Could 2014 be the year the housing market really recovers?

Loading...

| Washington

Spring is upon the United States, at least according to the calendar, which means it's time not just for crocuses and baseball but also for the housing market's months of greatest activity.

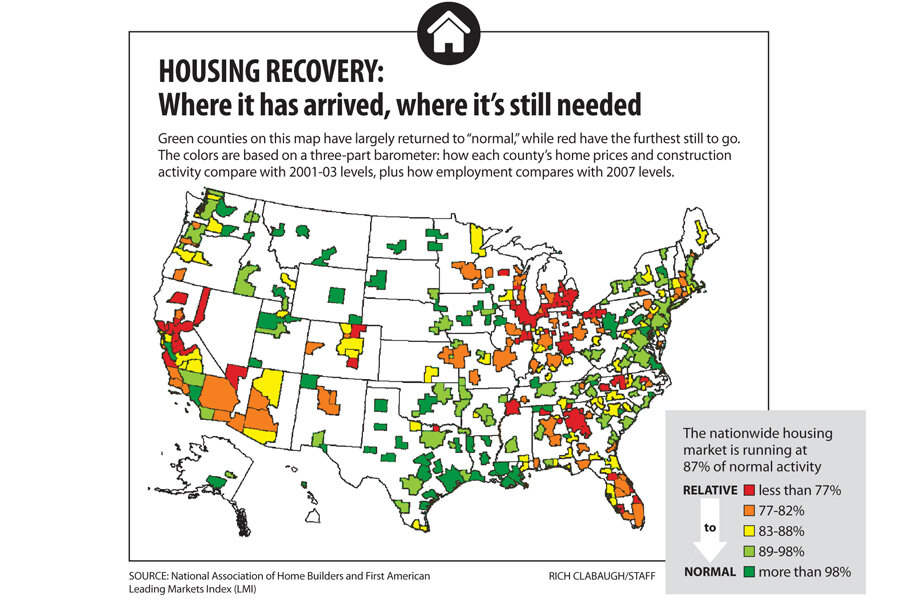

The story of US real estate this spring varies by location, but a simple theme runs through it all: A housing market recovery is well under way across the country, but not yet complete.

Since the market has been such a wacky place for more than a decade now, it's worth pausing for a moment on that word "recovery."

The word doesn't mean getting home prices back to pre-recession peaks. Those peaks, after all, were artifacts of an unsustainable boom.

A better definition would be when local markets no longer have historically high rates of foreclosures and mortgage distress, and are experiencing a healthy and sustainable pace of home sales and construction.

By that definition, 2014 could be an important transitional year.

Last year saw big gains in house prices, as buyers competed with cash-rich investors for access to a relatively slim inventory of properties for sale (including a shrinking supply of bank-owned foreclosure properties).

Now investors are backing off a bit. And many would-be buyers are feeling the pinch of higher prices. At the same time, those higher prices promise to lure more sellers to list their homes during the big spring sales season that's just around the corner. That would help to create a market with a more balanced mix of buyers and sellers.

"Things are moving in the right direction," says Greg McBride, chief financial analyst at Bankrate.com, a financial information firm in North Palm Beach, Fla. He predicts that recent gains in home prices "will entice would-be sellers, but a more modest pace of home price appreciation will keep buyers active."

Mr. McBride calls conditions "pretty favorable for home buyers" because mortgage rates remain historically low while home prices "have not gotten anywhere near the nosebleed levels prior to the housing bust."

But if this is a market approaching greater normalcy, it's still a market with challenges.

One is that household incomes aren't rising as fast as home prices. Another is that potential first-time buyers aren't finding it easy to save money for down payments.

Still, many housing analysts see a pent-up supply of young Americans who want to step out of family nests to form households of their own.

"2014 will be the year where we need to see the first-time home buyers step up to the plate in greater numbers," says Daren Blomquist, vice president of RealtyTrac, an industry data firm based in Irvine, Calif.

Rising home prices are a positive factor for a different category of buyers: people who want to move but have felt unable to sell their existing home. At today's higher prices, more of them are no longer "underwater," unable to pay off their loan by selling their house.

What will the evolving mix of buyers and sellers mean for home prices this season and beyond?

The to-and-fro forces make this a tough market to forecast, but many economists see 2014 as a year of progress though at a slower pace, with modest gains in home prices for the nation on average. Already, an uptick in mortgage interest rates prompted a slowdown in the pace of price gains in many cities late last year, from New York and Washington to Phoenix and cities on the Pacific coast.

Forecasting firm Capital Economics sees price gains slowing to perhaps 4 or 5 percent this year, compared with a roughly 12 percent pace seen last year. "We believe this is required to put the house price recovery on a more sustainable path," writes economist Paul Diggle in the firm's London office.

But he also sees the risk of a "much less benign scenario in which mortgage-dependent buyers are unable to replace investors" because of rising interest rates or tight credit conditions. In that circumstance, the trend of price gains could potentially reverse course.

At 4.37 percent, the average interest rate on a 30-year fixed mortgage has gone up sharply from about 3.5 percent last March.

RealtyTrac recently estimated that the average monthly payment on a median-price three-bedroom home (including principal, interest, insurance, taxes, and maintenance) has gone up 21 percent over the past year.

Still, the overall housing market has been growing healthier. Rates of foreclosure are approaching pre-recession levels in a number of cities, even some where the boom and bust cycle was most extreme, such as Phoenix. And although coastal cities have returned to lofty home values, many US markets are priced in a reasonable zone relative to local incomes and rents.

On average, US home prices have jumped about 22 percent from their recession low points, but won't reach their boom-level peaks unless they climb that much again, according to the Urban Institute's Housing Finance Policy Center in Washington.

"The monthly cost of owning a home is still less than renting in the majority of markets," Mr. Blomquist said in releasing the news about how costs have risen.

Here's a look at a few important facets of the market that will shape the environment in 2014 and beyond.

The buyers: Demand sizzles in Boston, despite higher interest rates

In some local housing markets, there are simply more buyers shopping than there are sellers with "for sale" signs at the curb.

Joyce Wang and her husband found recently that this can be a recipe for bidding wars. The young couple wanted to buy a condominium in Boston and learned that the neighborhood they had selected – well situated for their work and grad-school plans – is in hot demand.

Sellers can sometimes take for granted that they'll have multiple offers to choose from, Ms. Wang says. "They say on the listing, we're going to be examining offers Tuesday afternoon," after the opening weekend, she says.

In February, the couple put in an offer on one condo for $20,000 above the listing price, but the bid wasn't good enough to be in the running.

That prompted a change in strategy: They shifted away from the most sought-after blocks – where investors were snapping up properties to rent to college students – and decided they could live with commuting by bus rather than subway.

By late February, Wang and her husband had struck a deal for a condo they could afford. In Boston's pricey market, where neither owning nor renting comes cheap, they now hope to build equity in a home of their own – and to save some money. "Our rent next year would have been higher than the cost of mortgage and condo fees," Wang says.

Most places across the US aren't seeing this same level of competition. But, despite a rise in interest rates since last spring, buyers in the most popular urban neighborhoods or suburbs face a similar pressure to pounce quickly.

Other markets that were hot last year, including Phoenix, have cooled off, however, as investors have moved on and traditional buyers have grown more cautious.

The builders: Construction rekindles from Texas to California

In the past decade, many US home builders have been through a tumultuous boom and bust, and aren't eager to repeat that experience.

So despite all the talk of "lean inventory" in the US housing market, and the reality of double-digit price increases last year, builders aren't rushing to pour foundations on every lot they can find.

The good news is that will help prevent overbuilding, or having supply get ahead of demand. "We're going to let the market come to us," Donald Tomnitz, chief executive officer of the construction firm D.R. Horton, said on a recent conference call for financial analysts. "We decided that we would not overreact."

That should be good for profit margins.

The potential downside for the US housing market could be a pace of new construction that undershoots demand.

Home building, after all, fell off a cliff during the Great Recession of 2007 to 2009 and still hasn't recovered to normal levels.

Mr. Tomnitz at D.R. Horton put it this way: "There's just not a lot of inventory out there," especially along the Pacific coast from Seattle down to southern California.

The company is expecting the big spring season to be a good one, with strong buyer demand in the robust markets from within its home state of Texas to California, where the down-and-up roller coaster has been more volatile.

If the housing recovery continues, construction activity should follow for small builders as well as large players like D.R. Horton.

For now, one of the biggest segments of construction activity is building apartments and condos. "Multifamily" housing units cater to a new environment in which buying a stand-alone home isn't as easy for families as it was during the 2000s credit boom. Behind this shift in demand: Many older households have turned from owners to renters, at least while they wait to repair foreclosure-damaged credit scores. Meanwhile, student debt and a weak job market make it hard for young households to save money for a down payment. (Some Millennials – and some in older generations – are edging into co-living arrangements; see story, page 26.)

The helpers: Chicago's a reminder that housing-market distress persists

The great foreclosure surge has been diminishing, but it's not over.

For Ed Jacob in Chicago, it's an everyday reality in the communities where he works. His organization, Neighborhood Housing Services of Chicago, tries to help low-income families hang on to their houses or find affordable housing to begin with.

Although it wasn't an epicenter of the housing boom (like Nevada or Florida), Chicago was hit harder than many big US cities when the recession and housing downturn came. The share of Chicago mortgage holders who have "negative equity" (mortgage balances larger than their home's current value) is about 1 in 3, well above the national average and about on par with distressed areas like Tampa, Fla., or Detroit.

"Everybody sees the headlines, which [say] the housing market has recovered," Mr. Jacob says. "It depends on where you live."

That's true from one city to another; the market is much steadier now in Dallas or Boston than in most Midwestern cities. It's also true within an area like Cook County in Illinois.

A lot of communities are on the rebound, Jacob says, but some south- and west-side neighborhoods are still seeing year-over-year declines in home prices.

The problem, in large measure, is jobs and incomes. Low-income neighborhoods are often the last to feel a recovery in jobs. And even for people with jobs, wage growth has lagged behind historical norms.

Yes, sagging prices have made housing "affordable." But other factors hold potential buyers back: weak income growth, lack of confidence about the economy, and a loan-approval climate that has swung from too loose (during the housing boom) to arguably too tight today.

Jacob sees some "green shoots" of hope, including more people working on home-maintenance projects. But he also sees potential clouds on the horizon. Many people who hung on to their homes – thanks to government-assisted refinancing deals – aren't in the clear yet.

The federal Home Affordable Modification Program helps distressed borrowers lower their mortgage costs and avoid foreclosure. But the special support starts phasing out after five years, a time frame that was intended to allow the economy – and people's personal finances – to recover from the recession.

That five-year period is drawing to a close, with mortgage rates set to start adjusting upward on many of the loans in 2015. The pocketbook recovery, meanwhile, is still a work in progress.

The regulators: Mortgage market still leans heavily on government support

For US policymakers, healing the housing market so far has been a lot about stopping a downward spiral in home prices. The Federal Reserve has kept interest rates low in part to help make homes attractive to buyers.

The effort to maintain the flow of low-cost credit has helped sellers, not just buyers. As home prices have bounced back from recession lows, fewer would-be sellers are staying on the sidelines because of a loan bigger than the home's value.

But another big hurdle for policymakers still looms: overhauling America's mortgage-lending system for the long term.

Since the recession, the vast majority of new home loans have been extended with some form of government guarantee. Borrowers deal with a private-sector lender – a bank or a mortgage broker. But the loans are often resold to investors, whose confidence hinges on guarantees (against the risk of default) provided by the government-backed corporations Fannie Mae and Freddie Mac. In many other loans, the Federal Housing Administration bears the risk.

Both parties in Congress agree Fannie and Freddie should ideally play a smaller role, to reduce risk to taxpayers and to encourage a greater private-sector role in the market.

"There is near unanimous agreement that our current housing finance system is not sustainable in the long term," Sen. Tim Johnson (D) of South Dakota said recently, announcing a bipartisan plan for mortgage reform.

Both sides agree that a government role is needed to help ensure a reliable flow of mortgage credit when hard times hit. Their plan is to replace Fannie and Freddie with a new federal mortgage insurance corporation that would raise private capital to insulate US taxpayers from financial risk.

Delays in overhauling the lending system mean leaving the housing market in limbo, with taxpayers saddled with too much risk, the mortgage industry uncertain about its future, and Congress tempted to tap Fannie and Freddie for purposes unrelated to their core mission.

So it's time to move forward, economists say, if Congress can capitalize on the growing level of bipartisanship on the issue.