All Stefan Karlsson

Bank of England adopts unemployment targetThe Bank of England has practically abandoned its target of moving inflation down to 2 percent, saying it won't consider raising interest rates until unemployment falls below 7 percent, Karlsson writes. The move isn't likely to change much policy, but it is an explicit reminder that inflation rates have been above 3 percent since 2005.

Bank of England adopts unemployment targetThe Bank of England has practically abandoned its target of moving inflation down to 2 percent, saying it won't consider raising interest rates until unemployment falls below 7 percent, Karlsson writes. The move isn't likely to change much policy, but it is an explicit reminder that inflation rates have been above 3 percent since 2005. US sees GDP go up, but it isn't any richerLast week's GDP report showed that the US' first quarter GDP was 3.5 percent higher than previously reported. Still, America is not any richer, Karlsson says.

US sees GDP go up, but it isn't any richerLast week's GDP report showed that the US' first quarter GDP was 3.5 percent higher than previously reported. Still, America is not any richer, Karlsson says.- Europe: Slowly pulling out of crisis?Although experts predicted that European countries would not be able to eliminate their deficits while Germany kept up its surplus, Karlsson notes that exactly that has happened: several countries, including Spain, Portugal, and Italy, are all back to reporting budget surpluses.

The farm bill survived. Who supports it?Although farmers only make up a tiny percentage of the US population, the farm bill has survived politics in part because of Americans' attitudes toward food producers, Karlsson says.

The farm bill survived. Who supports it?Although farmers only make up a tiny percentage of the US population, the farm bill has survived politics in part because of Americans' attitudes toward food producers, Karlsson says. Why earnings will be 'better than expected'Most earnings reports will say results were 'better than expected,' but Karlsson is skeptical that's the truth of the matter.

Why earnings will be 'better than expected'Most earnings reports will say results were 'better than expected,' but Karlsson is skeptical that's the truth of the matter. Latvia picks up the euro. It won't change much.Latvia's entry into the Eurozone will not affect exchange rates or monetary policies, Karlsson says.

Latvia picks up the euro. It won't change much.Latvia's entry into the Eurozone will not affect exchange rates or monetary policies, Karlsson says.- The Irish economy is not contracting. Here's why.Although The Irish Times recently published an article claiming Ireland's economy has lurched back into recession, Karlsson argues that GDP is a poor measure of how the country is really doing. Ireland is actually recovering from its economic slump, Karlsson says.

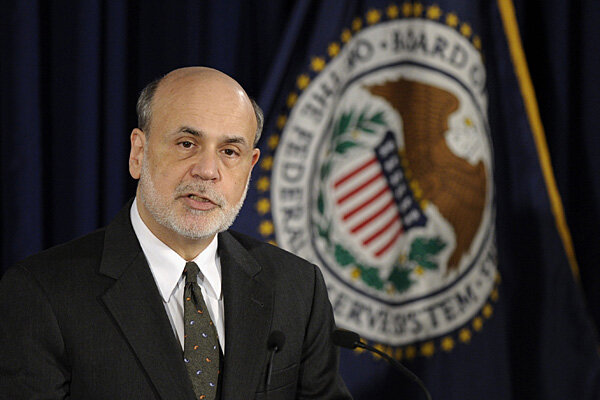

- Fed unlikely to end supportTraders sold off bonds and stocks after the Fed expressed optimism about the future of the US economy, but Karlsson says he doubts the Fed will decrease its bond purchases anytime soon.

Should you cheer on Abenomics?Abenomics will likely raise prices in Japan and lower prices elsewhere, creating a deflationary effect on countries other than Japan, Karlsson argues. That may benefit Japan — but it will also hurt other economies.

Should you cheer on Abenomics?Abenomics will likely raise prices in Japan and lower prices elsewhere, creating a deflationary effect on countries other than Japan, Karlsson argues. That may benefit Japan — but it will also hurt other economies. Japanese bond yields inch up. Are 'Abenomics' to blame?Japanese bond yields have started to move up again, rising above the pre-'Abenomics' level to 0.91 percent, Karlsson writes, something that worries many Japanese officials. Private demand has collapsed as investors have increasingly started to believe that the Bank of Japan through its purchases will actually achieve its new stated inflation target of 2 percent, a slump in demand that some have called a "bond buyer's strike."

Japanese bond yields inch up. Are 'Abenomics' to blame?Japanese bond yields have started to move up again, rising above the pre-'Abenomics' level to 0.91 percent, Karlsson writes, something that worries many Japanese officials. Private demand has collapsed as investors have increasingly started to believe that the Bank of Japan through its purchases will actually achieve its new stated inflation target of 2 percent, a slump in demand that some have called a "bond buyer's strike." How monetary inflation leads to consumer price inflationThe most important factor determining whether or not monetary inflation will mainly cause consumer price inflation or asset price inflation is simply what the early receivers of newly created money choose to do with them, Karlsson writes.

How monetary inflation leads to consumer price inflationThe most important factor determining whether or not monetary inflation will mainly cause consumer price inflation or asset price inflation is simply what the early receivers of newly created money choose to do with them, Karlsson writes. Could UK claim title of Europe's biggest economy?Speculation that the UK could become Europe's biggest economy is wishful thinking, Karlsson writes. Germany is far more competitive than both Britain and France and will outperform both, as it has done in recent years.

Could UK claim title of Europe's biggest economy?Speculation that the UK could become Europe's biggest economy is wishful thinking, Karlsson writes. Germany is far more competitive than both Britain and France and will outperform both, as it has done in recent years.- Germany's declining population gets sudden immigration boostImmigration to low unemployment Germany surged to 369,000 last year, with the influx from southern European nations on the rise.

Do high stock prices mean economic inequality?Any change in stock prices isn't intrinsically good or bad for everyone, Karlsson writes. Higher stock prices tend to be good for those who hold stocks, which typically benefits the wealthiest 'one percent.'

Do high stock prices mean economic inequality?Any change in stock prices isn't intrinsically good or bad for everyone, Karlsson writes. Higher stock prices tend to be good for those who hold stocks, which typically benefits the wealthiest 'one percent.' Jobs report: why the economy isn't as strong as you thinkFriday's jobs report shows the US economy added 165,000 jobs in April. There is no doubt that the US economy is recovering, Karlsson writes, but the jobs report confirms that the pace of economic recovery remains very slow.

Jobs report: why the economy isn't as strong as you thinkFriday's jobs report shows the US economy added 165,000 jobs in April. There is no doubt that the US economy is recovering, Karlsson writes, but the jobs report confirms that the pace of economic recovery remains very slow. How art will raise GDP by 3 percentThis summer, the US will start to include intellectual property as part of capital expenditure, rather than as input cost. The relevance of this is that it will raise GDP (likely by about 3%) as input costs are subtracted from GDP while capital investment is included, Karlsson writes.

How art will raise GDP by 3 percentThis summer, the US will start to include intellectual property as part of capital expenditure, rather than as input cost. The relevance of this is that it will raise GDP (likely by about 3%) as input costs are subtracted from GDP while capital investment is included, Karlsson writes. David Stockman NYT piece rankles liberal punditsDavid Stockman has really upset leading liberal pundits through an article he published in the New York Times, Karlsson writes. A breakdown of responses to the David Stockman piece.

David Stockman NYT piece rankles liberal punditsDavid Stockman has really upset leading liberal pundits through an article he published in the New York Times, Karlsson writes. A breakdown of responses to the David Stockman piece. Euro countries take deficit limits with grain of saltWhen governments pledge to meet certain deficit limits, it is worth nothing if the people who enforce the rules are the politicians themselves, Karlsson writes.

Euro countries take deficit limits with grain of saltWhen governments pledge to meet certain deficit limits, it is worth nothing if the people who enforce the rules are the politicians themselves, Karlsson writes. Cyprus is running out of optionsLosses for depositors in Cyprus seem almost inevitable, Karlsson writes. The only remaining possible solution would be if Russia, out of a desire to bail out its oligarchs, steps in with money for Cyprus.

Cyprus is running out of optionsLosses for depositors in Cyprus seem almost inevitable, Karlsson writes. The only remaining possible solution would be if Russia, out of a desire to bail out its oligarchs, steps in with money for Cyprus. Cyprus tax opponents get an unlikely ally: Vladimir PutinCyprus tax opponents got a less-than-desirable endorsement from Vladimir Putin, patron of the oligarchs, Karlsson writes. The last thing opponents of the Cyprus tax needs is anything that creates the perception that opposition to the tax is based on a desire to protect the oligarchs, he adds.

Cyprus tax opponents get an unlikely ally: Vladimir PutinCyprus tax opponents got a less-than-desirable endorsement from Vladimir Putin, patron of the oligarchs, Karlsson writes. The last thing opponents of the Cyprus tax needs is anything that creates the perception that opposition to the tax is based on a desire to protect the oligarchs, he adds.