AIG: We'll pay bonuses back

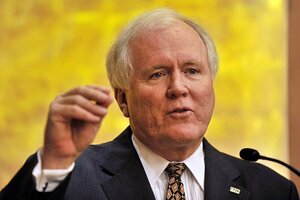

AIG CEO Edward Liddy, shown here speaking at an American Chamber of Commerce luncheon in December, has offered to pay back the US for $165 million it handed out in executive bonuses.

Mike Clark/AFP/Newscom/File

Poor Edward Liddy. He took the reins of AIG long after the company had faltered. He's didn't like the legal contracts that forced him to pay bonuses to the division that pushed the proud company into the soup.

He even offered to pay back the bonuses.

That's right. "AIG also is committed to seeking other ways to repay the American taxpayers for AIG Financial Products retention payments," Mr. Liddy wrote in a letter to Treasury Secretary Timothy Geithner on Saturday. An AIG spokesman confirmed Monday that the company intends to pay back to the US the amount it spent on the bonuses.

But none of that matters now. The political furor in the past two days over the $165 million in bonuses has taken a life of its own and ratcheted up pressure on the company to find a way to unpay its executives.

A new capitalism?

It's as good an introduction as any to the new world of Quasi-Nationalization – a place where capitalism bumps into Congress, where the federal government has squeezed out most of the shareholders, and new rules supplant traditional ones.

For example:

Quasi-Nationalization Rule No. 1: Once the government has bailed you out, it can intervene all it wants. If you're a bank that was too easy with loans during the boom times, it's no good to follow the prudent dictates of business and cut back. That's unpatriotic.

"We need our nation's banks to go the extra mile" and lend, Mr.Geithner exhorted banks on Monday.

Q.N. Rule No. 2: Ixnay on executive bonuses. Your congressman might get mad.

Congress and the administration excoriated AIG over the bonuses, as anyone would after having handed the failing insurer enough taxpayer money to fund the GDP of Norway for a year. (Click here for Obama's scathing assessment.)

Who's the decider?

But the outrage begs a larger question. If many financial companies come under quasi-government ownership, how much say should the White House and Congress have in their decisionmaking?

What if those bonuses had gone to the top salespeople who were making big money for AIG in one of its traditional lines of business? Do politicians get to set the pay scale?

It's a world where there are no easy answers.

"The government has a lot of right to start meddling right now" in such issues, said Paul Oyer, an economist at the Stanford University Graduate School of Business, in an interview. "When the government gets down to micromanaging the pay at these firms, then I begin to get nervous."

The best one can hope for is that this is a temporary world and that the division between public and private becomes again more distinct in the future.