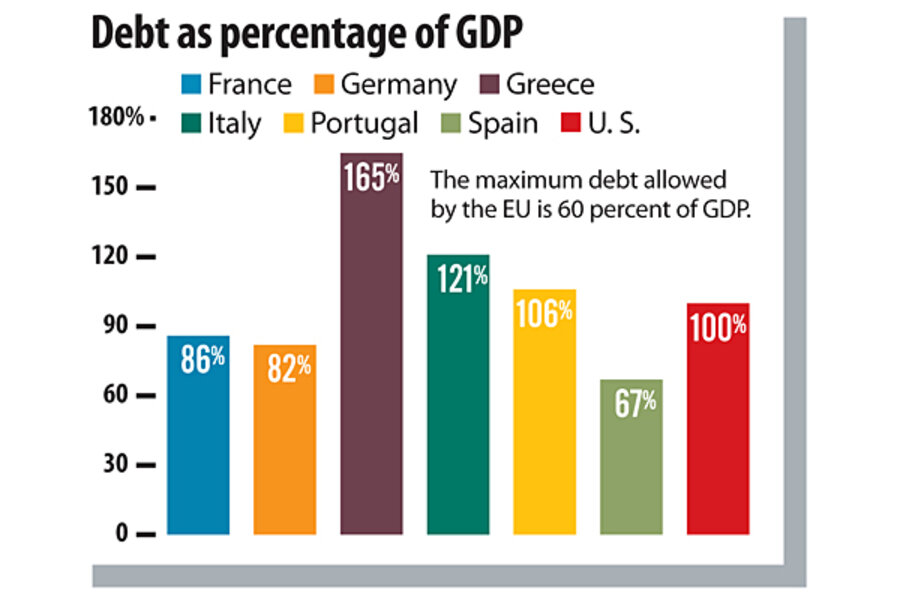

The maximum debt allowed by the European Union is 60 percent of gross domestic product. None of the countries pictured meet that standard.

Governments have collapsed. Bailouts have run into the hundreds of billions of euros. Greece is drowning in debt, Italy ousted longtime leader Silvio Berlusconi in a bid to claw its way out, and Spaniards rejected the ruling Socialists, hoping that political change might spare them the woes of their neighbors. Still, the two-year debt crisis builds. How did the eurozone get here?

The graphics below paint part of the picture: untaxed shadow economies, low productivity, and deficit spending. While deficits have been curtailed significantly since 2009 due to austerity measures, some see deeper systemic problems.

Take Greece. "For 10 years, investors basically believed that Greece was Germany," says Jacob Kirkegaard, of the Peterson Institute for International Economics in Washington. But, he says, Greece is "fundamentally a corrupt, dysfunctional government that is unable to raise enough tax revenue to pay for all of its expenses." Then there's Spain. The size of its debt relative to its economy is a manageable 67 percent, but sluggish growth undermines investors' faith that it can repay loans. Those who lost money in Greece are in no hurry to lose more in Spain.

The maximum debt allowed by the European Union is 60 percent of gross domestic product. None of the countries pictured meet that standard.

Our name is about honesty. The Monitor is owned by The Christian Science Church, and we’ve always been transparent about that.

The Church publishes the Monitor because it sees good journalism as vital to progress in the world. Since 1908, we’ve aimed “to injure no man, but to bless all mankind,” as our founder, Mary Baker Eddy, put it.

Here, you’ll find award-winning journalism not driven by commercial influences – a news organization that takes seriously its mission to uplift the world by seeking solutions and finding reasons for credible hope.

Explore values journalism About usYour subscription to The Christian Science Monitor has expired. You can renew your subscription or continue to use the site without a subscription.

If you have questions about your account, please contact customer service or call us at 1-617-450-2300.

This message will appear once per week unless you renew or log out.

Your session to The Christian Science Monitor has expired. We logged you out.

If you have questions about your account, please contact customer service or call us at 1-617-450-2300.

You don’t have a Christian Science Monitor subscription yet.

If you have questions about your account, please contact customer service or call us at 1-617-450-2300.