All Paper Economy

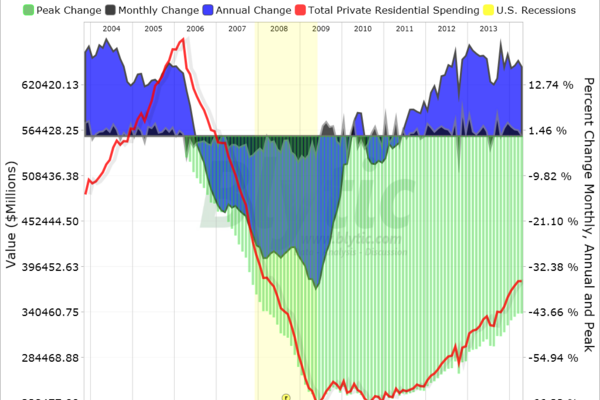

Census: Construction spending in April has mixed resultsThe US Census Bureau released their latest read on construction spending. Total private construction spending and single family construction spending since March has gone up, while non-residential construction spending declined.

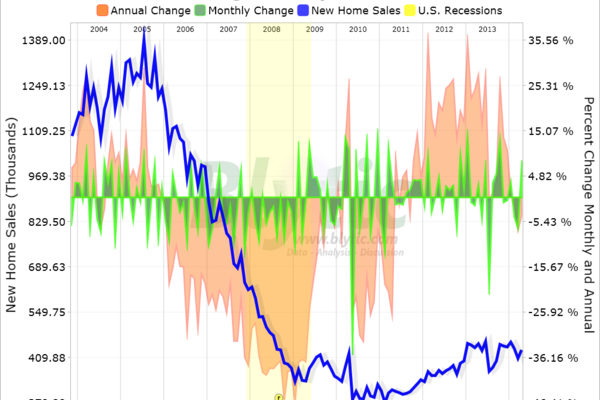

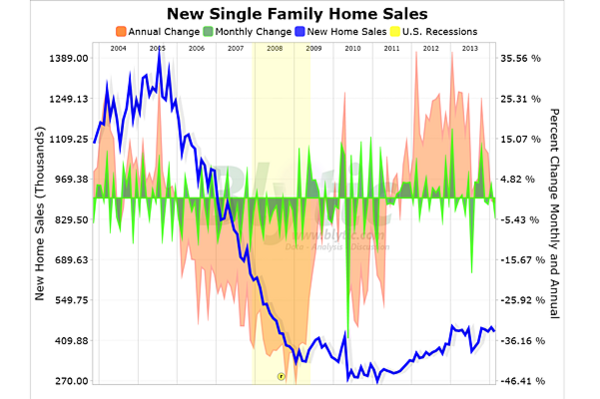

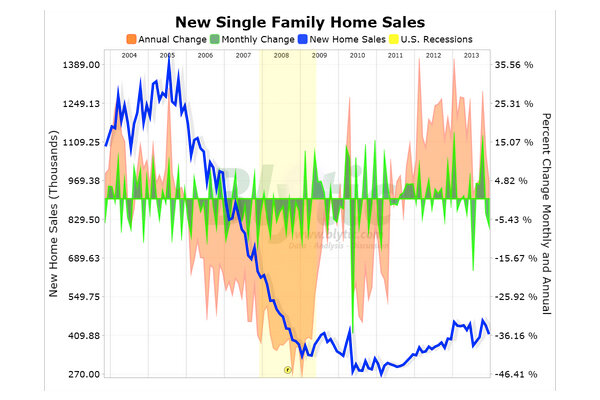

Census: Construction spending in April has mixed resultsThe US Census Bureau released their latest read on construction spending. Total private construction spending and single family construction spending since March has gone up, while non-residential construction spending declined. New home sales jump 6.4 percent in AprilThe US Census Department released its monthly New Residential Home Sales Report for April on Saturday. Sales are improving, but home sales aren't at the level as they were in recent years.

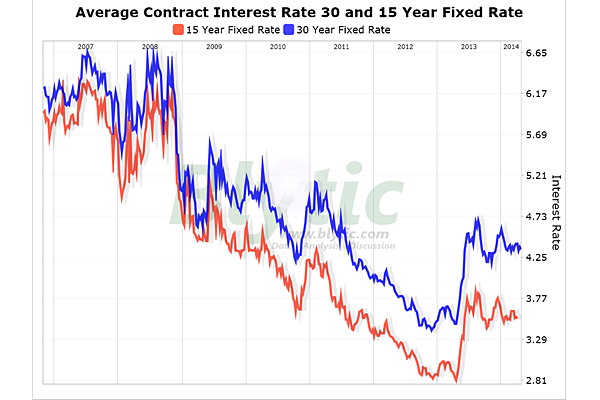

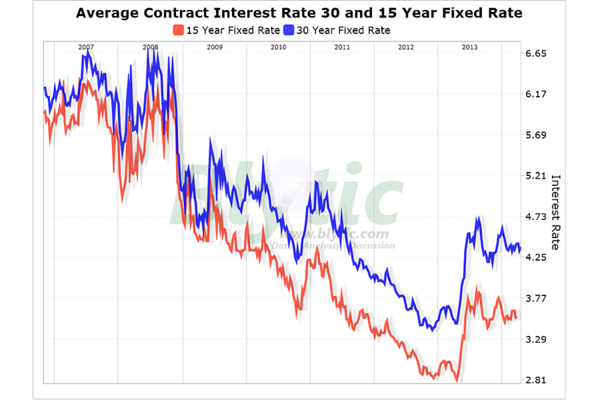

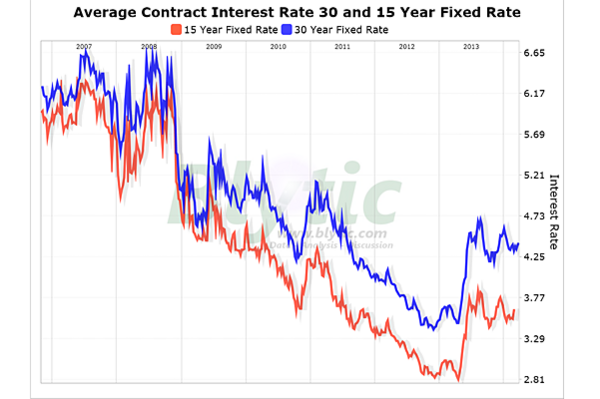

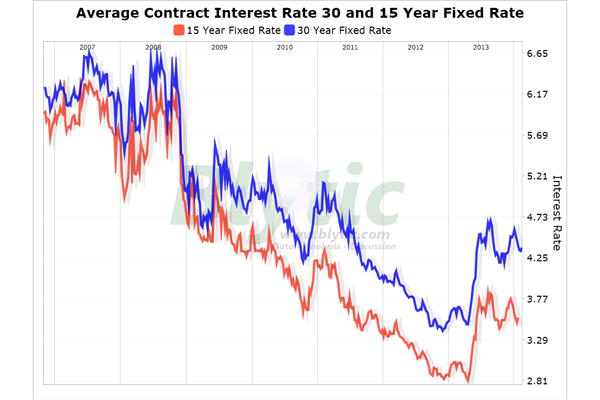

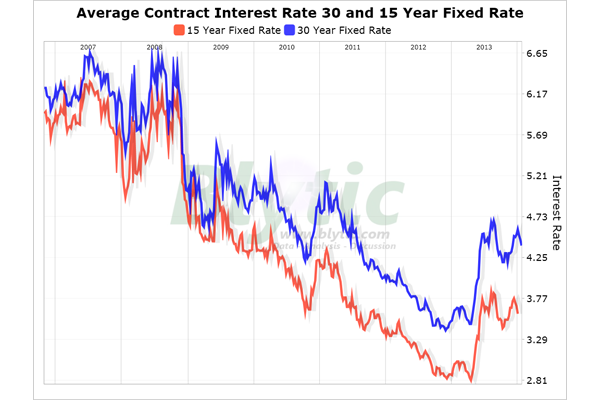

New home sales jump 6.4 percent in AprilThe US Census Department released its monthly New Residential Home Sales Report for April on Saturday. Sales are improving, but home sales aren't at the level as they were in recent years. Mortgage rates fall to 4.34 percentThe average rate for a 30 year fixed rate mortgage (from FHA and conforming GSE data) decreased 2 basis points to 4.34 percent since last week while the purchase application volume declined 4 percent and the refinance application volume declined 7 percent over the same period.

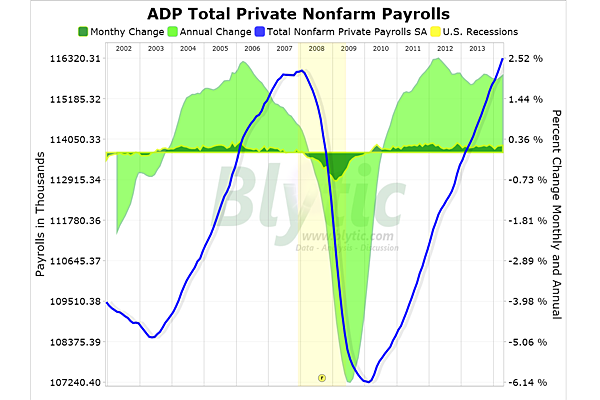

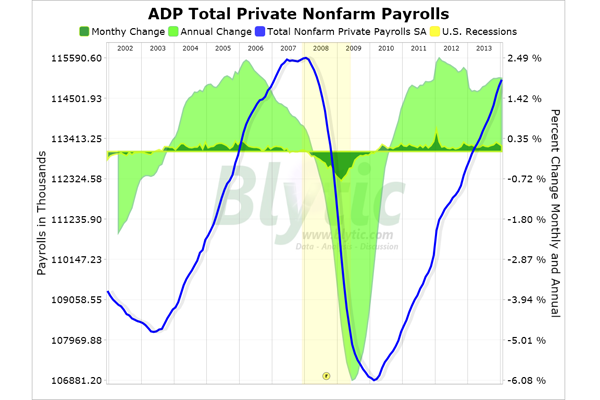

Mortgage rates fall to 4.34 percentThe average rate for a 30 year fixed rate mortgage (from FHA and conforming GSE data) decreased 2 basis points to 4.34 percent since last week while the purchase application volume declined 4 percent and the refinance application volume declined 7 percent over the same period. ADP: Private employers add 220,000 jobs in AprilPrivate employers added 220,000 jobs during the month of April, bringing the total employment level 2.06% above the level seen in April 2013.

ADP: Private employers add 220,000 jobs in AprilPrivate employers added 220,000 jobs during the month of April, bringing the total employment level 2.06% above the level seen in April 2013. Mortgage rates rise to 4.37 percentRates for a 30-year fixed mortgage climbed to an average 4.37 percent since last week, while the purchase application volume declined 3 percent and the refinance application volume declined 4 percent over the same period.

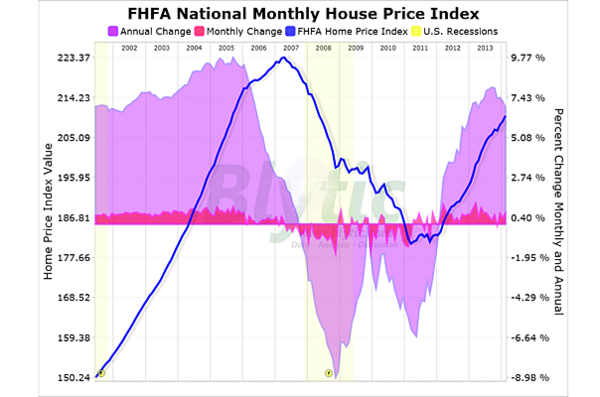

Mortgage rates rise to 4.37 percentRates for a 30-year fixed mortgage climbed to an average 4.37 percent since last week, while the purchase application volume declined 3 percent and the refinance application volume declined 4 percent over the same period. Home prices rise in FebruaryHome prices increased 0.63 percent in February and 6.88 percent above the level seen in February 2013.

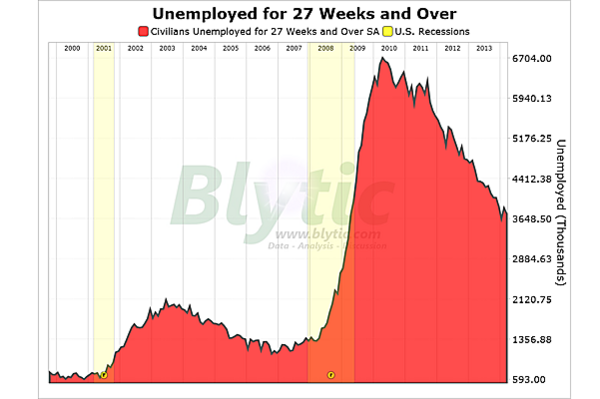

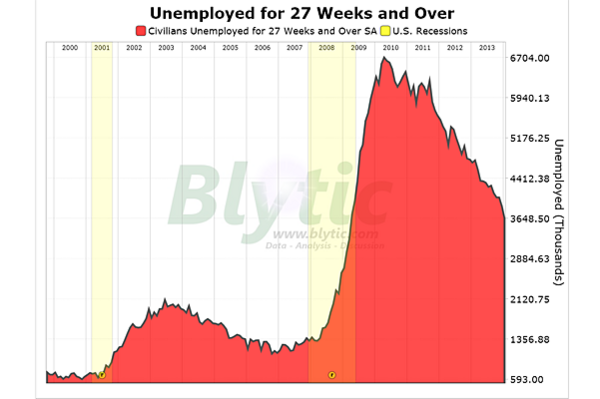

Home prices rise in FebruaryHome prices increased 0.63 percent in February and 6.88 percent above the level seen in February 2013. Situation for long-term unemployed improvingConditions for the long term unemployed improved in February while still remaining distressed by historic standards. Workers unemployed 27 weeks or more declined to 3.739 million, or 35.8 percent of all unemployed workers.

Situation for long-term unemployed improvingConditions for the long term unemployed improved in February while still remaining distressed by historic standards. Workers unemployed 27 weeks or more declined to 3.739 million, or 35.8 percent of all unemployed workers. Mortgage rates climb to 4.41 percentThe average rate for a 30 year fixed rate mortgage (from FHA and conforming GSE data) increased 2 basis points to 4.41 percent since last week while the purchase application volume increased 1 percent.

Mortgage rates climb to 4.41 percentThe average rate for a 30 year fixed rate mortgage (from FHA and conforming GSE data) increased 2 basis points to 4.41 percent since last week while the purchase application volume increased 1 percent. New home sales fall in FebruaryNew home sales fell 3.3 percent from February and 1.1 percent below the level seen in February 2013, according to the latest figures from the Census Department.

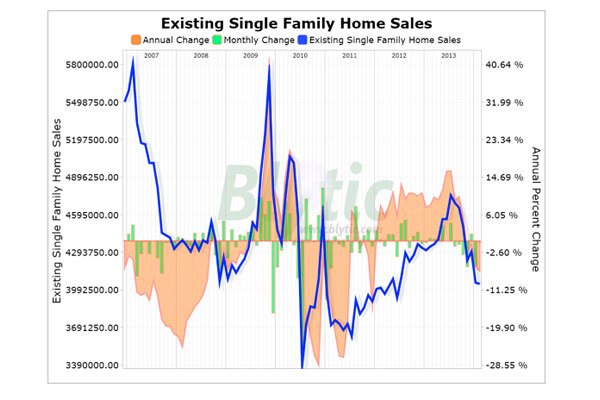

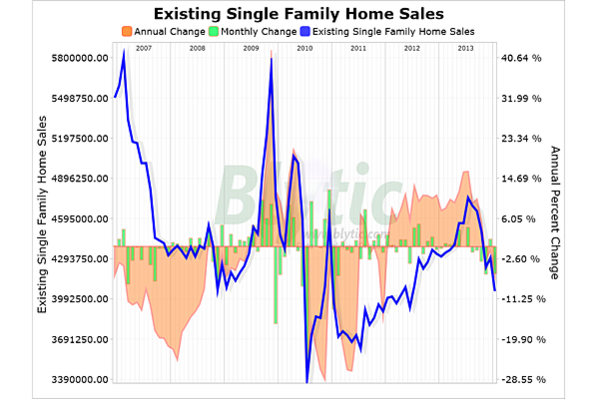

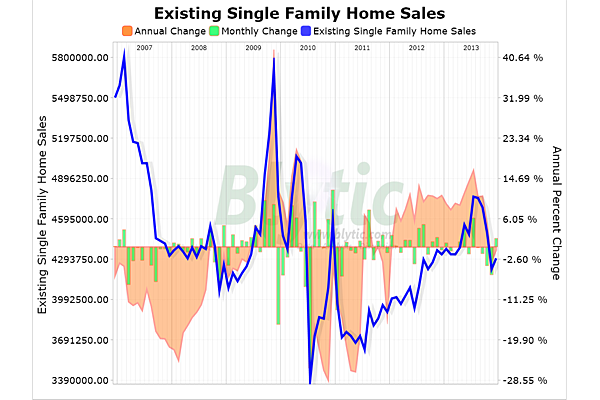

New home sales fall in FebruaryNew home sales fell 3.3 percent from February and 1.1 percent below the level seen in February 2013, according to the latest figures from the Census Department. Existing home sales report: Weak home sales in FebruaryFebruary wasn't a good month for those looking to sell their house: total home sales fell .4 percent since January.

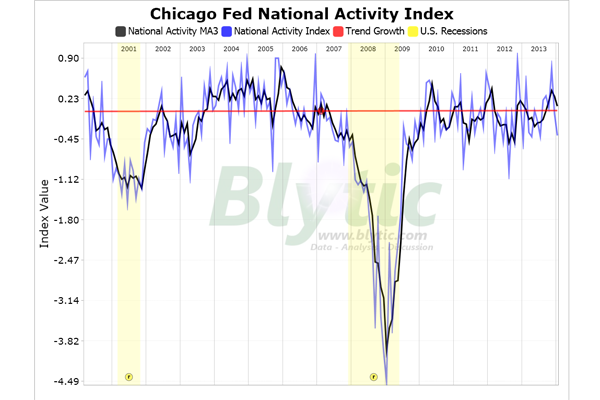

Existing home sales report: Weak home sales in FebruaryFebruary wasn't a good month for those looking to sell their house: total home sales fell .4 percent since January. Chicago Fed: National economic activity slowed in JanuaryThe Chicago Fed reported that its National Activity Index showed economic growth slowed in January due to declines in production-related areas. However, the agency reported that the national economy has been growing over the past several months.

Chicago Fed: National economic activity slowed in JanuaryThe Chicago Fed reported that its National Activity Index showed economic growth slowed in January due to declines in production-related areas. However, the agency reported that the national economy has been growing over the past several months. Existing home sales plunge in JanuaryExisting home sales fell 5.1 percent since December and 5.1 percent below the level seen in January 2013.

Existing home sales plunge in JanuaryExisting home sales fell 5.1 percent since December and 5.1 percent below the level seen in January 2013. Survey: Average 30-year mortgage rate rises to 4.37 percentA survey from the Mortgage Bankers Association found a 6 percent decline in the purchase application volume since last week, while the average rate for a 30-year mortgage rose to 4.37 percent.

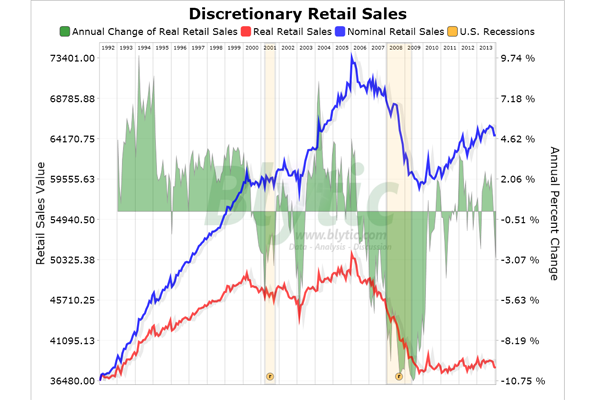

Survey: Average 30-year mortgage rate rises to 4.37 percentA survey from the Mortgage Bankers Association found a 6 percent decline in the purchase application volume since last week, while the average rate for a 30-year mortgage rose to 4.37 percent. Census: Estimated year-to-year retail sales up by 2.6 percentThe US Census estimated that retail sales in January were $427.8 billion, an increase of about 2.6 percent over the same period last year.

Census: Estimated year-to-year retail sales up by 2.6 percentThe US Census estimated that retail sales in January were $427.8 billion, an increase of about 2.6 percent over the same period last year. Long-term unemployment fallsWorkers unemployed 27 weeks or more declined to 3.646 million or 35.8 percent of all unemployed workers while the median term of unemployment declined increased to 16.0 weeks, according to the latest employment situation at work

Long-term unemployment fallsWorkers unemployed 27 weeks or more declined to 3.646 million or 35.8 percent of all unemployed workers while the median term of unemployment declined increased to 16.0 weeks, according to the latest employment situation at work ADP: Private employers added 175,000 new jobs in JanuaryADP reported that the bulk of job growth in the U.S. last month came from small- and medium-sized employers -- companies with fewer than 500 workers.

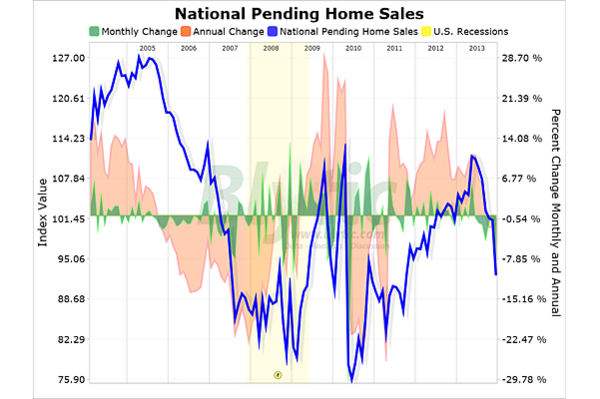

ADP: Private employers added 175,000 new jobs in JanuaryADP reported that the bulk of job growth in the U.S. last month came from small- and medium-sized employers -- companies with fewer than 500 workers. Pending home sales take an unexpected plungePending home sales took a huge dip in December, falling 8.7 percent from November and 8.8 percent below the level seen in December 2012.

Pending home sales take an unexpected plungePending home sales took a huge dip in December, falling 8.7 percent from November and 8.8 percent below the level seen in December 2012. Average rate for a 30 year mortgage drops to 4.39 percentWhile the average interest rate for fixed-rate 30 year mortgages has dropped to 4.39 percent, it's unclear how rates will be affected when the Fed tapers their bond buying efforts.

Average rate for a 30 year mortgage drops to 4.39 percentWhile the average interest rate for fixed-rate 30 year mortgages has dropped to 4.39 percent, it's unclear how rates will be affected when the Fed tapers their bond buying efforts. December new home sales come in above last year, but below NovemberMonday, the US Census Department released its monthly New Residential Home Sales Report for December from November but still rising above the level seen in December 2012.

December new home sales come in above last year, but below NovemberMonday, the US Census Department released its monthly New Residential Home Sales Report for December from November but still rising above the level seen in December 2012. Existing home sales climb 1 percent in DecemberExisting home sales rose 1 percent in December but fell on a year-over-year basis, according to the latest data from the National Association of Realtors (NAR).

Existing home sales climb 1 percent in DecemberExisting home sales rose 1 percent in December but fell on a year-over-year basis, according to the latest data from the National Association of Realtors (NAR).