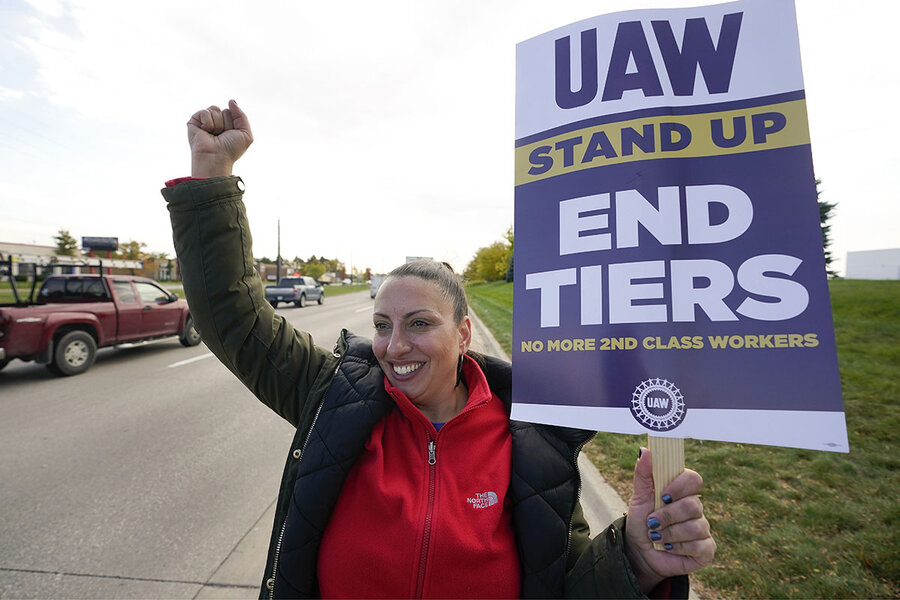

Why striking UAW is so public about wanting more – despite big offers

Loading...

Contract talks between the United Auto Workers union and the three major U.S. automakers are more public than ever this year. It’s part of the union’s high-stakes strategy to win a contract so good that hundreds of thousands of nonunion autoworkers will sit up and take notice.

If the union succeeds, it could convince many of those nonunion workers to join their ranks.

Why We Wrote This

A story focused onThe United Auto Workers union has gotten big concessions in its strike so far. Yet it’s demanding more – and publicly, rather than behind closed doors. Experts say it’s to impress nonunion autoworkers and win them over.

“You kind of want to be with the winner,” says professor Tod Rutherford, who studies labor and the auto industry at Syracuse University.

For decades, unions have been seen on the losing side of collective bargaining, either giving concessions at contract time or losing members. “If unions are now seen to be relevant actors and also ones that are winning good contracts for their membership, then that has a knock-on effect. It gives them greater credibility to start being able to unionize the Teslas and some of these other [nonunion] plants,” Dr. Rutherford says.

This helps explain the hard line that the leadership of the United Auto Workers union has maintained, despite substantial progress at the bargaining table. It’s part negotiating strategy, part theater.

Contract talks between the United Auto Workers union and the three major U.S. automakers are more public than ever this year. It’s part of the union’s high-stakes strategy to win a contract so good that hundreds of thousands of nonunion autoworkers will sit up and take notice.

If the union succeeds, it could convince many of those nonunion workers to join their ranks.

“You kind of want to be with the winner,” says professor Tod Rutherford, who studies labor and the auto industry at Syracuse University.

Why We Wrote This

A story focused onThe United Auto Workers union has gotten big concessions in its strike so far. Yet it’s demanding more – and publicly, rather than behind closed doors. Experts say it’s to impress nonunion autoworkers and win them over.

For decades, unions have been seen on the losing side of collective bargaining, either giving concessions at contract time or losing members. “If unions are now seen to be relevant actors and also ones that are winning good contracts for their membership, then that has a knock-on effect. It gives them greater credibility to start being able to unionize the Teslas and some of these other [nonunion] plants,” Dr. Rutherford says.

This helps explain the hard line that the leadership of the United Auto Workers union (UAW) has maintained, despite substantial progress at the bargaining table. It’s part negotiating strategy, part theater.

“The union is using the public,” says Toby Higbie, professor of history and labor studies at the University of California, Los Angeles. “It’s taking its case to the public in the way that the UAW did in the 1930s and ’40s and ’50s, when they made big demands, made those demands very public, and tied their UAW demands to the broader aspirations of other working people.”

After a flurry of activity late last week, for example, when the UAW announced that all three automakers had agreed to a 23% pay increase for workers over four years, union president Shawn Fain made a speech on Facebook, saying there was “still room to move” and took Ford to task for “pretending” that there wasn’t.

Such blunt talk can overshadow the union’s strategic approach to the strike, which it has gradually expanded by staging walkouts at specific plants to goad automakers to make concessions. On Monday, for example, the UAW expanded its strike to include Stellantis’ Sterling Heights, Michigan, plant, where the automaker assembles its hugely profitable Ram pickups. And on Tuesday, it struck the Arlington, Texas, plant that makes General Motors’ highly profitable full-size SUVs.

“There’s been progress, but progress is uneven and Stellantis probably lags behind the others,” especially on core issues, says Marick Masters, a business professor at Wayne State University in Detroit who has written extensively on the history of the UAW. Those core issues include a cost-of-living allowance to protect workers from inflation, the speed at which lower-tier pay for newer union workers will be eliminated, and the conversion of temporary employees to full-time workers.

The challenge in bargaining simultaneously with all three automakers is that they may want different things while the union is going to push for uniformity, he adds. General Motors, for example, has made the huge concession – according to the union, anyway – that workers at its joint-venture battery plants would be covered by the UAW contract. That move would ensure the union would retain its leverage as the automakers move to electric vehicles. Ford and Stellantis, however, are not known to be ready to accept such a proposal.

The talks are complicated by the fact that the companies face an uncertain future. The move to electric vehicles is proving costly and there are growing concerns that consumers may not embrace them as quickly as automakers had planned. The strike itself is adding to those uncertainties.

On Tuesday, GM withdrew its forecast – or guidance – for its financial performance this year, in part because of the strike. In announcing better-than-expected $3.1 billion quarterly earnings, the company said the walkouts cost it $200 million in the third quarter and another $200 million per week so far in the fourth quarter. Ford will report its quarterly earnings on Thursday.

Although the hardline union rhetoric combined with the companies touting strike-related losses may suggest an impasse, many analysts say this sort of posturing is typical of the final stage of bargaining before an agreement.

“The UAW strategy is working,” says Susan Schurman, professor of labor studies and employment relations at Rutgers University. But “you have to have an end game. You have to know when enough is enough and trying to go further is going to create more downsides than upsides.”

“These negotiations are at a critical juncture,” agrees Thomas Kochan, emeritus management professor at the Massachusetts Institute of Technology. Financial pressures are rising for the companies and the union risks undercutting its broader appeal, he says, adding, “If the strike expands and goes on for a much longer time, it may cause nonunion workers to pause and ask: ‘Is this something we are prepared to endure?’”