Credit-card deals become harder to find

Loading...

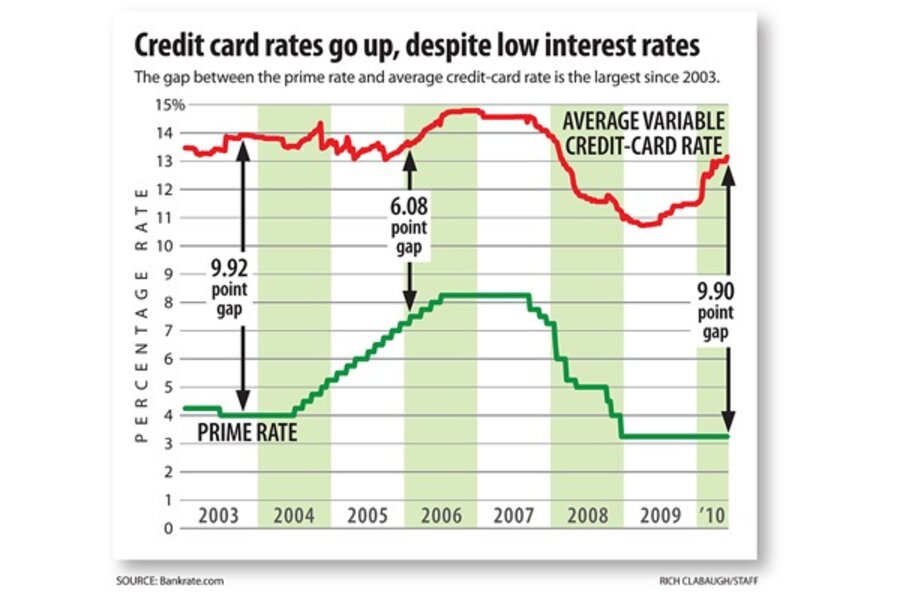

Seen your credit-card statement lately? The prime rate, which credit-card rates are supposed to track, is at 3.25 percent, its lowest level since 1955. But the interest charged by the average credit-card company is already more than 13 percent – and rising.

That's the largest gap in more than six years (see chart) and a measure of the impact that the recent recession has had on lenders. More important, it's an indication of how the options have narrowed for borrowers, especially for those who carry a balance on their card month to month.

For some of those borrowers, the new environment can be a shock.

When the interest rate on his Discover card shot up four percentage points a few months ago – to just over 17 percent – Kyle Schroeder called to ask for a lower rate, as he'd successfully done in the past. This time, Discover wouldn't play ball. Nor would American Express agree to raise the limit on a card he has with them.

Mr. Schroeder, an entrepreneur who manufactures and sells shaving cream in Los Angeles, is usually in a position to pay his balance in full, but he will calculate which of his four cards would be best to use if he has to make a large business purchase. After his experience with Discover, he paid off the balance and stopped using the card.

This is the new norm for many consumers. With credit markets still tight, many credit issuers feel less pressure to negotiate to keep current customers.

Mel White, a marketing executive based in Portland, Ore., couldn't get Capital One to lower the rate on a card he's had with them since 1999, currently at 15.9 percent. Instead, they offered him an interest-free cash advance for the amount he's currently carrying on his card for one year and a $150 fee.

Consider a balance transfer carefully

Transferring balances to cards with lower rates is one solution, provided the transfer fees don't cancel out the interest savings. Consumers can also try paying down their debt and asking for a lower rate again. But credit-card companies might cut limits if consumers make large payments toward their balance, cautions Robert Manning, author of "Credit Card Nation" and founder of the Responsible Debt Relief Institute, a nonprofit based in Rochester, N.Y., that helps individuals and financial institutions assess consumer debt.

Instead, he advises paying in smaller increments – $500 to $1,000 at a time. Even then, most credit-card companies won't consider negotiating until you're two payments late, he says. "Unfortunately, the only way [for consumers] to express their unhappiness is to not pay their bills." Nonpayment can lower credit scores, which can make job searches or mortgage applications tougher.

Those with good credit still have several options: a home loan or home equity line of credit, for example. Credit unions also offer credit cards, whose interest rates are capped by the federal government at 18 percent. Some consumers can still get rates below 10 percent.

Few options for weak borrowers now

But weaker borrowers have far more limited options. They're unlikely to qualify for new cards or loans. Based on the severity of their financial situation, they can try negotiating a payment plan with the credit-card company through a registered nonprofit credit counselor or, if things are really bad, file for bankruptcy.

The key is determining whether indebted consumers can afford their payments. If they can, a payment plan is a good option. If they can't, it's better for consumers not to exhaust their limited financial reserves trying to make payments on debts they'll ultimately have to default on, says Mr. Manning.

Credit-card reforms have changed the rules for credit issuers. The Credit Card Accountability, Responsibility, and Disclosure (CARD) Act, which President Obama signed into law in May 2009, introduced new restrictions on credit-card fees and penalties, such as over-limit fees (unless the consumer opts into an over-limit program) and retroactive interest rate increases.

Those reforms were designed to protect consumers. But reform stopped short of capping what credit-card companies can charge in interest. That means that rate increases are companies' primary way to recoup earlier losses and to make up for lost revenues from industry practices now banned by federal law.

The consumers most affected by the higher rates are those who carry a balance from month to month, meaning less-well-off borrowers.

"[Credit issuers] don't know the difference between squeezing [consumers] hard to raise revenues ... and pushing them into bankruptcy," says Manning. With fewer borrowers making payments, there will be less income for issuers, leading to higher interest rates and even more nonpayments – a lose-lose cycle that won't relent until consumers and lenders better understand their debt.

Related:

Debit card fees: Senate votes for limits, seeking to aid consumers