Foreclosures rise. Big banks show profits. How can that be?

Loading...

It's an anomaly of the great credit bust. Big banks in the US are reporting profits even as their borrowers are going into foreclosure at a record pace.

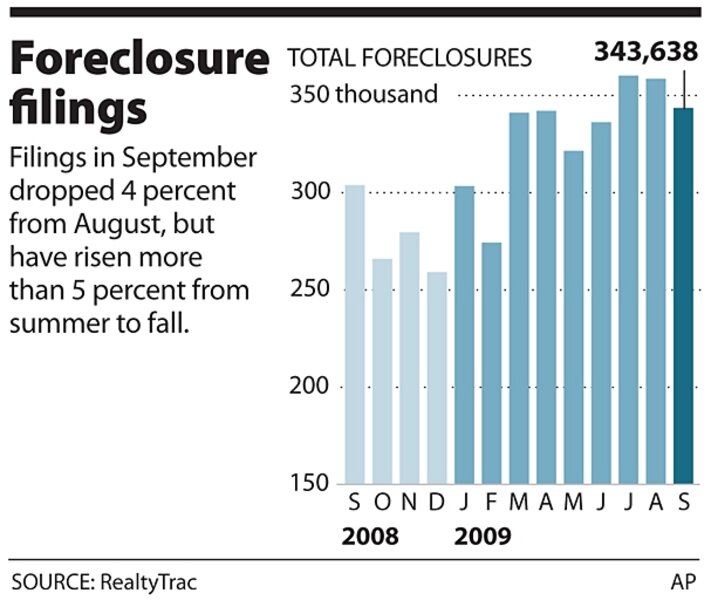

The stark disconnect came into the spotlight Thursday. The number of foreclosure filings rose 5 percent in the third quarter to a record level, RealtyTrac reported. The firm says foreclosure-related actions occurred on 1 in every 136 US housing units during the quarter.

Meanwhile Citigroup, a banking behemoth that has received massive federal support during the financial crisis, reported net income for the quarter of $101 million.

How is this possible? It's an important question for the economy, but it also has political implications.

Many voters see banks getting bailouts while efforts to help ordinary households appear weaker or less effective.

Banks did rank higher on the bailout pecking order, financial policy experts say, and that's one explanation for the mismatch between home loans and bank profits.

But the story is more nuanced. The overall housing market has made progress this year, and home prices are no longer in a free fall – something that benefits millions of homeowners as well as banks.

"Evidence is building that financial markets are stabilizing and the American economy is starting to grow again," Sheila Bair, chairperson of the Federal Deposit Insurance Corp., told a Senate hearing this week. But, she warned, "significant credit distress persists" for banks and households alike.

Citigroup still has lots of bad loans to work through. Its credit losses totaled $8 billion for the quarter, down from $8.4 billion in the second quarter.

Still, most US banks appear likely to muddle through their problems. Apart from the government help – from low-cost loans to infusions of capital – earnings on good loans, coupled with loss-reserves, will help banks work through their losses. And the largest banks are diversified into areas far afield from real estate.

"All of the big players have an advantage in that they do a lot of trading" in addition to lending, says Brian Bethune, an economist at IHS Global Insight in Lexington, Mass. "They do foreign exchange. They’re heavily involved in the bond markets."

President Obama and Congress backed the financial bailouts out of concern that a panic by bank investors, left unchecked, would cause a spiral of job losses in the economy as lending dried up. Even after the bailouts, unemployment has surged to nearly 10 percent.

As for homeowners, the Obama administration hopes to help 4 million Americans avoid foreclosure through its "making home affordable" program, which offers incentives to banks to modify loan terms for at-risk borrowers. Even if that program succeeds, however, economists say that foreclosures will remain high if unemployment keeps rising or if home prices turn downward again.

Some lawmakers hope to extend an $8,000 tax credit for first-time homebuyers, which has helped to revive demand for homes this year. The Federal Reserve has also been helping to hold mortgage interest rates low, in part by buying mortgage-backed bonds.

Although foreclosure activity rose for the quarter, RealtyTrac said the pace was highest in July and slowed somewhat in August and September. Still, other studies have found that about 1 in 4 mortgage holders is "under water," with a loan larger than the value of their home. So it's not clear if the pace of foreclosures has peaked.

----

Follow us on Twitter.