Dow's upward streak ends. Now what?

Loading...

The stock market is like an orchestra that's always losing its place. Some players focus on the notes to get back on track. Others look to the conductor or their fellow players. Then there are those who listen to the cacophony and try to pick out the tune.

Those in the latter group are the technical analysts, who look at a stock's or the market's price movements, rather than, say, its earnings or economic forecasts, to figure out where stock prices are headed. Where many analysts hear only random noise, they spot patterns.

This week the stock market offered them a rare event that happens only about as often as a solar eclipse — a stock market streak.

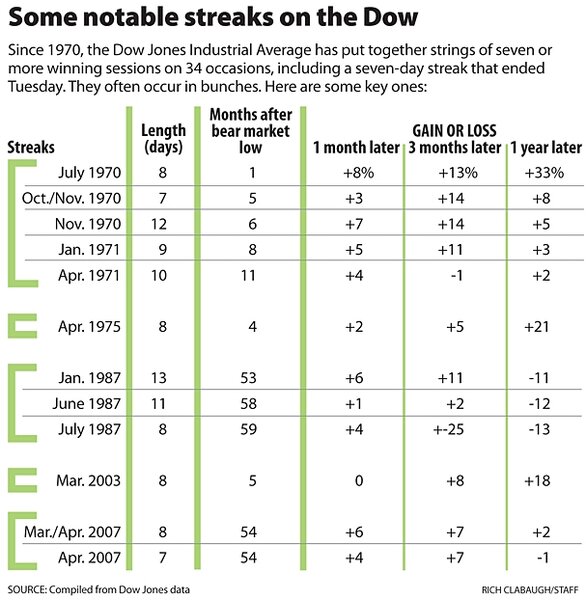

From July 13 through Tuesday, the Dow Jones Industrial Average rose every day for an overall gain of nearly 10 percent. (The Nasdaq is still on the upswing, rising 11 days in a row through Wednesday.) Since 1970, the Dow has only had 33 streaks of seven or more up days — 34 if you count the one that ended Tuesday. So what can the streak tell us about the future, if anything?

In the immediate term, it suggests that the market is overbought, says Peter Mauthe, president of Rhoads Lucca Capital Management in Dallas. "Once you reach seven days, you're typically overextended."

Looking out a month or two, the picture gets a little more intriguing. Of the first 33 streaks we have data for, the Dow was up one month later in 27 cases. The average gain: 3 percent.

In October 1998, for example, the Dow was up 7 percent after a seven-day string; in June 2005, it was up only 0.2 percent after a seven-day string. The last time the Dow enjoyed such a streak was 2007. In March of that year, the index strung together eight winning sessions, followed by a one-day loss, and then another seven-day string of gains. At that point, the Dow had risen more than 5 percent. A month later, it had gained an additional 4.5 percent.

We pointed out in a previous post that these streaks usually come in bunches. Since 1970, a streak has been twice as likely as not to come with another streak of at least six days within four months.

Perhaps the granddaddy of this phenomenon was 1970, when an eight-day streak in July was followed by strings of 7, 12, 9, 10, and 6 up days. By the time it was over in June 1971, the Dow had moved from 669 to 923, gaining a whopping 38 percent.

Investors have to be careful, though, looking out much further than a month, because these long streaks can appear at market tops just as easily at market bottoms. In 1987, for example, a bunch of four streaks (including the only 13-day string in the past 40 years) was capped off by an eight-day run in July.

Short-term investors who sold a month later would have hit the market's peak and pocketed a 3.5 percent profit. But those who held on for three months would have lost a stunning 25 percent because of October's "Black Monday" crash, the Dow's worst one-day percentage drop in history.

Investing in streaks at the early stages of a market upturn helps minimize the risk. It's like a Bactrian camel, says Tom McClellan, a well-known technical analyst and editor the McClellan Market Report, in an interview. "If you're on your way up the first hump, that's a great place to be. If you're on your way up the second hump, you're going to slide down the tail. So knowing which hump you're on is terribly important."

Even then, world events can intrude. In July 1973, the Dow fell to a 19-month low and then quickly went on a 10-day, 5.7 percent upward tear. Normally, that would bode well for further gains. But in August, Libya began nationalizing oil companies and the Nixon administration imposed price ceilings on some oil production. Within a month the index was down 3 percent. Three months later, it would fall sharply as OPEC initiated its first long oil embargo.

For the record, Mr. McClellan doesn't think this streak bodes well for very long. He says the Federal Reserve was actively pumping money into the economy in late 2008 then slammed on the brakes on 2009. His data show that it takes eight months for that phenomenon to show up in the stock market, which is one reason for this month's market euphoria and could lead to more in August.

"I predict that we're going to blow off in August and have ugliness in September and October," he says.

Looking out much further than that using a single factor, such as a market streak, is problematic because so much else is happening, McClellan says. "Randomness is with us, also."

Still, here's a final thought for those who like to puzzle over rare events: Only three times since 1970 have streaks of seven days or better occurred within four months of a bear market low (meaning the Dow had fallen at least 20 percent). In each of the first two cases (July 1970 and April 1975), the markets had surged one year later, up 33 percent and 21 percent, respectively. The Dow streak that just ended is the third such occurrence.

_______________

- Readers should consult their financial adviser before making any investment decisions. The writer likes to investigate trends and you can follow his musings on Twitter. He is not a stock analyst.