Tear down Wall Street? Actually, change is happening (slowly)

Loading...

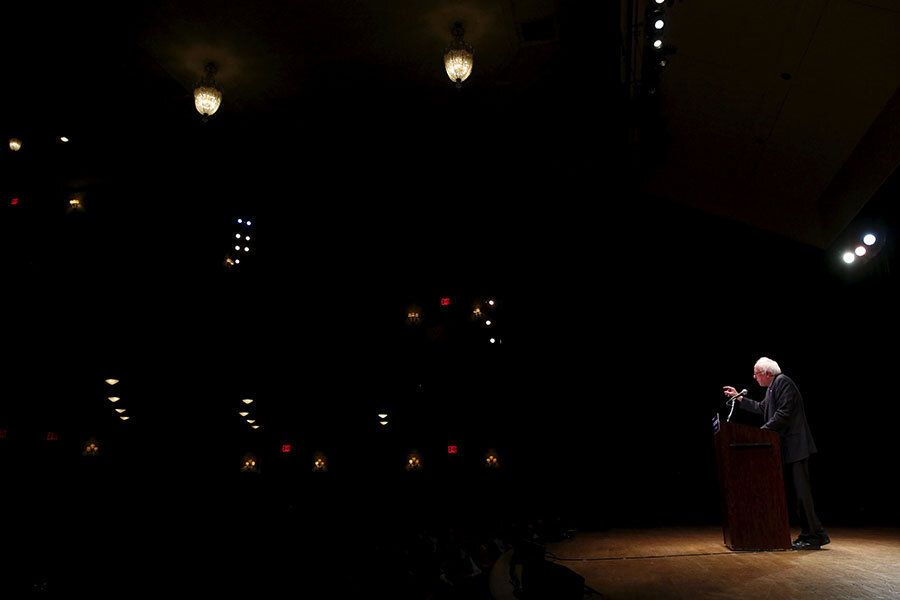

Whatever happens at Tuesday night's town hall for the Democratic presidential candidates, it is almost certain that Sen. Bernie Sanders will talk about breaking up the banks or regulating Wall Street. Almost singlehandedly, he has put Wall Street reform on America’s agenda in 2016.

His fiery rhetoric – “The business model of Wall Street is fraud” – has tapped into voters’ deep resentment about the financial crisis that triggered the Great Recession. Following his lead, Democratic hopeful Hillary Clinton and even some Republican candidates have bashed the big banks and offered reforms of their own.

The problem for these political reformers is that their proposals are probably nonstarters, no matter who becomes the next president. The last time the United States enacted sweeping changes for the financial-services industry – in 2010 – Democrats occupied the White House and both houses of Congress. Absent such a one-party sweep in November, Congress won’t have the votes to pass major reforms. Financial firms are too smart and their lobby is too powerful.

So is reform doomed? Not at all. Change is already bubbling up in and around Wall Street. The biggest banks are safer, not riskier. The idea that corporations have a social responsibility is rising to challenge the notion that they exist only to serve shareholders. Other proposed reforms are no longer dismissed out of hand. All this has the potential to be more far-reaching than any of the politicians’ solutions, albeit at a much slower pace than they would like.

“Things change – they just take longer than anyone would think,” Roger Martin, former dean of the Rotman School of Management at the University of Toronto and co-author of “Playing to Win,” writes in an e-mail.

There’s no question that many voters believe the financial system is rigged against them. In 2015, after an epic stock market recovery and billions of dollars paid in fines by Wall Street firms for their misdeeds, a Pew Research survey found that 65 percent of Americans believe the economic system unfairly favors the wealthy. Such distrust stretches back decades to at least 1941, when 60 percent of Americans told Gallup that too much power was invested in the wealthy and in large corporations.

But the broad-based nature of the 2015 Pew survey is telling: Americans at all income levels, Republicans and Democrats, said the economic system was unfair by a margin of at least 54 percent to 43 percent. The only group that disagreed were the wealthiest Republicans with family incomes of $100,000 or more.

When Goldman Sachs announced in January it would pay $5.1 billion in fines for its misdeeds, longtime Wall Street critic Sen. Elizabeth Warren (D) of Massachusetts took to Facebook to express the anger of many: “Seven years later. No admission of guilt. No individuals are going to jail…. That’s not justice – it’s a white flag of surrender.”

What reforms are needed?

Of course, prosecuting wrongdoers of the past will do little to reform Wall Street of the present. After paying hefty fines – Bank of America ($16.7 billion), JPMorgan ($13 billion), Citigroup ($7 billion), Morgan Stanley ($3.2 billion) – firms have already taken many steps to ensure that they don’t repeat past mistakes.

“The idea that Wall Street is corrupt is, candidly, out-of-date, socialist babble,” says Charles D. Ellis, author of “The Partnership,” a history of Goldman Sachs. “It may resonate with people emotionally, but it has almost nothing to do with reality.”

The 2010 reforms – known as the Dodd-Frank act – have also had an effect. Financial institutions designated as too big to fail are now subject to stricter scrutiny and regulations. As a result, these 30-odd banks are safer today than before the recession because they have more capital backing their loans and must meet annual stress tests by the Federal Reserve.

But such reforms don’t go far enough, many reformers say. Vermont Senator Sanders wants to enact a new version of the Glass-Steagall act, a Depression-era law that kept commercial banks from engaging in riskier investment banking and vice versa until the law’s repeal in the 1990s. He also calls for the biggest banks to be broken up.

Even Minneapolis Fed President Neel Kashkari last week called for the breakup of big banks because, among other things, banks not considered too big to fail may become too big to fail in a jittery stock market.

What’s most needed, say some reformers, is a change in the culture of the financial-services industry. In particular, two ’70s-era theories embraced by Wall Street need a serious rethink.

The first is the linking of executives’ pay to the share price of their companies. In 1976, two scholars propounded that idea in an influential article, arguing that when their compensation was tied to the share price, executives would jettison their cushy perks and focus on improving the company’s performance and its value to shareholders. Things didn’t quite turn out as expected.

Before performance-pay became popular, shareholders were actually doing pretty well. The average growth in profits exceeded the growth in pay for the chief executives at America’s largest corporations. For each dollar of profit, CEO pay decreased by a third between 1960 and 1980, according to a 2003 study coauthored by Mr. Martin. Between 1990 and 2000, however, when pay incentives were aligned, CEO pay per company dollar of profits increased eight times – a bad deal for shareholders and the reverse of what the theory would have predicted.

The second ’70s era idea is that corporations’ only duty is to increase shareholder value. The late Nobel laureate economist Milton Friedman argued that other things, like better pay for workers or corporate community service, were unnecessary expenses unless they improved the bottom line. Unfortunately, that logic has led to an intense focus on corporations’ short-term performance.

For example, more than half of a typical company’s value comes from moves it will make three or more years in the future, according to consulting firm McKinsey & Co. Nevertheless, it found in a 2013 survey that 55 percent of chief financial officers would pass up a valuable investment if it meant falling short of Wall Street’s consensus quarterly earnings target for their company.

“In the recent history of bad ideas, few have had a more pernicious effect than the one that corporations should be managed to maximize ‘shareholder value,’ ” writes Steven Pearlstein, a Washington Post columnist and international affairs professor at George Mason University.

Others are adding their voices, too. One example is Larry Fink, chief executive of BlackRock, the world's largest investment group with $4.6 trillion under management.

"Today’s culture of quarterly earnings hysteria is totally contrary to the long-term approach we need," he wrote in a recent letter to the CEOs of the largest US and European corporations. "To be clear, we do believe companies should still report quarterly results – 'long-termism' should not be a substitute for transparency – but CEOs should be more focused in these reports on demonstrating progress against their strategic plans than a one-penny deviation from their [earnings per statement] targets or analyst consensus estimates."

Two places to start

So what can be done? Martin, the Canadian author, has two proposals. First, delink executives’ pay from the stock price – or add other metrics to the calculation, so that corporations focus more on customer satisfaction. The second would be to remove the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, which allow CEOs to give “guidance” about their companies’ future earnings without getting sued if they’re wrong.

“Eliminating guidance calls would turn executives away from an obsession for these arbitrary numbers and back toward the real business goal of delighting customers and creating real value,” Martin writes in a chapter of “A Force for Good: How Enlightened Finance Can Restore Faith in Capitalism,” published last year.

Other changes are already taking root on the investing side.

“If you look at companies 20 years ago, you would have been hard-pressed to even hear the word ‘social responsibility’ considered in a business context,” says Martin Whittaker, CEO of JUST Capital, in a written response to questions.

But by the end of 2013 (the latest statistics available), some $6.57 trillion – more than 1 in 6 dollars under professional management in the United States – was invested according to socially responsible strategies, the US SIF Foundation says. JUST Capital, a New York-based nonprofit, wants to build on that momentum by creating research tools that will help investors measure the “justness” of corporations. It expects to launch a just company index this fall.

A related innovation is impact investing, where shareholders put their money in companies that directly measure the social impact of their operations. The companies might be financing entrepreneurs in India, supporting cocoa farmers in Ivory Coast, or building affordable homes in places like Detroit.

So far, only about $60 billion has been committed to impact investments, according to the Global Impact Investing Network, a pittance by Wall Street standards. Nevertheless, some of the largest financial firms are beginning to build expertise in the area. Last year, Goldman Sachs bought Imprint Capital Advisors, a specialist in impact investing.

"Impact investing is very real – and growing,” says Mr. Whittaker. “In the last few years, the conversation is evolved at an incredibly rapid rate, and we believe it will only continue to do so.”

Many longtime impact investing advocates worry that Wall Street will derail the movement by emphasizing opportunities with a high financial return and little social return. And the time for reforms to take hold could take decades.

“I'm not convinced that Wall Street is ever going to believe that it should reform or ever will want to reform,” says John Katovich, president of Cutting Edge Capital, an Oakland, Calif., law firm that works with companies dedicated to social change.

“You don't stand up and say: ‘We're going to shut down Wall Street’ ... because Wall Street will kill you,” he adds. “But in 50 years, I think that the things that we and others are building toward are going to provide some really meaningful alternatives” to Wall Street.

Martin is more sanguine: “I have been railing against quarterly guidance since 1998,” he says. “As of 2016, it is no longer considered avant-garde to stop giving earnings guidance…. Even awesome ideas take time.”