Medicare premium hike could offset Social Security raise

Medicare price increases could wipe out any gain from a Social Security cost-of-living-adjustment next year for three-quarters of Medicare beneficiaries, estimates AARP.

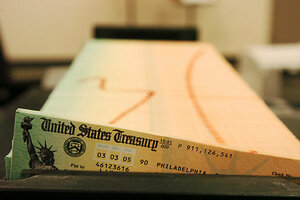

This February 2005 file photo shows trays of printed Social Security checks waiting to be mailed from the US Treasury. The government is projecting a slight cost-of-living adjustment for Social Security benefits next year, the first increase since 2009. But for most beneficiaries, rising Medicare premiums threaten to wipe out any increase in payments, leaving them without a raise for a third straight year.

Bradly C. Bower/AP/File

WASHINGTON

Millions of retired and disabled people in the United States had better brace for another year with no increase in Social Security payments.

The government is projecting a slight cost-of-living adjustment for Social Security benefits next year, the first increase since 2009. But for most beneficiaries, rising Medicare premiums threaten to wipe out any increase in payments, leaving them without a raise for a third straight year.

About 45 million people — 1 in 7 in the country — receive both Medicare and Social Security. By law, beneficiaries have their Medicare Part B premiums, which cover doctor visits, deducted from their Social Security payments each month.

When Medicare premiums rise more than Social Security payments, millions of people living on fixed incomes don't get raises. On the other hand, most don't get pay cuts, either, because a hold-harmless provision prevents higher Part B premiums from reducing Social Security payments for most people.

David Certner of AARP estimates that as many as three-fourths of beneficiaries will have their entire Social Security increase swallowed by rising Medicare premiums next year.

It's a tough development for retirees who lost much of their savings when the stock market collapsed, who lost value in their homes when the housing market crashed and who can't find work because the job market is weak or they are in poor health.

"You just don't have the words to say how much this impacts a person," said Joyce Trebilcock, a retired legal secretary from Belle, Mo., a small town about 100 miles west of St. Louis.

Like most U.S. retirees, Trebilcock, 65, said Social Security is her primary source of income. She said a back injury about 15 years ago left her unable to work, so she applied for disability benefits. Now, she lives on a $1,262 Social Security payment each month, with more than $500 going to pay the mortgage.

"I've cut back on about everything I can, and I take the rest out of my savings," Trebilcock said. "Thank God I've got that. That's going to run out before long, at the rate I'm going. ... I have no idea what I'm going to do then."

RELATED: Europe's 5 most generous pension systems

Medicare premiums are absorbing a growing share of Social Security benefits, leaving retired and disabled people with less money for other expenses, according to a report by the Congressional Research Service.

Social Security recipients spend, on average, 9 percent of their benefits on Medicare Part B premiums, plus 3 percent on premiums for the Medicare prescription drug program. By 2078, people just retiring would spend nearly one-third of their benefits on premiums for both Medicare programs, the report said. Also, when premiums for the prescription drug program increase, as they do almost every year, they can result in a pay cut for Social Security recipients.

"We could very well be entering a period where we're all stuck with flat benefits because of the growth in health care costs," said Mary Johnson, a policy analyst at The Senior Citizens League.

By law, Social Security cost-of-living adjustments, or COLAs, are determined each year by a government measure of inflation. When consumer prices go up, payments go up. When consumer prices fall, payments stay flat until prices rebound.

There had been a COLA every year from 1975 through 2009, when a spike in energy prices resulted in a 5.8 percent increase, the largest in 27 years. Since then, the recession has depressed consumer prices, resulting in no COLA in 2010 or 2011.

Older people might feel they are falling behind because they haven't had a raise since 2009, but many are benefiting, said Andrew Biggs, a former deputy commissioner of the Social Security Administration who is now a resident scholar at the American Enterprise Institute.

Consumer prices dropped, but Social Security benefits didn't drop, Biggs said. At the same time, health care costs went up, but Part B premiums stayed the same for most beneficiaries.

"They are better off because of that," Biggs said. "Somebody else is paying for a greater share of their health care. This will get me hate mail, obviously. But it is what it is."

Next year, the trustees who oversee Social Security project a 1.2 percent COLA. President Barack Obama, in his spending proposal for the budget year that begins Oct. 1, projects a COLA of 0.9 percent. The average monthly payment is $1,077, so either way, the typical increase is projected to be between $10 and $13.

The current spike in energy prices could boost next year's COLA, if it lasts through September, when the increase for 2012 will be calculated. The COLA will be announced in mid-October.

Medicare Part B premiums must be set each year to cover 25 percent of program costs. By law, they have been frozen at 2009 levels for about 75 percent of beneficiaries because there has been no increase in Social Security. That means the entire premium hike has been borne by the remaining 25 percent, which includes new enrollees, high-income families and low-income beneficiaries who have their premiums paid by Medicaid, the federal-state health care program for the poor.

The 2009 premium levels, which are still paid by about three-fourths of beneficiaries, are $96.40 a month. Most of those who enrolled in the program in 2010 pay $110.50 a month and most of those who enrolled in 2011 pay $115.40.

The Medicare trustees project a Part B premium of $113.80 a month for next year. Obama's budget projects a monthly premium of $108.20, said Donald McLeod, a spokesman for the Centers for Medicare and Medicaid Services. McLeod cautioned that the projections could change significantly by September, when 2012 premiums are calculated.

Under either projection, a small share of beneficiaries would get lower premiums. The vast majority would get higher premiums that could swallow their Social Security COLA.

"That little raise helps us," said Estelle Jones, 66, of St. Paul, Minn. "Food, heating bills, water bill, all that stuff has gone up. ... All my medicines are very expensive, and every month I have to figure out how I am going to pay for them."