Fed's deflation fears fade as recession slows

Loading...

The Federal Reserve says it has stopped worrying about deflation.

The shift, outlined in a policy statement Wednesday, doesn't mean the Fed is going to raise interest rates soon. But it signals that the central bank sees growing signs of stabilization in the economy. After a two-day policy meeting, the Fed's statement included these words: "The Committee expects that inflation will remain subdued for some time."

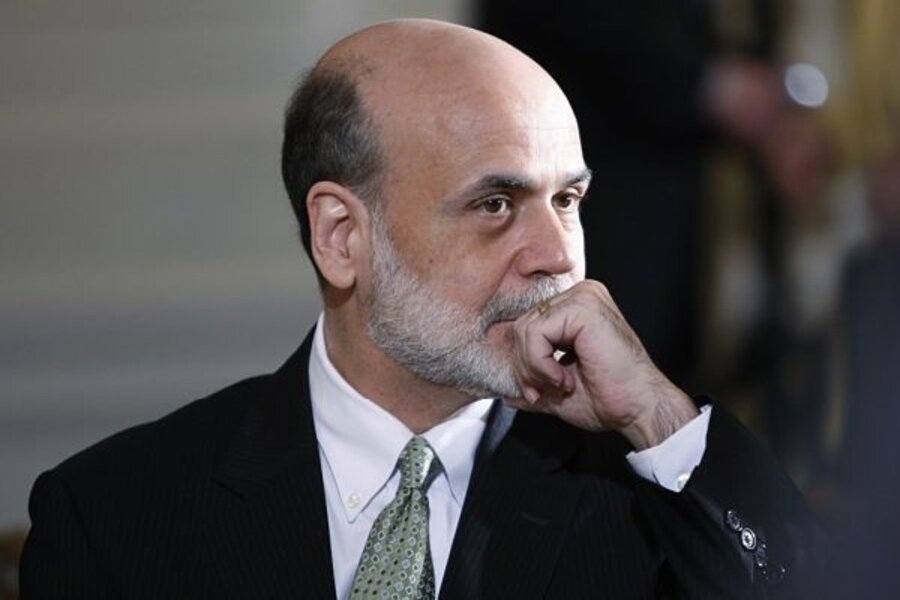

Two months ago, the committee's financial jargon wasn't so positive. "Inflation could persist for a time below rates that best foster economic growth and price stability in the longer term," Fed Chairman Ben Bernanke and his colleagues said in April.

They didn't use the word "deflation," but the severe recession has made that a concern. Just as too much inflation can be destabilizing, so can falling consumer prices.

Since last December, the monthly consumer price index (CPI) has been falling – now down 1 percent on a year-over-year basis. But the so-called “core CPI,” with food and energy prices stripped out, has remained positive.

What has changed since April, when the Fed worried inflation would undershoot its target? Oil prices for one.

The Fed noted the rise in commodity prices (which can be a force pushing other prices higher) and cited tentative signs of improvement in the economy. But if he's less worried about deflation, Mr. Bernanke isn't going too far the other way. Critics say the Fed risks setting the stage for a new inflationary spiral, with its stimulative monetary policy.

The Fed says the economy remains so weak that there's a long way to go before inflation is anything other than "subdued."

So on actual policy matters, the Fed announced no major changes this week.

It will keep its short-term interest rate near zero. And it maintained its plan to buy Treasury bonds and mortgage-based securities to help keep broader interest rates low for consumers. The Fed's Open Market Committee, chaired by Mr. Bernanke, said it expects these policies "will contribute to a gradual resumption of sustainable economic growth in a context of price stability."

Given the uncertainties on both sides of that forecast, Mr. Bernanke wants to leave himself maximum wiggle room. The committee said it "will continue to evaluate the timing and overall amounts of its purchases of securities in light of the evolving economic outlook and conditions in financial markets."