Concentrated solar power: Did it miss its chance?

The world's largest concentrated solar power plant is now up and running, but the technology is losing out to cheaper photo-voltaic solar power.

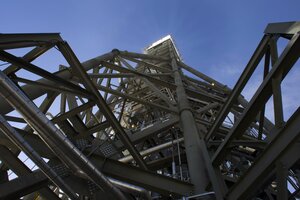

Sunlight is concentrated onto a boiler (top) in Tower One during the grand opening of the Ivanpah Solar Electric Generating System in the Mojave Desert near the California-Nevada border last month. But only a few other projects are going forward because PV solar power is cheaper.

Steve Marcus/Reuters/File

Now that the world’s largest concentrated solar plant is operational in California’s Mojave Desert, the question is whether it will prove its mettle and whether more of those facilities will crop up.

The 392-megawatt Ivanpah solar plant doesn’t just have competition from natural gas and nuclear facilities. It is also up against photovoltaic (PV), or rooftop solar panels, which have fallen in price by 70 percent since 2010. Odds are that concentrated solar power (CSP) technology, which focuses the sun’s rays to produce heat, will have a tough time competing, unless it can reduce costs and perfect the technology.

“CSP has fallen by the wayside of the solar industry after attracting huge amounts of government and investor money in 2010 and 2011,” says Ed Cahill, a research associate with Boston-based Lux Research and lead author of its recent report on CSP. “ But the industry can still bring the technology back to the forefront for utility-scale, stand-alone power applications.”

The plunge in solar PV prices has led to 4,400 megawatts of solar-panel installations in the United States. PV’s gain will be CSP’s loss. Because several large plants are in the pipeline, the 520 megawatts of CSP capacity in operation now could become 1,300 megawatts by year end. But after that, while PV takes off, CSP's growth will slow and eke its way to 2,000 megawatts by 2018.

“Concentrated Solar Power missed its chance,” says Peter Asmus, principal research analyst for consulting firm Navigant, in an interview. “The best application is to use it [solar power] in a distributed manner" with rooftop solar panels.

Despite these odds, however, CSP plants are still viable: Lux’s Mr. Cahill says that advanced components and thermal energy storage could enable higher operating temperatures, which would mean that the technological costs fall between 6 percent and 33 percent.

Ivanpah – a joint effort between NRG Energy, Google, and Brightsource Energy –takes 173,500 mirrors and focuses the sunlight to the plant’s solar receiver steam generator, which then produces electricity. If engineers can perfect the system’s thermal energy storage, then CSP could be cheaper and a more constant source of power than PV cells.

Ivanpah received a $1.6 billion loan guarantee from the US Department of Energy and it accounts for 30 percent of the solar thermal energy now consumed in the United States.

The solar energy harnessed from Ivanpah’s Units 1 and 3 are being sold to Pacific Gas & Electric under two long-term power purchase agreements, while the electricity from Unit 2 is being sold to Southern California Edison under a similar contract.

“We don’t have all the answers yet to know if CSP is economical,” says Tom Conroy, president of Evolving Energies in Sante Fe, N.M, in an interview. “We are spending several billion dollars to build CSP without storage to find this out, with some strong government loan guarantees. At the moment, CSP with storage is significantly more expensive, which should not be surprising given that we are building the first few plants. But by associating energy storage with these plants, we create dispatchable power” that has more value.

The benefit of CSP is that the facilities can be equipped with molten salt as a heat transfer fluid and energy storage device, allowing generation to occur after the sun has set. But they can take years to build because the plants need thousands of large mirrors, steam generators, and salt tanks. Regulatory and financial uncertainty, for example, has caused Brightsource to indefinitely delay some CSP projects.

PV panels, by comparison, are located on rooftops and in huge fields. Energy derived from them, however, can only be accessed when the sun is out.

PV technology has historically been more suitable for smaller projects, but the 70 percent panel price declines over three years has led some developers to convert their CSP plants to PV technologies. Duke Energy, for example, is aggregating thousands of panels to provide utility-scale PV plants in North Carolina.

Solar-panel prices will continue to fall. As new technologies evolve and competition continues to intensify, the hope is that those prices will fall to 5 cents per kilowatt-hour by 2020 without subsidies. As a current benchmark, El Paso Electric and First Solar are entering into a 25-year power purchase agreement that is valued at about 5.7 cents per kWh with subsidies, all to finance a 50 megawatt PV project.

NRG Energy, meanwhile, is not just investing in CSP technology. It’s also going long on PV and it will offer the innovation to its retail base of 2.3 million customers, some of whom will prefer distribution generation that tries to avoid the transmission lines that are run by utilities.

In the future, Americans will produce most of their own power, mostly through PV panels, many analysts predict.

"That this future is going to occur is, in my opinion, inevitable; that it’s going to occur faster than almost every person thinks it’s going to occur is highly probable,” said David Crane, chief executive of NRG, in a recent conference call.

While state mandates and financial incentives are driving solar energy production, each technology must ultimately prove its worth in the marketplace. With new CSP units coming on line, the pressure is on – especially as they compete against solar rooftop developers, who now have the inside track.