Germany to Europe: Don't criticize us on eurocrisis leadership

Loading...

| Berlin

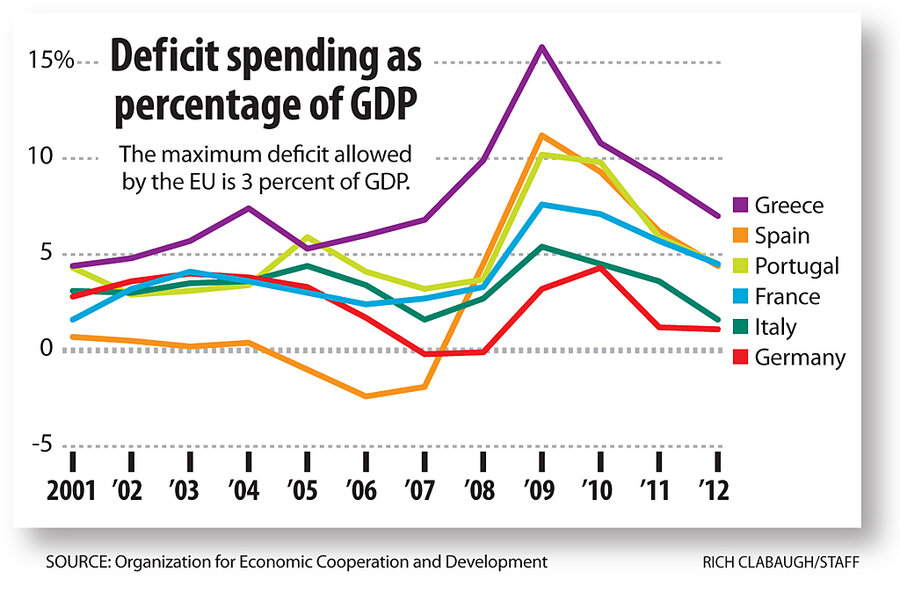

The euro crisis: It sounds like an arcane finance story. But as Germany sets the tone and the rules, the crisis has great meaning for Europe's future. Germany's foreign minister calls it a "defining moment for the image of the European Union." Critics say German is a bully, twisting Europe's arm with an austerity regime that will bring subservience. Is it a new era of the strong versus the weak? Below is an effort to voice the German consensus that supports a "German doctrine." To read a case made against it – reported from Berlin, Paris, and London – read here.

Amid Europe's most serious economic crisis since World War II, Germany has taken the lead. Berlin insists on austerity as a way to reform debtor nations and as a price tag for bailouts worth billions. European nations en masse are signing up to live within their means.

On March 2, German Chancellor Angela Merkel got 25 of the 27 European Union nations to agree to hard-wire fiscal discipline and debt limits into their national laws – a quiet shift with historic implications.

German officials realize the subject is touchy. Across Europe, there's a new antipathy toward Berlin. But Germans are confident that their model of austerity will work for the rest of Europe, just as it has for them. Here is a composite picture of what they say:

The world criticizes Germany for being strong, but not leading, in the euro crisis. Now, as we start to lead, we are criticized, if not demonized. We are called selfish or Nazis. But if we are to lead, we want to use our experience, our rules, and our models. That means an austerity policy favoring price stability and cutting debt. And we don't want to be rushed; we have domestic political hurdles to surmount. German voters don't want to pay for others' excesses. They were told when Germany joined the eurozone that they would not have to bail anyone out. This is basic.

Our approach stresses responsibility and competitiveness. We keep wages low, build quality products, and export them for cash. We do not take a Keynesian view of stimulus; we rely on the neoliberal school of Hayek. Our distinctive German model emerged after the war from something called ordoliberalism, which stresses clear rules and fiscal rectitude. ("Ordo" comes from the Latin word for "order.")

We are suspicious of the Anglo-Saxon model that has brought a global morass of financial instruments, debt, and excess. Washington and London are not our fiscal ideals. We take seriously the problem of moral hazard, where money is loaned with no guarantee of payback. Greece, which borrowed, spent, and hid its balance sheets, is a poster child for this hazard. The new EU "fiscal compact" agreed to in January will ensure it doesn't happen again. Germans can't afford to be left holding the bag for the rest of Europe. Germany is strong, but it is not that strong.

Yes, some of our private banks may have been caught up in the Anglo frenzy of lending before the 2008 financial crisis. Some still have exposure to outside debt. But we are fixing that.

It is folly to believe Europe can continue with high wages and debt without basic change. The rest of the world has jumped up and down asking for bigger and thicker fire walls of cash to reassure markets. Christine Lagarde, head of the International Monetary Fund, just came to Europe, again with that request. But fire walls are not our approach. We don't believe in solving a debt crisis by piling up more debt. The government cannot buy its way to growth. Nor do we advocate talking loudly and publicly about the crisis. We want to quietly address problems. We've already created a new fiscal union with tighter rules. Austerity needs time to take effect.

Besides, Germany has already committed nearly $300 billion to bailout funds and sped up the arrival of a new permanent fund, the European Stability Mechanism. Why don't we get any credit for that?

And why doesn't anyone look more closely at our success? We are Europe's only real globalized export economy. We didn't have a housing bubble, debt bubble, or credit boom. We had few financial products to detoxify (and the bad ones came from the United States and Britain).

Our policies have brought a good life and our situation is secure. Germany doesn't have an unemployment problem; it has a labor shortage! We have created 2 million jobs since 2000. Prices are stable. Germans are working harder. The retirement age has been increased from 65 to 67, while in Greece, some public workers retire at 52. There are very few German strikes. Germany benefits from a systematic approach to high-tech and industrial niche products. It stays competitive and fresh and plans to remain so. We make machines that Asian and South American firms are buying. We are busy. We do our homework. If others can't keep up, maybe they should look at how we do things.

People are correct when they say our history has made us fearful of inflation and heavy state control. But as Ulrike Guérot of the European Council of Foreign Relations in Berlin notes, our policy goes past old fears of inflation or fears of nationalism: "There is an ideological edifice behind German economic orthodoxy." Over time, our economic model of ordoliberalism has evolved into a branch of neoclassical economics.

But the German model transcends economics. It is almost a mind-set or gestalt. It fuses social welfare with a competitive spirit inside a strong state. Germany argues that if deficits are cut, collective bargaining curtailed, wages and prices kept stable, and plenty of information made available, markets will adjust. Keynesian-style government stimulus is counterproductive. For us, stimulus comes from competitiveness.

Germans believe so much in these things that they are willing to be criticized in the short term if it will bring long-term stability. The Greeks call us Nazis and the Italians have waved the swastika.

It's terribly unfair. We privately feel others are sometimes jealous of our success. But while our policies may be unpopular, profligate states are finally starting to reform. Things are actually getting better.

We – and by we, we mean Europe – will get through this crisis. Once European nations have reformed, we may be less chary of raising the idea of Eurobonds, stimulus, and other means of helping out. Let them reform first. Then we will help. In the meantime, the European Central Bank under Mario Draghi has lent nearly a trillion euros to European banks at 1 percent. That will quiet the crisis. In our perfect world, the ECB wouldn't lend, but we aren't saying anything.

Yes, we feel some frustration with Europe. Yes, we had a quiet but intense debate last year on whether Europe is dragging us down, and whether to align more closely with emerging global players, the so-called BRICS (Brazil, Russia, India, China, and South Africa), whom we voted with on Libya. But we realized that in a changing world, we need to stand with our friends and the ones we know best, and we closed that debate.

We want Europe. Europe helps us avoid backsliding into authoritarianism and nationalism and helps stability. Europe is our main trading partner and, for crying out loud, we have spent 50 years in pursuit of European harmony and good citizenship. We want and deserve to be seen as "pro-Europe."

But Berlin is starting to tire of attacks on Germany's efforts to solve Europe's problems. We believe deeply in austerity. It is a consensus supported by the German mainstream and the two large center parties.

There is little chance the German view will change. So don't waste your time trying.