Foreclosures hit a record in 2009. This year could be worse.

Loading...

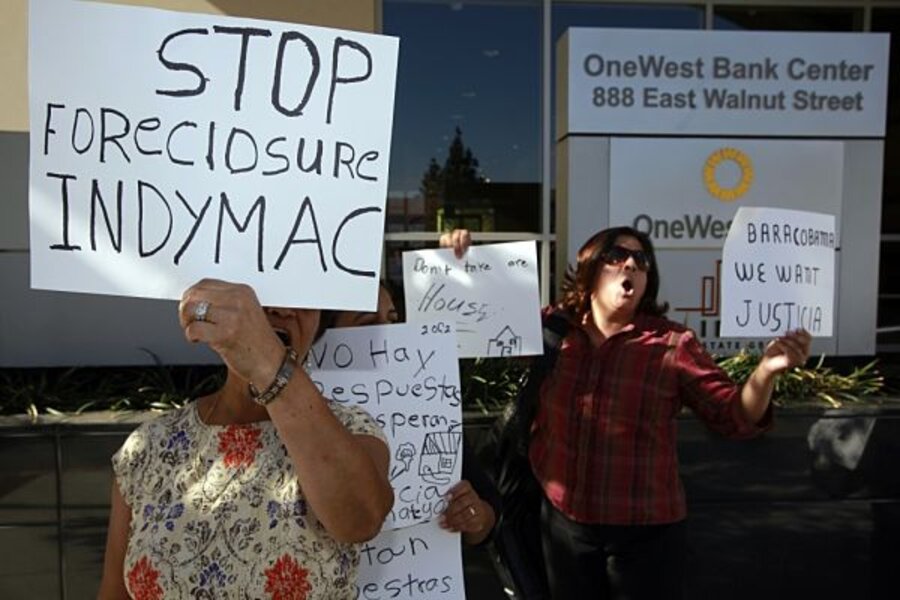

A record 2.8 million US properties were served with foreclosure filings in 2009. This year, it could be even worse as a new wave of homeowners falls into delinquency.

Already, 1 in 45 homes in the US received at least one foreclosure filing last year; in troubled Nevada, it was 1 in 10, according to a report released Thursday by RealtyTrac, an online marketplace for foreclosed properties, based in Irvine, Calif.

The numbers "are bad, but in all likelihood they should have been worse," says Rick Sharga, senior vice president with RealtyTrac. "We've seen a lot of artificial slowing of foreclosure proceedings that are intended to help the homeowner. But realistically, the [Obama] administration has come to realize how difficult this problem is to solve."

So while states, cities, and even banks are slowing the foreclosure process by looking for ways to keep overly indebted homeowners in their homes, the prospects that many will avoid foreclosure are not bright, he adds.

The prospects are further eroded because a new class of homeowners is falling into delinquent status.

"We're dealing now with a very different set of borrowers than we were at the start of the year," said John Courson, president and CEO of the Mortgage Bankers Association, at a press briefing Tuesday.

The big problem 12 months ago – subprime borrowers – is largely resolved. But the "great recession" and the unemployment it has brought on is now pushing prime borrowers into delinquencies. Without regular income, the unemployed are even less likely to be able to avoid foreclosure, Mr. Sharga says.

The result will probably be even more foreclosures this year, he adds. "It's very unlikely we'll see a double dip on home prices, but it's also unlikely we're going to see appreciation anytime soon."