Is the recession returning?

Economics can estimate what the probability of an economic recession is by looking at long and short yields.

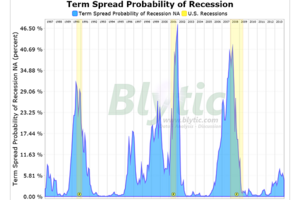

Compared to peaks in 1990, 2001, and 2008, the probability of a recession occurring in January 2014 looks slim, according to this chart.

SoldAtTheTop

With the weak economic recovery lagging through its fourth continuous year, it's sensible to start looking for clues, however so slight, of the possibility of oncoming recession.

First, let’s remember that while the NBER makes the official call of both the “peak” of a business cycle expansion and the “trough” of the subsequent recession, their officiating is delayed to say the least.

For a more “real time” assessment of the prospects of recession, various methods of number crunching have been formulated to distill out a basic probability assessment from several underlying macro series data sets.

One popular statistical method is the yield-curve based “Term Spread” probability method.

Spearheaded by economist Professor Arturo Estrella of the Rensselaer Polytechnic Institute, this method derives a probability of recession from the spread between long and short yields (10-year and 3-month) and is by all accounts the standard for recession probability forecasting.

The latest data indicates that the probability for recession is remains elevated with a January 2014 probability (the probability that there will be a recession by that date) of 4.4%.

Keep in mind that a positive indication using this method would require this probability to reach 30% so while the probability is clearly rising, the current probability is still quite low.