'No Way Out' (of the recession), especially for the poorest

Loading...

Once upon a time, Kevin Costner made great movies. Like "No Way Out" the 1987 Pentagon thriller that co-starred the always superb Gene Hackman. The title resonates with the lingering pessimism people are feeling about the U.S.

The Friday jobs numbers confirm that the jobless recovery is a harsh reality. History will tell (along with some robust econometrics, no doubt) whether the policy responses were effective, counterproductive, or just plain irrelevant. But the theme at this moment is surely a sense that nothing is working. The U.S. economy is stuck in a pattern of high unemployment and there is no way out.

A microcosm of the macro predicament is the state of the venture economy. Once upon a time, young startups planned on building valuable companies bound for a public offering. But somehow or another, the outlet for new offerings shriveled. Some argue the cause was the ill-conceived Sarbanes-Oxley law. Others say the previous IPO market was a bubble. Regardless, the new normal is a business world where startups have, essentially, no way out.

A new survey of tech executives and venture capitalists confirms the sentiment.

The survey was done by DLA Piper and can be read in its entirety here (when it gets released - growthology comment). ... The most surprising stat: A whopping 72% of respondents said that they no longer viewed an IPO as the optimal exit for a venture-backed company. Let me repeat that: Only one-quarter of the VCs and Valley executives surveyed said their goal when starting or funding a company was to take it public.

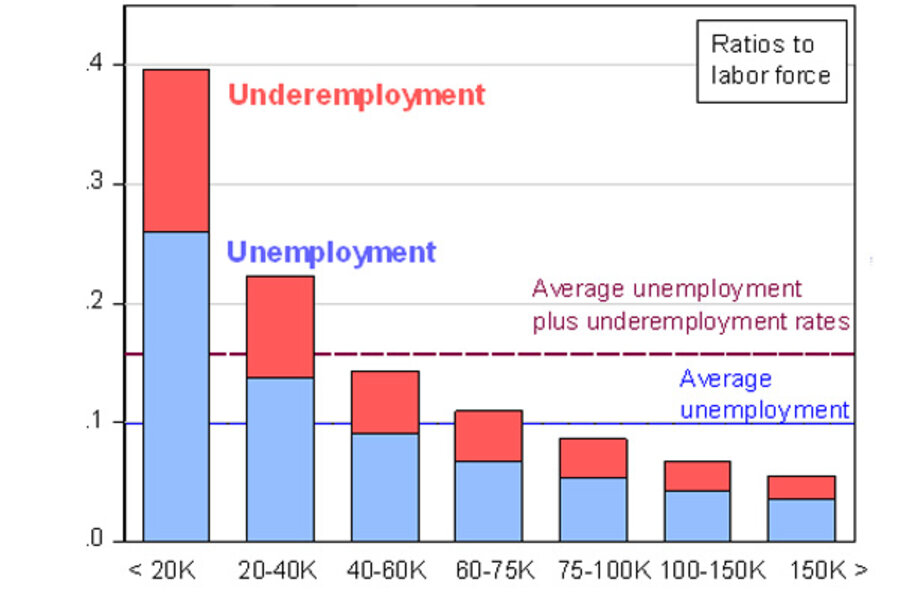

Before we shed too many tears for the titans of Silicon Valley and the lower probability of whipping up billion dollar IPOs after a few years of toil, we should remember that the biggest victims of the weak economy are lower-income workers. Econbrowser's Menzi Chinn compiled a must-see chart:

In researching statistics for our forthcoming book, Lost Decades, Jeff Frieden and I stumbled upon this study by Andrew Sumand Ishwar Khatiwada, with Sheila Palma, of Center for Labor Market Studies at Northeastern University. They characterized the mid-2010 employment situation as "A Truly Great Depression Among the Nation's Low Income Workers Amidst Full Employment Among the Most Affluent".

Americans making less than $20k incomes per year have an average unemployment rate of about 26 percent, which is more like 39 percent when factoring in the underemployed. To me, the implications of this are obvious. The minimum wage is failing to protect workers as promised. Don't forget, the Congress raised the minimum wage three times in the teeth of the recession, pricing exactly these lower-income workers out of jobs. Is there really a mystery here? Other worker protections, like extending unemployment insurance way beyond the norm, like new mandatory benefits, like promised high tax rates on "rich" entrepreneurs who do all of the job creation, are backfiring.

Although the poisonous political atmosphere of the last decade has fueled the populist policies gumming up economic growth, I remain hopeful tha the looming divided government of 2011+ will be like the 1995-2000 era when Democratic President Bill Clinton worked with Republicans in Congress to truly reform economic policy. But when I'm not hopeful, I remember the epic line of Lieutenant John J Dunbar (Dances with Wolves), paraphrased here:

Major Fambrough: You wish to see the [production possibilities] frontier?

John Dunbar: Yes sir, before it's gone.

Add/view comments on this post.

------------------------------

The Christian Science Monitor has assembled a diverse group of the best economy-related bloggers out there. Our guest bloggers are not employed or directed by the Monitor and the views expressed are the bloggers' own, as is responsibility for the content of their blogs. To contact us about a blogger, click here. To add or view a comment on a guest blog, please go to the blogger's own site by clicking on the link above.