All Tax VOX

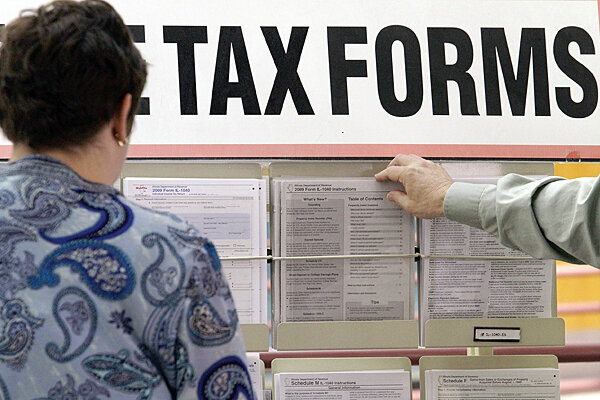

Estate tax up in the air. Is the time to give now?

Estate tax up in the air. Is the time to give now?Wealthy people might do well to consider being very generous this month and giving very large gifts at today’s bargain tax prices, Williams writes.

Tax hikes ahead. Time to accelerate dividend payments?

Tax hikes ahead. Time to accelerate dividend payments?While some investors would be hurt by the accelerated dividend payouts, many low- and middle-income taxpayers could benefit, Williams writes.

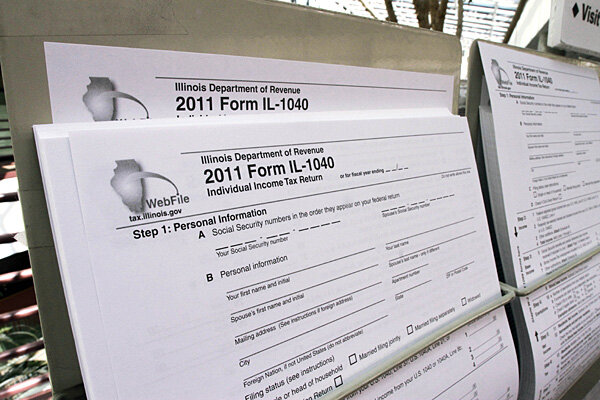

The looming alternative minimum tax debacle

The looming alternative minimum tax debacleTens of millions of Americans will face a huge tax increase when they file their 2012 tax returns early next year from the expiration of the temporary increase in exemption levels under the alternative minimum tax, Toder writes.

Will the fiscal cliff hurt charities the most?

Will the fiscal cliff hurt charities the most?With income tax deduction caps among the ideas considered in the fiscal cliff debate, the challenge becomes to raise revenue without discouraging giving, Gleckman writes.

Payroll tax cut expiration lurks in 'fiscal cliff's' shadow

Payroll tax cut expiration lurks in 'fiscal cliff's' shadowThe expiration of the payroll tax cut would increase taxes by $115 billion in 2013, Maag writes, yet President Obama and others have been strangely silent – arguing instead about the fate of the 2001-2003 tax cuts.

Tax cuts: How can 98 percent of us be middle-class?

Tax cuts: How can 98 percent of us be middle-class?Politicians can fight over whether some households should be exempt from tax increases, Gleckman writes, but can they at least stop claiming that 98 percent of us are middle-class?

Fiscal cliff: Will the states tumble, too?

Fiscal cliff: Will the states tumble, too?Fiscal cliff talk has been mostly focused on what would happen to the federal budget and the national economy. But what impact would the fiscal cliff have on individual states?

Fiscal cliffs, loopholes and entitlements: The truth behind politicians' favorite buzzwords

Fiscal cliffs, loopholes and entitlements: The truth behind politicians' favorite buzzwordsWhen Congress has tough decisions to make, they trot out euphemisms like fiscal cliff, tax loopholes and entitlements, Gleckman writes.

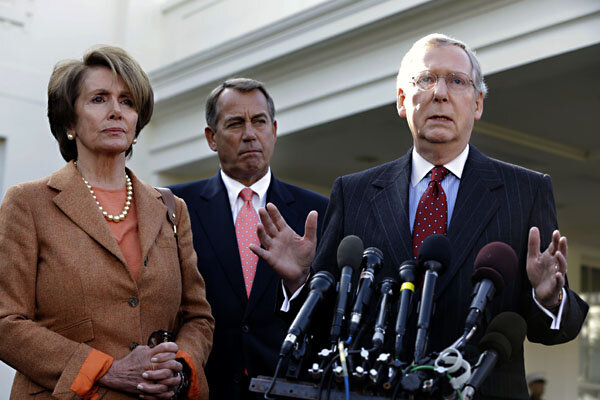

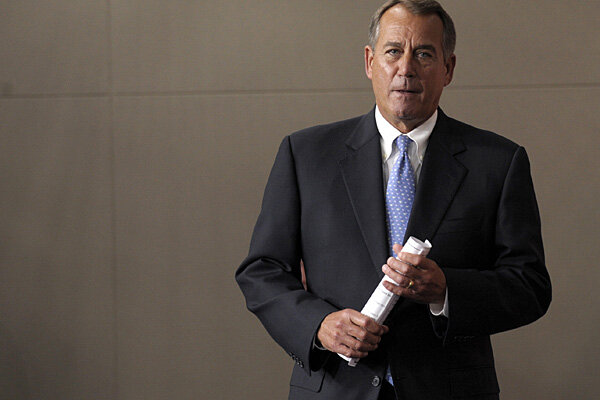

Washington dances away from the fiscal cliff

Washington dances away from the fiscal cliffDemocrats and Republicans may say they're far apart, but both sides are looking for a deal on the fiscal cliff, Gleckman writes.

Five tough challenges for Obama's second term

Five tough challenges for Obama's second termWith his reelection Tuesday, President Obama faces a second term full of painful choices on issues ranging from the fiscal cliff to Medicare and Medicaid, Gleckman writes.

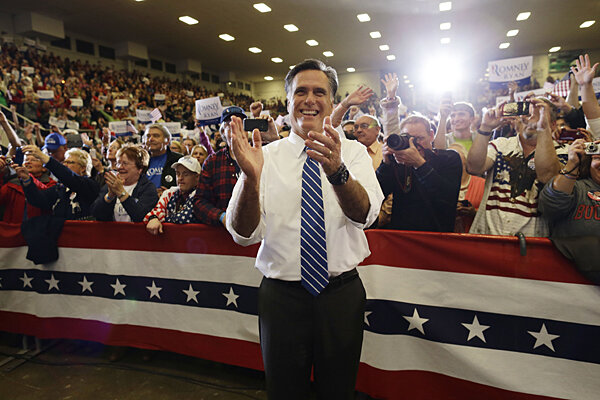

The end of a disappointing campaign for both Obama, Romney

The end of a disappointing campaign for both Obama, RomneyGleckman asks: How do both presidential candidates get away with dodging critical fiscal issues on the campaign trail? We let them, he answers.

What is Mitt Romney’s tax plan?

What is Mitt Romney’s tax plan?Howard Gleckman offers a breakdown of Republican presidential candidate Mitt Romney's proposed tax plan.

What is President Obama's tax plan?

What is President Obama's tax plan?Gleckman offers a description of what President Barack Obama has pledged to do on tax policy if he is reelected president in November.

Protecting the Child Tax Credit as fiscal cliff looms near

Protecting the Child Tax Credit as fiscal cliff looms nearA crucial safety net for low- and moderate-income families is jeopardized as the nation hurtles towards the fiscal cliff, Maag writes.

The 10 biggest differences between the Romney and Obama tax plans

The 10 biggest differences between the Romney and Obama tax plansPresident Obama and GOP candidate Mitt Romney have very similar tax plans, Gleckman writes, but there are some key differences.

The real lesson about capping itemized deductions

The real lesson about capping itemized deductionsThe campaign of GOP presidential candidate Mitt Romney has criticized the Tax Policy Center for new research that provides evidence that a deduction cap is a pretty good, though insufficient, idea, Gleckman writes.

How much revenue would a cap on itemized deductions raise?

How much revenue would a cap on itemized deductions raise?Capping deductions would raise revenue in a highly progressive way but how much revenue and how progressive depend on the cap, Williams writes.

What the Joint Tax Committee really said about tax reform

What the Joint Tax Committee really said about tax reformGleckman takes a closer look at a new analysis of tax reform by the Joint Committee on Taxation. His perspective may offer some relief to tax reformers.

Mitt Romney's '$5 trillion tax cut': 5 things you should know

Mitt Romney's '$5 trillion tax cut': 5 things you should knowRomney has proposed about $5 trillion in specific, gross tax cuts over the next decade relative to current policy, most but not all of which would go to high-income taxpayers. He has also promised to offset a substantial portion of those cuts—presumably in the trillions of dollars—by reducing deductions and other tax breaks.

Romney plan: Rich to pay same share of taxes? Or $230,000 less?

Romney plan: Rich to pay same share of taxes? Or $230,000 less?Under Mitt Romney's tax plan, an across-the-board cut would allow the top 1 percent to pay less in taxes, as Obama charges. But they could still pay the same overall share, as Romney claims, if taxes go down for everyone.