Fall of Russian ruble injects uncertainty into global economy

Russia’s turmoil involving the ruble serves as a reminder of the way falling petroleum prices can roil the outlook for oil-exporting nations.

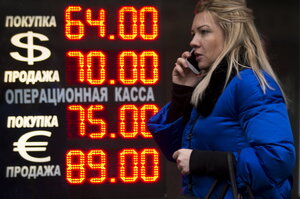

Signs advertising currencies light next to the exchange office in Moscow, Russia, Tuesday, Dec. 16. After a massive overnight rate hike by Russia's Central Bank, the ruble staged a two-hour rally Tuesday morning before rolling back to new historic lows.

Alexander Zemlianichenko/AP

Washington

A collapsing Russian ruble signals economic trouble for Russia and new uncertainty for the global economy.

The Russian currency has been plunging in tandem with the price of oil – a commodity that plays a crucial role in that nation’s finances. And on Tuesday, even a big overnight boost in interest rates by the Central Bank of Russia didn’t stop the ruble’s fall.

For Russia, the meaning seems clear: Forecasters see a recession there in 2015, with the main question being how deep and protracted.

For the world economy, the import is murkier.

Maybe economic woes in Russia won’t mean much. The country accounts for only a small fraction of world economic activity. Although major European stock indexes fell more than 2 percent Tuesday, US stocks largely shook off the dire headlines about the ruble.

But at the very least, Russia’s turmoil is serving as a reminder of the way falling petroleum prices can roil the outlook for oil-exporting nations. It also brings new doubt about whether the US Federal Reserve will move steadily forward on its expected path toward raising US interest rates sometime in 2015.

And it raises new uncertainty about Russian politics and foreign policy: Desperate financial times could spawn new dangers as Vladimir Putin seeks to maintain a grip on power, as Russians feel a squeeze from tighter monetary policy and Western economic sanctions.

What’s clear now is that Russia faces a ruble crisis that’s hard to contain.

The Central Bank of Russia hiked its benchmark interest rate by 6.5 percentage points overnight, less than a week after a 1 percentage point rate boost. Although the move was a significant new show of resolve, the currency still fell further Tuesday.

“The course of the rouble will depend more on developments on the oil price and economic sanction fronts than on the path of the policy interest rate,” says Charles Movit, an economist at the forecasting firm IHS Global Insight, in an e-mailed analysis.

In a telephone interview, he says Russia has now tried two policy levers: intervening in currency markets and raising interest rates. A third option – imposing capital controls to limit the flow of investors exiting the currency – might be tried next, he says.

The key, though, is what happens to oil prices.

Rising oil production around the world, coupled with relatively weak demand and Saudi determination to hold onto its market share, has made for a historic downdraft for oil prices. The giant among OPEC nations, Saudi Arabia hopes to drive out higher-cost sources of oil (including US-based shale deposits) from production.

Russia is a relatively high-cost oil producer, yet is heavily reliant on oil as a source of government revenue.

“This [ruble crisis] really could be cured rather simply if Saudi Arabia changes its mind” and cuts oil production, Mr. Movit says. The price of oil might then rise back toward $80 per barrel.

As Russia’s outlook has deteriorated, stock markets and currencies in other oil-producing nations and some other emerging markets have also been under pressure.

“Investors’ loss of appetite for risk as the crisis in Russia unfolds is now having adverse consequences for the currencies of a broad sweep of emerging market countries,” the forecasting firm Capital Economics said in a research report Tuesday.

All this could make the US Federal Reserve wary of signaling its intent to hike interest rates, at a time of new unease in the global economy. The Fed has a policy meeting this week.

The White House, meanwhile, said Tuesday that Mr. Obama will sign into law additional sanctions designed to penalize Russia for its actions in Ukraine, the Associated Press reported. The penalties are targeted at weapons-making companies.