Stocks slide in wait for Greek confidence vote

Loading...

Investors were taking few chances Friday while they waiting for a confidence vote in Greece on the country's embattled prime minister. Stocks fell on concerns that the country might not go through with an austerity program needed to prevent a default on its debt.

The Dow Jones industrial average closed down 61 points Friday and fell 2 percent for the week, its first weekly loss since September.

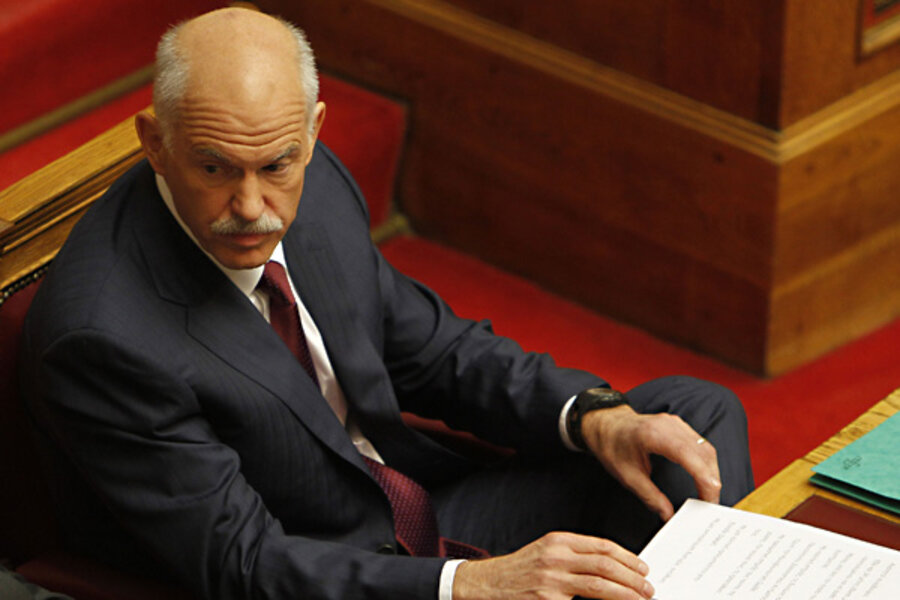

Europe's debt problems were again the main focus for investors this week. Stocks plunged Monday and Tuesday after Prime Minister George Papandreou shocked investors with an announcement that he would put the country's austerity plan to a public vote. He backed away from the plan, but investors are still unnerved by the political turmoil in Greece. It threatens to hobble Europe's efforts to control its debt crisis.

In one bright spot Friday, Groupon Inc. jumped 31 percent to $26.11 on its first day of trading. The initial public offering of the company, which pioneered online group discounts, priced at $20 a share late Thursday.

The dollar rose after the Labor Department raised its estimates for job growth. The nation added 80,000 jobs last month, the 13th consecutive month of gains. The government also said a total of 102,000 more jobs were added in August and September than had been previously reported.

The release of the monthly employment report is usually a focus for the stock market, but this time developments in Europe's debt crisis were driving trading.

"Unless the jobs number came out with a huge surprise one way or the other, it's just a momentary diversion from where the market focus has been, and will continue to be for the foreseeable future, until there is a resolution in Europe," said Brad Sorenson, head of market analysis at Charles Schwab.

Investors are worried that if Greece defaults it could cripple European banks and cause fiscal strain on much larger European countries like Italy, which are too big to bail out. Greece, Ireland and Portugal — all relatively small countries — have received financial lifelines from international lenders.

The Dow fell 61.23 points, or 0.5 percent, to close at 11,983.24.

The Standard & Poor's 500 index fell 7.92, or 0.6 percent, to 1,253.23. The Nasdaq composite shed 11.82, or 0.4 percent, to 2,686.15

Starbucks Corp. jumped 7 percent to $44.19 after the company's quarterly results beat Wall Street's expectations.

Advanced Micro Devices Inc. fell 1 percent to $5.67 after the chip maker said it would cut 1,400 workers because of a weak market for computers. It also reported manufacturing delays.

Social networking site LinkedIn Inc. dropped 5.9 percent to $82.37 after posting its first quarterly loss since going public.