For the economy to grow, it has to be fair

Despite what you'll hear on the campaign trail in the next few months, there is no necessary tradeoff between fairness and economic growth. History shows that higher taxes on the wealthy would mean a healthier economy for everyone else.

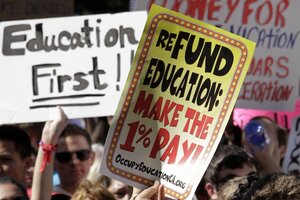

Calling on higher taxes for the rich, students from around the state gathered at the Capitol to protest the rising cost of higher education in Sacramento, Calif., in this March file photo. Reich argues that a fair economy, in which the wealthiest Americans pay the highest tax rates, is essential for economic growth.

Rich Pedroncelli/AP/File

One of the most pernicious falsehoods you’ll hear during the next seven months of political campaigning is there’s a necessary tradeoff between fairness and economic growth. By this view, if we raise taxes on the wealthy the economy can’t grow as fast.

Wrong. Taxes were far higher on top incomes in the three decades after World War II than they’ve been since. And the distribution of income was far more equal. Yet the American economy grew faster in those years than it’s grown since tax rates on the top were slashed in 1981.

This wasn’t a post-war aberration. Bill Clinton raised taxes on the wealthy in the 1990s, and the economy produced faster job growth and higher wages than it did after George W. Bush slashed taxes on the rich in his first term.

If you need more evidence, consider modern Germany, where taxes on the wealthy are much higher than they are here and the distribution of income is far more equal. But Germany’s average annual growth has been faster than that in the United States.

You see, higher taxes on the wealthy can finance more investments in infrastructure, education, and health care – which are vital to a productive workforce and to the economic prospects of the middle class.

Higher taxes on the wealthy also allow for lower taxes on the middle – potentially restoring enough middle-class purchasing power to keep the economy growing. As we’ve seen in recent years, when disposable income is concentrated at the top, the middle class doesn’t have enough money to boost the economy.

Finally, concentrated wealth can lead to speculative bubbles as the rich in the same limited class of assets – whether gold, dotcoms, or real estate. And when these bubbles pop the entire economy suffers.

What we should have learned over the last half century is that growth doesn’t trickle down from the top. It percolates upward from working people who are adequately educated, healthy, sufficiently rewarded, and who feel they have a fair chance to make it in America.

Fairness isn’t incompatible with growth. It’s necessary for it.