Ben Bernanke: Bring down the federal debt, don't just 'stabilize' it

Reducing the debt-to-GDP ratio is the most important long-term fiscal policy for the US, said Fed Chairman Ben Bernanke during his semiannual report to Congress.

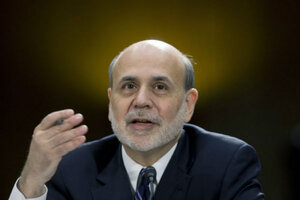

Federal Reserve Chairman Ben Bernanke testified before the Senate Banking Committee on Tuesday. In his semiannual report, the Fed chairman spoke about the looming spending cuts and suggested that the long-term goal should be to reduce the debt-to-GDP ratio.

Carolyn Kaster/AP

Ben Bernanke sat down in front of a microphone Tuesday and offered some blunt advice to the elected officials who have been failing to agree on a deficit-reduction plan.

Bring the federal deficit down, the Federal Reserve chairman said, enough that the national debt actually falls back to precrisis levels.

Chairman Bernanke's semiannual report to the Senate Banking Committee comes as Democratic and Republican lawmakers are locked in contentious debate over fiscal policy – a debate that could result in big cuts to federal spending in a “sequester” at the end of this week.

His advice also implicitly challenged President Obama’s stated goal as not sufficiently ambitious. Mr. Obama has said he’s “fighting” for a plan to “stabilize our debt and our deficit in a sustainable way for the next decade.”

Bernanke used some similar language, but suggested a much more challenging target.

“Fiscal policymakers will have to put the federal budget on a sustainable long-run path that first stabilizes the ratio of federal debt to GDP and … eventually places that ratio on a downward trajectory,” Bernanke said in his prepared testimony.

The distinction between the two goals may seem subtle, and Bernanke didn’t reference Obama or his administration by name, but the difference between Obama’s goal and Bernanke’s is many trillions of dollars over time.

During the five decades before the financial crisis, America had a national debt that, on average, totaled less than 40 percent of one year's gross domestic product, the Fed chairman said. Today the US public debt totals about 75 percent of GDP, with the number increasing if you add in obligations from the Treasury to fund Medicare and Social Security.

Bernanke suggested “replenishing this fiscal capacity,” by gradually reducing the debt-to-GDP ratio. Bernanke cited two reasons for this objective: to promote economic growth and to have a cushion against potential adversity.

Stabilizing the federal debt at the current level is better, of course, than having it continue to rise. And Obama isn’t the only one in Washington who has laid out that goal.

But Bernanke’s words Tuesday are a reminder that, to some degree, the word “stabilize” misses a central question: whether the long-run goal should be to reduce the debt.

The Congressional Budget Office and other forecasters say it’s possible the debt will remain at about 75 percent of GDP a decade from now. But then, judging by forecasts of health-care costs and baby-boomer retirements, they predict the debt will start rising again.

In that context, stabilizing the debt beyond Obama’s one-decade window is very challenging. Bernanke adds that, unless the US can bring its debt-to-GDP ratio down over time, the country will lack flexibility for dealing with potential events such as a war or a new financial crisis.

As Bernanke and prior Fed officials have long done, he refrained from proposing any specific fiscal policies, leaving that to the president and Congress.

But Bernanke echoed many other economists in criticizing the so-called sequester plan that is poised to take effect, under current law, on March 1. He said the sequester amounts to unnecessary economic damage up front, and not enough deficit reduction in the long run.

The cuts would hit everything from the FBI to public schools, and would come at a time when the economy is struggling to recover the jobs lost during recession.

Many members of Congress, including those at Tuesday's hearing, don’t like the sequester any better than Bernanke.

Sen. Pat Toomey (R) of Pennsylvania said the March 1 spending cuts would occur “without regard to any sense of what are our higher and lower priorities.”

The sequester appears set to take effect, however, because the two parties differ sharply on how to replace it, with Republicans wary of tax hikes and Democrats wary of deep spending cuts or big adjustments in entitlement programs such as Medicare.

Whatever the mix of policies, Bernanke said the goal should be to replace the sequester “with policies that reduce the federal deficit more gradually in the near term but more substantially in the longer run.”

Fiscal policy is Washington’s consuming issue now, prompting senators to seek numerous comments from Bernanke, the nation’s most visible economic prognosticator. He was questioned about a range of topics, from policy toward “too big to fail” banks to whether the Fed’s own monetary policies are still helping the economy.

Several senators expressed concern that financial markets still expect that the government would bail out big banks if another crisis hits. And some voiced doubt over whether the Fed’s bond-buying program, known as “quantitative easing,” is working.

The Fed chairman advised lawmakers to weigh the quality of federal spending, not just its quantity.

He said some spending or tax policies can help the economy because they “increase incentives to work and save, encourage investments in workforce skills, advance private capital formation, promote research and development, and provide necessary and productive public infrastructure.”