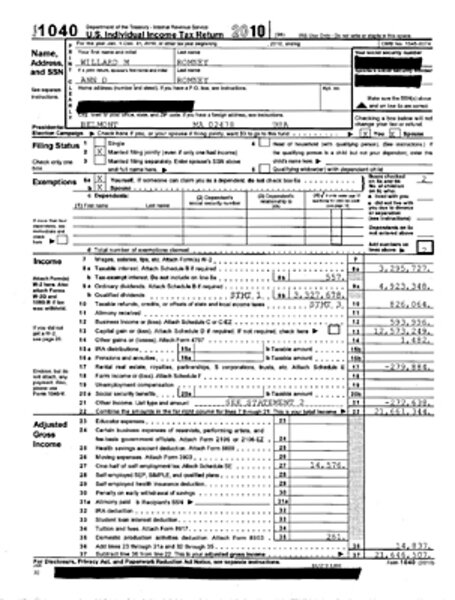

MItt Romney's just-released tax returns – the first he's ever made public – confirm what most Americans already knew: Mr. Romney is very wealthy. Now they can put some numbers to his income: almost $21.7 million in 2010 and some $20.9 million in 2011.

This annual income would make Romney, a founder of the private-equity firm Bain Capital, among the elite in terms of his earnings, say tax experts.

“He’s in the top, top tier,” says Roberton Williams of the nonpartisan Tax Policy Center in Washington. “He’s not in the top 400 – you would need $100 million or more [a year] for that, but he’s well up there.”

What differentiates Romney from many other millionaires is that little of his annual income comes from working a 9-to-5 job. Rather, most of it comes from investments, and the tax rate on investments is relatively low. As a result, Romney's tax rate was about 13.9 percent in 2010 and an estimated 15.4 percent in 2011 – lower than the rate paid by most middle-class Americans.

“He’s not paying much tax compared to others in his category,” says Mr. Williams.

Romney also receives tax deductions for charitable giving. He gave almost $3 million in 2010, including $1.5 million to the Mormon church, his tax records show.

Romney’s federal taxes totaled about $3 million in 2010 and an estimated $3.4 million in 2011. His noninvestment income from speaking engagements, royalties, and the like – which are taxed at a higher rate – amounted to $593,996 in 2010 and about $110,500 in 2011.

The Romney campaign, in a conference call with reporters Tuesday morning, was quick to note that the presidential candidate's returns show there was no attempt to hide income or evade taxes.

“Romney paid 100 percent of what he owes,” said Ben Ginsberg of the law firm Patton Boggs, Romney’s national counsel, who said Romney's relatively low tax rate is because capital gains and dividends are taxed at 15 percent and because the former Massachusetts governor gives generously to charities.

“His effective tax rate comes about because of the current US tax rate as contained in the current US tax laws, passed by Congress,” said Mr. Ginsberg.

Indeed, Romney's tax returns illustrate the tax code's complexity. Ann and Mitt Romney’s 2010 tax return runs 203 pages, including schedules and supplemental information from blind trusts, charitable foundations, and foreign bank accounts. Indeed, the campaign’s total release of Romney’s tax filings over two years ran more than 500 pages, including filings from three trusts and a foundation.

“It is complicated and fully transparent,” said Ginsberg. “It reflects that fact that Governor Romney earned his wealth as a highly successful businessman.”

The Romney campaign also noted that Romney’s tax liability would not change under the candidate's proposed tax reforms. Under rival Newt Gingrich’s proposed tax law, Ginsberg noted, Romney would have paid no taxes on his income over the past two years. “Governor Romney is opposed to that,” said Ginsberg.

A sizable portion of Romney’s income – $7.4 million in 2010 and $5.5 million in 2011 – was derived from “carried interest” from his days at Bain Capital. When Romney ran Bain Capital, he and his partners received 20 percent or more of the gains in their investments as long as the profit exceeded a preset rate of return. However, Romney and his partners did not ante up 20 percent of the capital – that came from other investors, such as pension funds. From their profits, those other investors pay the Bain partners in what is called “carried interest” taxed at the long-term capital gains rate, which is 15 percent.

The Romney campaign also stressed that the candidate himself makes few decisions about where or when to invest his money. Instead, most such decisions are made by a trustee, Brad Malt, who works for Ropes and Gray, a law firm.

“It is inaccurate to report he [Romney] has anything to do with these investments. I have control over where these funds go,” said Mr. Malt in Tuesday's conference call.

As required by the law, Romney’s accountants also had to estimate whether he owed money to Uncle Sam under the Alternative Minimum Tax provisions designed to try to prevent wealthy people from avoiding taxes. The AMT has a built-in exemption level but does not allow taxpayers to deduct certain things such as medical care and state taxes, which they can deduct under regular income tax. Under the AMT, Romney was dinged for an additional $232,989 in 2010 and an estimated $224,425 in 2011.

The tax form also shows that Romney – or at least his accountants – found filing by April 15 to be a daunting task. His Form 1040 for 2010 was sent to the Internal Revenue Service (IRS) on Oct. 15, after two extensions.

While Romney’s returns show he made a lot of money, Ginsberg says, they have not been audited by the IRS over the past 10 years.