Opinion: How to narrow the racial wealth gap

Families of color are less likely to have savings or inherit money and face significant barriers to building wealth, such as discriminatory policies and practices that thwart home ownership.

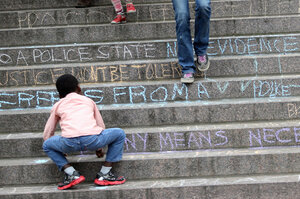

A young boy chalks messages on the steps of the Hennepin County Government Center during a Black Lives Matter protest in Minneapolis, Minn.

David Joles/Star Tribune/AP/File

Wealth inequality is even more of a problem than income inequality. That’s because you have to have enough savings from income to begin to accumulate wealth – buying a house or investing in stocks and bonds, or saving up to send a child to college.

But many Americans have almost no savings, so they have barely any wealth. Two-thirds live paycheck to paycheck.

Once you have wealth, it generates its own income as the value of that wealth increases over time, generating dividends and interest, and then even more when those assets are sold.

This is why wealth inequality is compounding faster than income inequality. The richest top 1% own 40% of the nation’s wealth. The bottom 80% own just 7%.

Wealth is also transferred from generation to generation, not only in direct transfers, but also in access to the best schools and universities. Young people who get college degrees are overwhelmingly from wealthier families.

Which is why kids from low-income families, without such wealth, start out at a huge disadvantage. This is especially true for children of color from low-income families. Such families typically rent rather than own a house, and don’t earn enough to have any savings.

Throughout much of America’s history, the federal government has given families tax breaks in order to help them save and build assets – such as paying no tax on income that’s put away for retirement, and being able to deduct interest on home mortgages.

But these tax breaks mainly help those with high income and lots of wealth in the first place, who can afford to put away lots for retirement or get a large mortgage on a huge home. They don’t much help those with low incomes and minimal savings.

Families of color are especially disadvantaged because they’re less likely to have savings or inherit wealth, and face significant barriers to building wealth, such as discriminatory policies and practices that thwart home ownership.

These structural disadvantages have built up to the point where the median net worth of white families is now more than 10 times greater than that of African-American or Latino families.

So what can we do to help all Americans accumulate wealth?

First, reform the tax system so capital gains – increases in the value of assets – are taxed at the same rate as ordinary income.

Second, limit how much mortgage interest the wealthy can deduct from their incomes.

Then use the tax savings from these changes to help lower-income people gain a foothold in building their own wealth.

For example:

1. Provide every newborn child with a savings account consisting of at least $1,250 — and more if a child is from a low-income family. This sum will compound over the years into a solid nest egg.

Research shows it could reduce the racial wealth gap by nearly 20% — more if deposits are larger. At age 18, that young person could use the money for tuition or training, a business or a home. Studies show such accounts can change children’s behavior and increase the likelihood they’ll attend college.

1. Allow families receiving public benefits to save. Today a family receiving public assistance can be cut off for having saved just $1,000. Raise the limits on what a family can save to at least $12,000—roughly three months’ income for a low-income family of four—and thereby put that family on the road to self-sufficiency.

All these steps would allow families to invest in their own futures – which is the surest way out of poverty. All of us benefit when everyone has the opportunity to accumulate wealth.

This article first appeared at robertreich.org