Mitt Romney's 15 percent tax rate: How does it compare to Obama or Perry?

Mitt Romney said Tuesday his tax rate is about 15 percent of his income. Barack and Michelle Obama paid 25 percent.

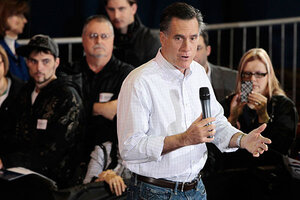

Republican presidential candidate Mitt Romney campaigns in Florence, S.C., Tuesday, Jan. 17, 2012.

AP Photo/Charles Dharapak

Washington

Mitt Romney never has coughed up his tax returns. But Tuesday, he told an audience in South Carolina he pays “closer to the 15 percent rate than anything.”

“What’s the effective rate I’ve been paying? It’s probably closer to the 15 percent rate than anything,” Romney said. “Because my last 10 years, I’ve … my income comes overwhelmingly from investments made in the past, rather than ordinary income or rather than earned annual. I got a little bit of income from my book, but I gave that all away. And then I get speaker’s fees from time to time, but not very much.”

Romney fumbled and stumbled to describe why and when he’d release his tax returns in South Carolina during Monday night's debate before offering a little more light Tuesday. What’s striking is that Romney didn’t release his tax returns when he was a candidate for governor of Massachusetts, nor during his governorship, nor during the 2008 campaign.

In fact, Romney has only faintly committed to releasing one year of his tax returns, meaning any (possible) financial hijinks from the past won’t go in front of the public’s eyes. Still, attack lines from Newt Gingrich and others saying Romney is holding out on South Carolina voters by holding off such disclosure until March or April don’t ring true when compared to past campaigns - as Yahoo’s The Ticket writes, both 2004 and 2008 saw most of the candidates release their tax returns around the same window Romney cited in his debate answer.

So Decoder wanted to know: What are other politicians paying in taxes?

In 2010, Barack Obama paid nearly half a million dollars - $453,770 - from total income of $1,795,614, for an effective tax rate of 25 percent. Here’s the President’s tax document, in case you’re interested in looking it over.

(If you’re prone to geeking out over such things, there are quite a few interesting tidbits about Obama’s life in his tax return. For example, the Obamas’ most favored charity was the Fisher House Foundation, a group that gives free or low-cost housing to veterans receiving treatment at medical centers. The Obamas donated more than $130,000 to the cause.)

Texas Gov. Rick Perry, who has released his tax returns since 1987, paid 23.4 percent of his $217,000 to the federal government in 2010.

Why is Romney’s rate lower? Much of his wealth comes from investment income - far more than your average presidential candidate when you compare his financial disclosure form to, say, Gary Johnson’s. Because dividends are taxed at 15 percent, even someone as megawealthy as Mitt Romney (estimated net worth: $270 million) can pay taxes far below the US’ top marginal tax rate of 35 percent.

Herman Cain’s financial disclosure, for what its worth, shows a lot about wealth but less about tax rates.

Want to check out your favorite candidates financial disclosure form? See them all from OpenSecrets.org here. (Spoiler: Ron Paul owns lots and lots and lots of stock in gold miners.)

Like your politics unscrambled? Check out DCDecoder.com