Six things Obama's budget plan reveals about his priorities

President Obama's $3.78 trillion budget for fiscal 2014 lays out elements of a possible 'grand bargain' with Congress. At the same time, it speaks to his policy priorities.

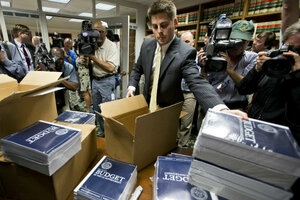

Copies of President Obama's budget plan for fiscal year 2014 are distributed to Senate staff on Capitol Hill on Wednesday. The president sent Congress a $3.78 trillion spending blueprint that seeks to tame runaway deficits by raising taxes further on the wealthy and trimming popular benefit programs, but it has drawn angry responses from both the right and the left.

J. Scott Applewhite/AP

With the arrival of President Obama's budget plan, it’s official: Both political parties have laid out fiscal blueprints that embrace the controversial idea of entitlement reform.

The catch: Mr. Obama won't seek cost savings within entitlements popular with the middle class unless new tax revenues are part of the package, while the budget House Republicans have put forward envisions no new tax revenue.

Still, the willingness of both sides to confront projected revenue shortfalls for Social Security and Medicare is significant. It’s a sign that leaders in both parties realize that, as politically risky as it may be to tinker with those programs, that’s the only path toward a sustainable fiscal plan for the nation.

Here’s a tour of Obama’s budget blueprint for the next 10 years, as seen through six central priorities:

1. New deficit reduction: $1.8 trillion.

The fulcrum of Obama’s budget is a $1.8 trillion offer for additional deficit reduction over the next 10 years, beyond some $2.5 trillion in steps Obama and Congress have already taken in the past two years to reduce future deficits (adding up to $4.3 trillion total). Obama first made the offer a few months ago in fiscal talks with House Speaker John Boehner (R) of Ohio, and now it’s an official part of his budget – a move intended to lure Republicans to the bargaining table.

"By including this compromise proposal in the Budget, the President is demonstrating his willingness to make tough choices to find common ground to further reduce the deficit,” the Obama administration says in its budget summary, released Wednesday.

The $1.8 trillion in deficit cuts would replace the “sequester,” cancelling those automatic budget cuts that are now affecting agencies ranging from the Defense Department to the Federal Aviation Administration. Instead, the budget savings would come largely from tax hikes and entitlement reforms, and a related easing of interest payments on national debt.

The Obama administration says its plan would bring the federal deficit down to 2.8 percent of gross domestic product in 2016 and 1.7 percent of GDP in 2023.

But overall, the national debt as a share of GDP would be little changed, falling from about 76 percent today to 73 percent in 2023. That contrasts with a House Republican budget that seeks to bring the budget into balance and debt down to 55 percent of GDP by 2023.

For all the debate about taxes, the key difference between the two budget visions is on spending. Where Obama would spend $3.78 trillion in 2014 and $46.5 trillion over the next decade, House Republicans would like to see $3.53 trillion and $41.5 trillion, respectively. The two sides are not nearly as far apart on tax revenue, with a gap between their plans of about $1 trillion for the next decade.

2. New taxes: $580 billion.

As with prior Obama tax hikes, the focus here is on raising revenue from upper-income households.

First, the president calls for a “Buffett rule,” to ensure that households with incomes higher than $1 million (business tycoon Warren Buffett is safely ensconced that category) pay at least 30 percent of their income (after charitable giving) in taxes.

Second, Obama seeks to limit the value of tax deductions for the top 2 percent of earners to 28 percent of taxable income.

While raising more money from income taxes through those channels, Obama would also seek to make the business side of the tax code more friendly to job creation.

He proposes simplifying the corporate tax code, with fewer deductions and lower tax rates, without raising any new tax revenue from that shift. He would make the research-and-development tax credit for corporations permanent.

3. New inflation measure for Social Security: $230 billion.

As baby boomers retire and as senior Americans live longer, the costs of Social Security are expected to outstrip program revenues.

As one step toward closing that gap, Obama has opened the door to a change in the way benefits are adjusted for inflation each year. Using a “chained consumer price index,” rather than the traditional consumer price index, would save some $230 billion from Social Security and other federal programs that get adjusted for inflation.

The chained CPI, some economists argue, is a more valid way of measuring changes in the cost of living, because it accounts for the way consumers might alter their spending habits – buying more chicken and less beef if the price of beef goes up.

But the idea has already sparked outcries from critics who say the idea is an unfair benefit cut to seniors.

Some other options for the program include having the eligibility age for benefits gradually tick upward, raising Social Security taxes on the rich or on all workers, or making benefits less generous for high-income retirees.

4. Medicare cost savings: $360 billion.

Obama’s deficit-reduction package includes $400 billion in savings from health-care programs, with most of that coming from Medicare. Those savings would include a means-tested step-up in premiums, so some seniors would shoulder more of the cost burden for their health care. And they would also include payment reductions to health-care providers, prodding them to deliver care at lower prices.

Republicans argue that Obama’s approach, although it would reduce budget deficits in the near term, comes nowhere near putting Medicare on a sustainable long-term path. Many of them would like to see the program shift toward a “premium support” model, in which seniors would buy their own insurance, using an annual payment from the government – with some restraint on how much that payment goes up each year.

Obama said Wednesday that his budget seeks to cut Medicare costs while keeping “rock solid” benefits, not, as Republicans have proposed, by shifting financial risk to seniors.

5. Spending on jobs: $50 billion for infrastructure.

Obama is framing his budget plan as less about austerity than about jobs and the middle class. Deficit reduction is important, in this context, as a sign of getting America’s fiscal house in order and avoiding a potential debt crisis.

But the president repeatedly champions the idea that government makes investments just like the private sector does, and that these investments can help create jobs.

A centerpiece of these efforts, in his latest fiscal plan, is to ramp up spending on things such as highways, bridges, and airports by some $50 billion. Obama also seeks added funds for clean energy, high-speed rail, and an “infrastructure bank” so that government can partner with private capital providers.

6. Preschool “for all,” paid for with cigarette taxes.

The president also is proposing establishment of program to offer preschool to all four-year-olds from low- or moderate-income families. The administration says the money to pay for the effort would come from a boost in taxes on tobacco products.

Many education experts say wider access to preschool would aid millions of children, who would otherwise be at an education disadvantage during formative early years.

“These are things that should not be partisan,” Obama said Wednesday, referring to that and other proposals designed to keep the US economy successful in a competitive global economy.

Obama is also proposing a new fund to spur the redesign of high school education nationwide, to better prepare students for the job market and college.