All Saving Money

Five student loan tips you should know (but probably don’t)

Five student loan tips you should know (but probably don’t)Unfortunately, it’s easy for even the most diligent student loan borrower to miss a few important things along the way.

Save the TV and iPhone for later: What to buy and skip in August

Save the TV and iPhone for later: What to buy and skip in AugustNow's the time to shop for back-to-school purchases and summer apparel, especially if there is a tax holiday in your state.

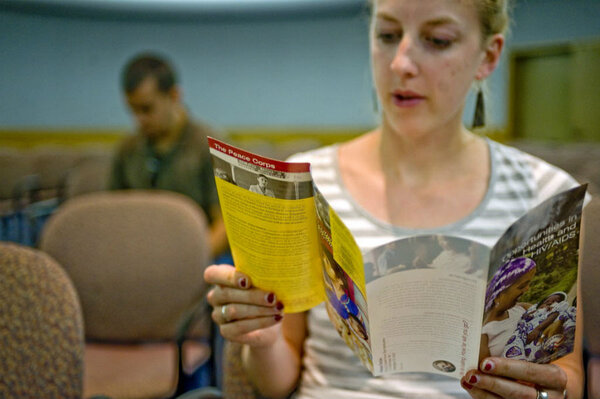

Five things to know before attending a for-profit college

Five things to know before attending a for-profit collegeFor-profit colleges don't always lead to profits after graduation. Here are five things you need to know before enrolling in a for-profit institution.

Five essential traits of a good investor

Five essential traits of a good investorGood investors can resist the influence of emotion on their investing decisions and often can avoid mistakes. Here's how.

How to do what you love and pay back student loans

How to do what you love and pay back student loansPaying off student loans may seem to be a daunting task, but it doesn't have to prevent you from accomplishing your goals after college. Here's what you need to know about student loan forgiveness.

What’s ‘affordable’ auto insurance? Now there’s an answer.

What’s ‘affordable’ auto insurance? Now there’s an answer.Everyone wants car insurance that fits their budget. After all, it’s required in most states, and if you can’t afford it, you can’t legally drive to work, school or anywhere else. But what exactly is affordable auto insurance?

How to get the most out of your state's sales tax holiday

How to get the most out of your state's sales tax holidayStates across the country are again easing the burden of stocking up on school supplies by eliminating sales tax for a few days. We have everything you need to know to take advantage of these sales tax holidays.

Best cell phone deals in August

Best cell phone deals in AugustSnag some of the best cell phone deals in August, including a few back-to-school specials.

Save while you shave: How to find the best razor for your face and your wallet

Save while you shave: How to find the best razor for your face and your walletFoil, rotary, or blade? Here are a few tips for finding the right tools for you and how to shave a few dollars off the price while you're at it.

Flying to Europe? Go through the Dublin Airport.

Flying to Europe? Go through the Dublin Airport.The airport in Dublin offers American travelers low air fare, easy access to the euro (so you don't have to keep switching currency on your travels), and a relatively new terminal.

Avoid these five online shopping mistakes

Avoid these five online shopping mistakesOnline shopping can be a great way to save a few bucks, just make sure to avoid these five online shopping pitfalls.

Fidelity joins the ranks of other online advisors

Fidelity joins the ranks of other online advisorsFidelity Go, Fidelity's version of a robo-advisor, is the financial firm's effort to attract young, tech-savvy investors. Here's how the service compares with other online financial advice services.

Best laptop deals: Now's the time to save $300 on a MacBook.

Best laptop deals: Now's the time to save $300 on a MacBook.Whether you're shopping for a computer for work or play, this week's roundup of the best laptop deals give you a lot of bang for your buck.

Should I tap my 401(k) to pay off debt?

Should I tap my 401(k) to pay off debt?The short is just one word, two letters: No.

7 ways to turn unwanted wedding gifts into cash

7 ways to turn unwanted wedding gifts into cashWhether it's a duck-shaped serving tray from Aunt Mabel or a $400 Disney Store gift card from the friend who must be hoping you have children ASAP, every newlywed couple has to consider what to do with gifts they didn't ask for and will likely never use.

It's never too early: How to build good credit in high school

It's never too early: How to build good credit in high schoolYou can build good credit and put yourself on a path to financial success even if you're still in high school. Here's how to become an authorized user of a card or attain your own credit card before you graduate school.

Why you should use your tablet as a phone

Why you should use your tablet as a phoneSwitching from a cell phone to a tablet can save you $15 to $30, and you'll still be able to call and text.

Baby boomers could take Millenials' lead with online investing

Baby boomers could take Millenials' lead with online investingAs baby boomers become increasingly comfortable with the internet, robo-advisers that provide low-cost portfolio management could see a spike in popularity.

The hazards of a long-distance home purchase

The hazards of a long-distance home purchaseFinding and buying a home in a city you know is one thing, but making a move thousands of miles away? What could possibly go wrong?

Trump's take on college affordability

Trump's take on college affordabilityNot much has been said about the Republican presidential candidate's plans for college affordability and student debt, but using federal financial aid to cover online schooling and gauging students' loan worthiness by the major they choose could be part of Trump's plan.