Mortgage rates jump, but will an upward trend develop?

Loading...

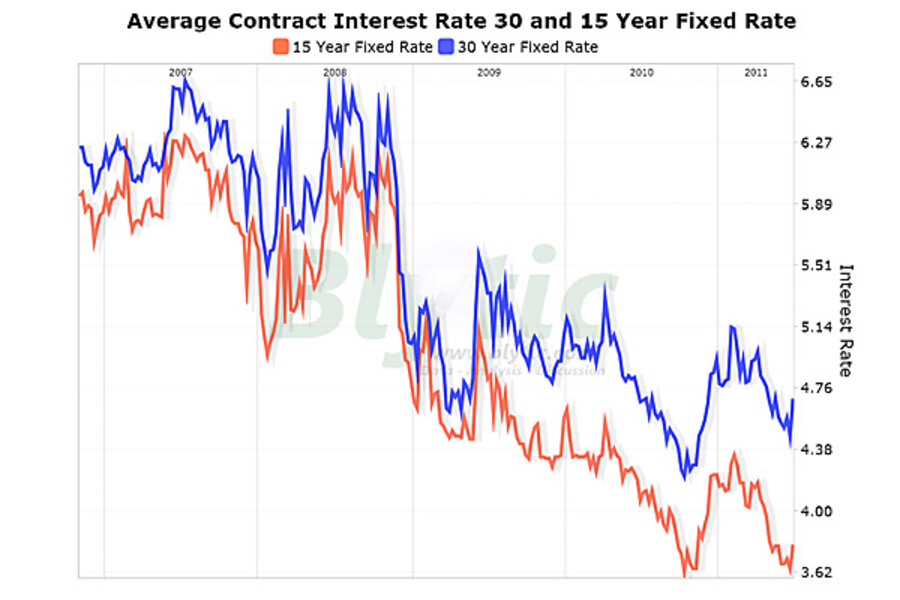

The Mortgage Bankers Association (MBA) publishes the results of a weekly applications survey that covers roughly 50 percent of all residential mortgage originations and tracks the average interest rate for 30 year and 15 year fixed rate mortgages as well as the volume of both purchase and refinance applications.

The purchase application index has been highlighted as a particularly important data series as it very broadly captures the demand side of residential real estate for both new and existing home purchases.

The latest data is showing that the average rate for a 30 year fixed rate mortgage jumped a whopping 23 basis points to 4.69% since last week while the purchase application volume increased 4.8% and the refinance application volume declined 9.2% over the same period.

Given that we are nearing at the end of the Feds QE2 intervention, it will be interesting to see how long rates trend in the next few months.

In any event, the purchase application volume remains near the lowest level seen in well over a decade while refinance activity continues to bounce around a bit.

The following chart shows the average interest rate for 30 year and 15 year fixed rate mortgages since 2006 as well as the purchase, refinance and composite loan volumes (click for larger dynamic full-screen version).

Add/view comments on this post.

--------------------------

The Christian Science Monitor has assembled a diverse group of the best economy-related bloggers out there. Our guest bloggers are not employed or directed by the Monitor and the views expressed are the bloggers' own, as is responsibility for the content of their blogs. To contact us about a blogger, click here. To add or view a comment on a guest blog, please go to the blogger's own site by clicking on the link above.