With big GM stock offering, vindication for the government bailout?

Loading...

| Ypsilanti, Mich.

General Motors has come roaring back, right?

Wall Street certainly thinks so. Investors snapped up GM stock on Nov. 18, the day the automaker resumed trading shares on the New York Stock Exchange after a 17-month hiatus and a near-death experience. That initial sale raised $20.1 billion for GM, most of which will go toward repaying $49.5 billion in bailout money owed to the US government.

But before anyone flings confetti or dances a jig over GM’s turnaround and the apparent success of the government bailout, talk to Don Skidmore.

A benefits representative for the United Auto Workers (UAW) here in Ypsilanti, Mich., Mr. Skidmore is dubious that GM is actually worth $33 a share, the opening price on the day of the firm’s initial public offering (IPO).

“A lot of [auto-worker] retirees come in and say, ‘Should they buy?’ and I tell them the same thing: Hold on,” he says. “I don’t think it’s a $33 [a share] company. It’s happening too quickly. I think it’ll dive down. We all think it’s going to be $10 [a share] in three months.”

Indeed, workers gathered recently at the UAW Local 849 hall in this manufacturing hub outside Detroit are wary of buying GM shares for themselves, saying the firm’s postbankruptcy restructuring cost them their previous stock benefits and burned away a majority of their 401(k) retirement nest eggs.

The contrasting views on Wall Street and in Ypsilanti about GM’s robustness are only part of the debate swirling around America’s No. 1 automaker. Opinions differ, too, on whether government intervention to save GM was the right thing to do.

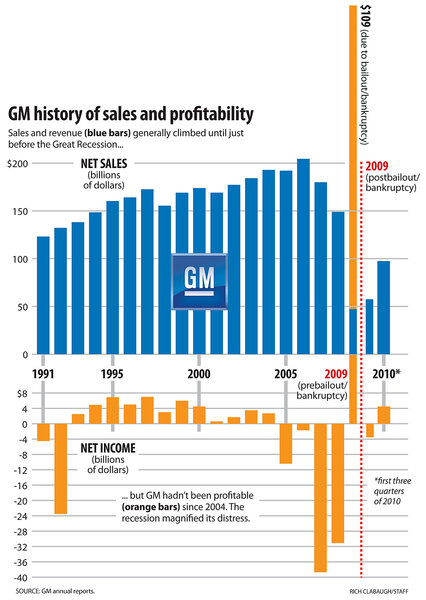

Some argue it’s hard to rail against the bailout, given where GM stood in 2008 and where it is now. It lost $30.8 billion that year. Now, GM is predicting its first profitable year since 2004. It earned $2 billion in the third quarter, topping Ford’s $1.7 billion.

GM credits cost-cutting measures such as reducing the number of US dealerships from 6,246 in 2008 to 3,605 in 2010, streamlining from 71 manufacturing plants in 2008 to 54 by 2010, and retiring failing nameplates (Hummer, Saab, and Pontiac). The hourly workforce also fell 34 percent, from 61,000 in 2008 to 40,000.

“The IPO says [GM is] a company with a future [profit] stream worth investing in. That is absolutely remarkable and a dramatic change to where they were. They were flat out of cash,” says Sean McAlinden, chief economist for the Center for Automotive Research in Ann Arbor, Mich., and a believer in the GM bailout and government-guided bankruptcy. “Paint me a better outcome if not assisted through this bankruptcy,” he says.

Though bailing out a private firm at taxpayer expense enraged some Americans, there was, of course, a precedent for it. Back in 1979, the US government guaranteed $1.5 billion in loans to an ailing Chrysler. Four years later Chrysler turned a profit, and it paid back the loans seven years early.

Chrysler chief executive officer Lee Iacocca’s decision to turn to Congress for money “broke the ice” for future bailouts, including the $10 billion Chrysler received last year, says Gerald Meyers, a professor at the University of Michigan Ross School of Business in Ann Arbor.

That crack in the ice has proved to be not such a great thing, says Dan Ikenson, an associate director at the libertarian Cato Institute in Washington. The loan guarantees did help to save Chrysler, he says, but they also planted the seed for automakers to “engage in risky behavior,” because they know if they “go bankrupt they can turn to the government for assistance.”

How the GM bailout turns out for America’s bottom line remains to be seen. With the proceeds from its IPO, GM will pay back some of the $49.5 billion it accepted from the government. But about $27 billion is still owed.

“Whether taxpayers get that back will depend on the price the government gets for its remaining 33% stake in the company when it sells its shares in the future,” stated a CNNMoney article, hours after GM shares began trading again. “The share price will have to rise about 65% [from its Nov. 18 level] in order for taxpayers to break even.”

The University of Michigan’s Mr. Meyers and the Cato Institute’s Mr. Ikenson say the government helped accelerate the GM turnaround, but they cite other factors as well.

“GM was on its way back before the government ever got into it,” says Meyers. Much-lauded car launches, such as the brand-new Chevrolet Volt and Cruze, “didn’t happen overnight,” and former GM CEO Rick Wagoner streamlined labor costs through buyouts that started 10 years ago.

Market forces are also working in the automaker’s favor: Consumer demand is up, and unit sales for cars and light trucks jumped 11 percent in the first 10 months of 2010 over the same period last year, according to Automotive News.

Ikenson, for his part, says the government did force GM to streamline its operations. But if US officials had allowed GM to liquidate, he says, private and foreign investors would have assumed the government’s role by buying majority ownership stock and cutting expenses to make GM more competitive. “If the hand-holding from the administration didn’t happen, the bank could have yielded a viable GM,” Ikenson says.

Mr. McAlinden of the Center for Automotive Research doubts that.

Investing in GM last year amid a “record-length recession” was beyond risky for any investor, he says. Without government intervention, the company’s failure was assured, he says, and would have meant a draconian loss of nearly 2 million jobs in the South and Midwest by the end of this year. “The whole auto industry would have shut down for at least a year,” McAlinden says. “It would have been an industrial Lehman Brothers.”

After GM gains more momentum and the government sells all its GM shares, public perception will swing in favor of the bailout, he predicts. “The country doesn’t want to own an auto company,” he says. “It’s just not the American way of doing things.”