On eve of first debate, Romney floats tax proposal that hits the rich

In an understated comment to a Denver radio station Tuesday, Mitt Romney suggests that one way to pay for his 20 percent cut in the tax rate is to limit itemized deductions to $17,000. For those, like himself, who itemize millions, it's a big hit.

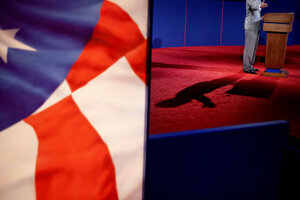

A shadow is cast across the stage Tuesday as a stand-in for Republican presidential candidate Mitt Romney speaks at the podium during a rehearsal for a debate at the University of Denver in Colorado. Mr. Romney and President Obama will hold their first debate Wednesday, Oct. 3.

David Goldman/AP

New York

The rich may not be as secure as they hope under a President Romney.

On Tuesday, the former Massachusetts governor said one option he is considering is to limit federal income-tax deductions to $17,000 per household.

If this option became a part of the Romney economic plan, tax analysts say, it would hit the wealthiest taxpayers the hardest, because they tend to itemize their deductions when they file their federal income taxes. Limiting deductions would also make it possible for Mr. Romney to stick to his plan not to add to the tax burden of low- and middle-income Americans.

This is not to say the wealthiest won't get some benefits. Romney still wants to reduce taxes 20 percent across the board. But his suggestion to radio station KDVR in Denver on Tuesday might well raise some howls among the well-heeled.

"You could use your charitable deduction, your home mortgage deduction, or others – your health-care deduction, and you can fill that bucket, if you will, that $17,000 bucket, that way," Romney said. "And higher-income people might have a lower number."

Although Romney did not say this was his actual plan, it is the most specific he has been on how he might pay for his proposed tax cut. The nonpartisan Tax Policy Center (TPC), a joint venture of the Urban Institute and Brookings Institution, has estimated that Romney’s tax cut would result in a loss of $500 billion in revenue for the federal government by 2015 and $5 trillion over 10 years.

“If Romney were to actually make this his plan, it would clearly raise a lot of money,” says Roberton Willams, a senior fellow at the TPC in Washington. “A lot of folks are itemizing more than $17,000 per year, including Mitt Romney, whose itemizing is in the millions.”

In fact, the Romney suggestion on capping itemization would likely raise alarms with philanthropic groups, mortgage bankers, and state and local governments. The wealthiest earners are most likely to give large amounts of money to charity, to have large mortgages, and to pay the highest amount of property taxes and state income taxes.

Romney’s suggestion "would hit the wealthiest the hardest,” says Mr. Williams, who has not had the chance to run the proposal through the TPC computer models.

According to the TPC, about 70 percent of the 158 million US households who file tax returns take the standard deduction, which was $11,900 in 2012. The other 30 percent itemize their deductions.

Of households that itemize, 90 percent are in the highest tax bracket, 35 percent. Of those in the 33 percent tax bracket, 71 percent itemize. By way of contrast, only 37 percent of those in the 15 percent bracket itemize their deductions.

It would not take a huge mortgage to fill up Romney’s $17,000 bucket. For example, the payment on a $500,000 30-year, fixed-rate mortgage at 4 percent would come to $2,387 per month, according to an online mortgage calculator. This would amount to $28,644 per year. Although some of that might be principal, most would be interest to start with, because interest is front-loaded on most loans.

It’s not clear if Romney would also limit deductions for medical expenses. Under today’s tax code, individuals who have high medical bills can deduct a portion of those bills from their taxes.

High-tax states would also head to Washington to fight the plan. If individuals could not deduct their property taxes as well as state and local taxes, some might move to a lower-tax state.

President Obama has proposed capping deductions in almost every budget he has introduced. Under his plan, the value of the deduction would be capped at 28 percent. Thus, a $1,000 gift to charity for someone in the 35 percent tax bracket would net them a $280 deduction (28 percent of $1,000) instead of a $350 deduction (35 percent of $1,000). That proposal has been shot down by Congress every year.

“The Romney proposal is quite different,” says Williams.