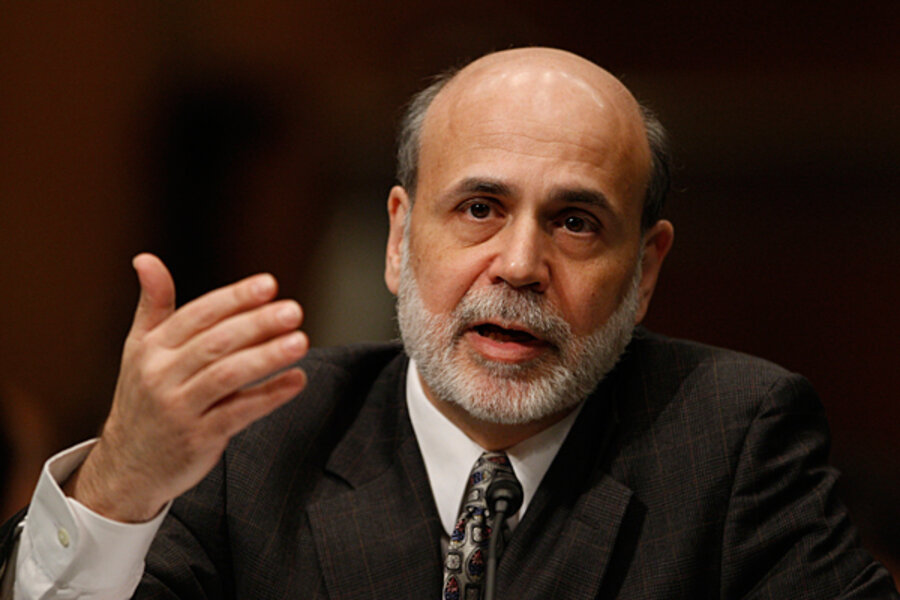

Ben Bernanke: Time to shift from stimulus to federal deficit

Loading...

| Washington

It’s a tipping point that Washington has talked about for a long time – and it’s approaching fast, Federal Reserve Board Chairman Ben Bernanke indicated on Wednesday.

The point in question is the moment at which the recovery appears to have advanced far enough for policymakers to turn their attention to another crucial economic priority: deficit reduction.

A credible plan to reduce America’s huge fiscal imbalance could boost economic confidence while reducing long-term interest rates, said Mr. Bernanke in testimony to the Joint Economic Committee of Congress.

“Addressing the country’s fiscal problems will require difficult choices, but postponing them will only make them more difficult,” he said.

Bernanke did not say what he thought those choices should be – or, more precisely, how the US should mix revenue increases and spending cuts. But his message was clear, according to Brian Bethune, chief US economist of HIS Global Insight.

'A serious long-term threat'

Bernanke indicated “the current path of fiscal policy is a serious long-term threat to the health of the national economy – there is no single issue that is more worthy of political sacrifice from elected representatives than this one,” said Mr. Bethune in a statement.

In his remarks, the Fed chief struck a moderately optimistic note about the current state of the US economy. Recovery began in the second half of last year, boosted by government stimulus spending, according to Bernanke. But with stimulus funds set to diminish in coming months, it’s the private sector that will now have to take the lead in stoking the engine of US GDP.

That private-sector boost appears to be happening, said Bernanke, as consumer spending has increased in the first months of 2010. In particular, car sales were strong in March as manufacturers offered another round of purchase incentives.

“Going forward, consumer spending should be aided by a gradual pickup in jobs and earnings, the recovery in household wealth from recent lows, and some improvement in credit availability,” said Bernanke.

The Fed chairman did sound a cautionary note on employment, saying it will take a significant amount of time to restore the 8-1/2 million jobs lost in the recent severe downturn. Weakness in the construction sector, plus the cash-strapped situation faced by many state and local governments, will be a drag on economic growth for the foreseeable future.

Bank lending falls

Bernanke also noted that bank lending to both households and businesses has continued to fall, despite the relatively improved financial position of the banking sector. The Fed is working to make sure its own supervision of banks isn’t part of the reason for the credit slowdown.

“Achieving the appropriate balance between necessary prudence and the need to continue making sound loans to creditworthy borrowers is in the interest of banks, borrowers, and the economy as a whole,” said Bernanke.

But Bernanke saved perhaps his toughest words for the state of the US balance sheet. His tone on the dangers of the deficit has sharpened in recent weeks as the dangers of financial meltdown have receded.

While federal deficits will decline somewhat in coming years with the decline in stimulus spending, a significant part of the deficit appears to be “structural,” he said, caused by long-term projections for Medicare and Social Security spending.

Current projections show the government running an imbalance of 4 to 5 percent of GDP through 2020, and that’s dangerous, Bernanke said.

“Maintaining the confidence of the public and financial markets requires that policymakers move decisively to set the federal budget on a trajectory toward sustainable fiscal balance,” he said.