As interest rates rise, housing market groans

Loading...

A jump in interest rates means the road to recovery in the housing market suddenly looks steeper.

As of Thursday, the nationwide average rate on a 30-year fixed-rate mortgage is 5.3 percent, up from 4.9 percent a week ago and 4.8 percent two weeks ago.

Rising loan costs appear to be having an immediate impact on housing activity. Borrower applications to refinance or take out a new mortgage fell 16 percent last week, the

Mortgage Bankers Association said Wednesday.

The shift comes at a sensitive moment, when the housing slump has shown tentative signs of bottoming out. The good news is that, despite the recent rise, interest rates on mortgages remain historically low. Moreover, a key reason for the rise in rates is positive.

More investors are expecting the economy to stabilize later this year, pushing interest rates up from fear-driven lows.

If interest rates stay on their upward march, however, it creates tougher terrain for the housing market. Fewer families can reap big savings by refinancing an existing mortgage. And for people looking to buy a home, the rate hike effectively makes homes less affordable.

That means home prices may have to fall further to bring housing demand up to match the glut of homes for sale.

"The big worry is still the record foreclosures that are occurring and the high level of job losses that are still occurring," says Dan McCue, a research analyst at Harvard University's Joint Center for Housing Studies in Cambridge, Mass. "Those are two big headwinds for housing.... When interest rates rise, that’s another headwind."

A central question now is how much interest rates will rise, and what role the Federal Reserve may play.

The Fed has been trying to keep mortgage rates down this year, by becoming a big buyer of mortgage securities issued by Fannie Mae and Freddie Mac. In effect, the Fed has indirectly become a big new player in the home lending market, pushing down the cost of credit.

But the central bank's influence will be limited if the private sector markets are moving in the opposite direction and pushing rates up.

Some recent indicators have made economists hopeful that the housing slump may be bottoming out:

• Falling home prices and low interest rates, has boosted the average affordability of homes to historic highs over the past year, according to the National Association of Realtors. Mortgage rates were above 6 percent a year ago, and home prices have fallen about 15 percent nationwide since then.

• Affordability has improved more in the Western US (where home prices have fallen further) than elsewhere.

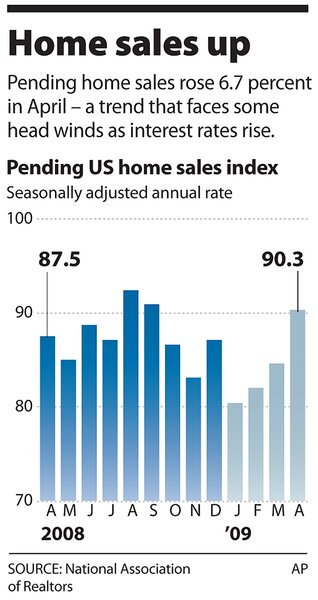

• Pending home sales, an early gauge of where the housing market is headed, have risen lately.

Despite the hopeful signs, the housing market correction is not complete.

Enough homes are still on sale to last the market for 10 months – a much higher inventory than usual. Foreclosures continue to add to the pool of available homes. Some 9 percent of home loans were at least one payment past due in the first quarter, and another 3.85 percent of home loans were in foreclosure, according to the Mortgage Bankers Association.

President Obama's "making home affordable" policy is preventing some foreclosures. The program gives banks and borrowers incentives to modify loans, so that monthly payments become affordable. But it doesn't provide an out for people who lose jobs or are deeply “under water,” with loan balances much higher than their property value.

Still, some analysts expect the decline in home prices to ease over the next year.

An inventory level of seven or eight months (instead of 10) “will be a sign that a leveling off in home prices is imminent,” economist Michael Darda writes in a recent report for MKM Partners, an investment firm.

That could happen later this year, he says. Although many people worry that the housing market can't stabilize until the job market improves, Mr. Darda says affordability is actually a better predictor than employment of housing demand.