All The Simple Dollar

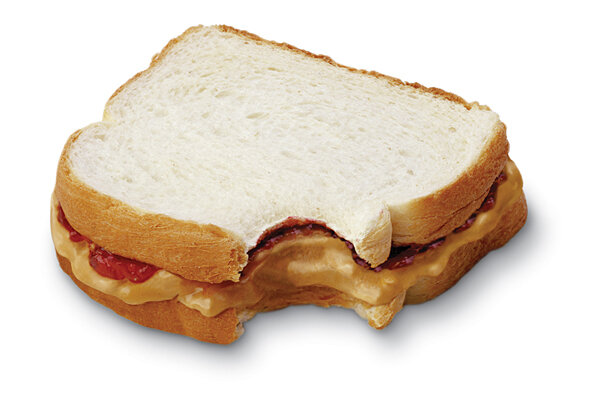

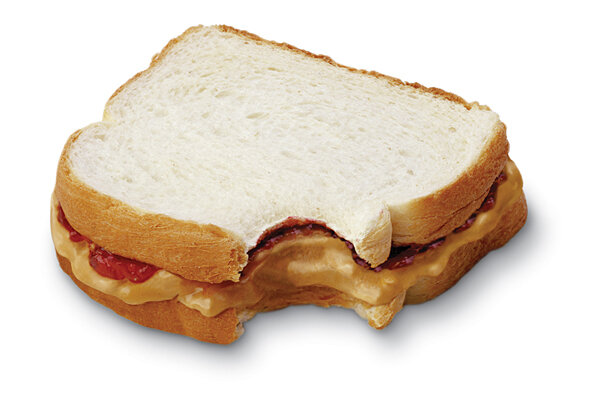

Does brown-bagging your lunch really save money?

Does brown-bagging your lunch really save money?In most cases, bringing lunch to work instead of buying it at a restaurant is a far cheaper option. But there are a few exceptions.

Curb your spending cravings

Curb your spending cravingsWe all indulge in something–books, coffee, shoes, dessert. We crave these things. Giving into these cravings, however, can be pricey and disturb your financial progress. Here are some simple tips to help you curb your spending cravings.

The easiest way to save money? Don't go in!

The easiest way to save money? Don't go in!Caught yourself in the magazine aisle yet again? Bought one too many coffees this week? Hamm shares this simple rule to help you save: Resist the temptation to go into the store in the first place.

Goals: Can you have too many at once?

Goals: Can you have too many at once?Goal-setting can be an important part of achieving success. But like anything, you can overdo it.

4 questions to ask about your 401(k)

4 questions to ask about your 401(k)The fear of being confused about 401(k) plans keeps a lot of people from making the simple but vital move to simply sign up for a plan, Hamm writes. Here are four questions to ask when signing up for a 401(k) plan.

Personal finance seems easy. It's not.

Personal finance seems easy. It's not.Spend less than you earn. At its core, that’s really what personal finance all boils down to, Hamm writes. But while personal finance advice might be simple, but it’s rather hard to implement.

A slight routine change can save you money

A slight routine change can save you moneyUnderstanding the routine or pattern that leads to a spending mistake can help you find a resolution. If you walk into your favorite boutique every time you go to the bank, your resolution could be as simple as changing your parking place. Hamm explains how to change your routine so as to avoid repetitive spending mistakes.

Financial planners: How to find the right one for you

Financial planners: How to find the right one for youHiring the right financial planner can be a very daunting task, Hamm writes, with a sea of titles and acronyms out there and many advisors clouding the water with clever marketing. How do we know if we’re hiring a good financial planner?

Other people make everything look so easy. It's not.

Other people make everything look so easy. It's not.People only share with you their good side–they advertise their successes, not their failures and struggles. Hamm offers these tips to help you remember that so you don't feel down on yourself.

The truth behind the 'perfect' dinner party

The truth behind the 'perfect' dinner partyDinner parties and other events depicted in magazines and television events take several extra hours of planning and preparation. Not to mention a lot of extra money.

Three financial traps to avoid

Three financial traps to avoidSome say you don't actually have to pay your income taxes, or that a certain company or investment is sure to make you rich. Beware these three financial traps, Hamm writes.

Making the right 'spur of the moment' purchase

Making the right 'spur of the moment' purchaseFor big purchases, there are lots of ways to ensure getting the best value. But what about small, day to day decisions? Three tips for making the right 'spur of the moment' purchase.

The curse of entitlement

The curse of entitlementHuman egocentrism is inherently costly to your relationships and to your finances. Is a sense of entitlement costing you? Hamm explains how patience and selflessness are financial virtues.

The ultimate guide to buying in bulk

The ultimate guide to buying in bulkA well-executed bulk purchase of an item can save you a lot of money, Hamm writes, but a poorly-executed one can cost you money,

Can money buy happiness? Revisiting an age-old question.

Can money buy happiness? Revisiting an age-old question.A new study throws a wrinkle in the timeless debate over whether making more money can make you happy.

Saving money is hard work

Saving money is hard workGetting good at saving money and cutting back on expenses takes hard work and practice, Hamm writes, just like any other activity in life.

How to protect yourself when a spouse mishandles money

How to protect yourself when a spouse mishandles moneyIf your spouse has bad spending habits, there are some simple steps you can take to financially protect yourself.

Teaching children to shop smart

Teaching children to shop smartThere was always something new and something more to want, Hamm writes, but parents can teach their children how to control their spending and develop healthy shopping habits.

What is 'cheap'?

What is 'cheap'?Frugality is easy when you’re seeking the best deal on a very specific item, Hamm writes. It becomes much harder when you’re comparing the merits of two similar items and trying to decide which one is really right for you.

Take saving money one day at a time

Take saving money one day at a timeOnce you see that you can behave in a financially responsible manner for one single day, Hamm writes, it isn't too much harder to chain a few of those days together. Once it becomes easier to chain a few of those days together, it isn't too much harder to simply adopt some of those better financial habits as permanent life changes.