The Trump economy: How will tariffs, taxes, and big debt affect workers?

Loading...

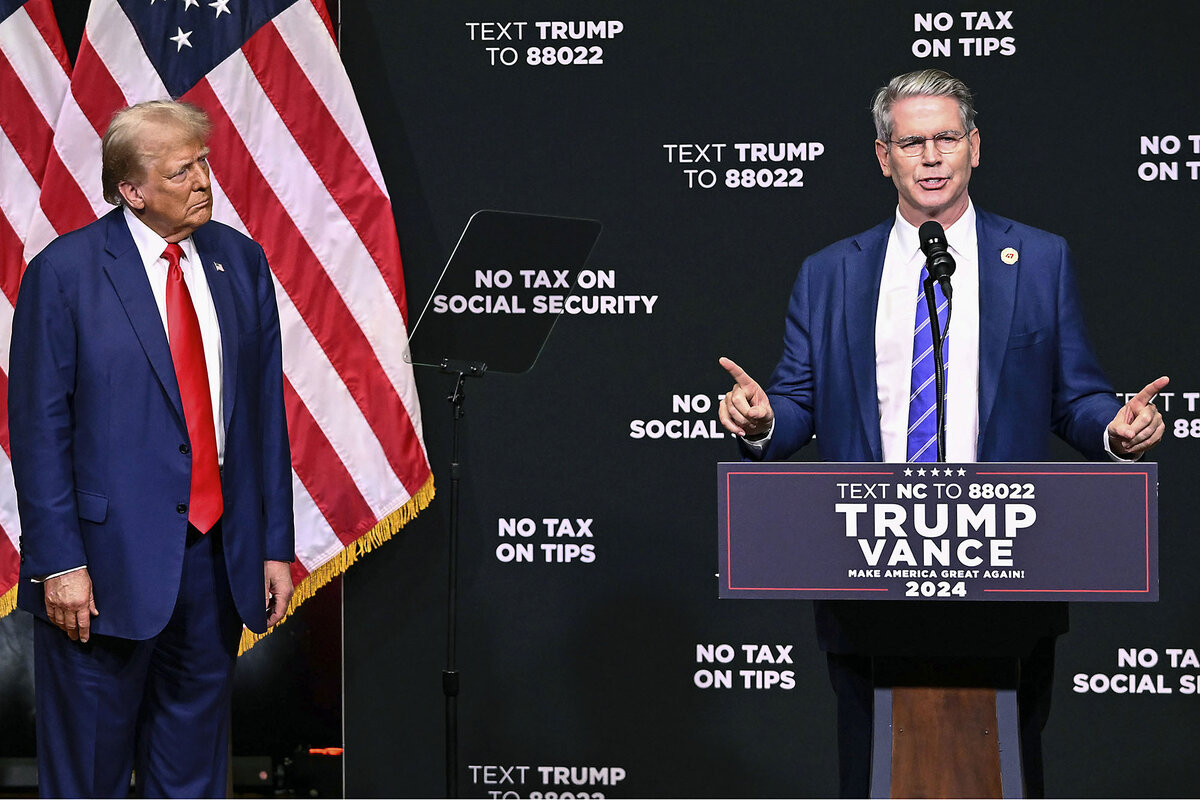

As in his first term, Donald Trump has selected two executives with both deep pockets and deep ties to Wall Street to lead the United States’ most important Cabinet posts for the economy – a top concern for American voters.

U.S. stock markets rose in apparent approval Monday following the Nov. 22 nomination of billionaire hedge fund CEO Scott Bessent for U.S. treasury secretary. Days earlier, the president-elect selected billionaire Howard Lutnick, head of a brokerage and investment bank, as commerce secretary.

“These are more consensus-oriented, market-friendly, business-friendly Cabinet appointments,” says Mark Zandi, chief economist at Moody’s Analytics. “Investors are OK with these choices, and that’s because they are mainstream.”

Why We Wrote This

President-elect Donald Trump’s economic team will face a minefield of fiscal and economic challenges, with no clarity as to how American workers will fare.

That said, the economic team – and it is not filled out yet – faces plenty of fiscal and economic challenges, with no clarity as to how American workers will fare. The incoming president promised in a statement Friday that under Mr. Bessent’s leadership, “No Americans will be left behind in the next and Greatest Economic Boom.”

But of Mr. Trump’s promised tax cuts, some economists wonder: Will they explode government borrowing – and interest rates? Likewise, of Mr. Trump’s promised tariffs, or taxes on imports: Will they trigger higher prices for imported goods? Will they start a trade war?

On Monday, after U.S. markets closed, the incoming president announced that on the first day of his administration, he will impose across-the-board tariffs on America’s biggest trading partners: a 25% tariff on all Canadian and Mexican goods, and a 10% tax on all Chinese goods. Many Chinese goods are already taxed under tariffs imposed in President Trump’s first term and continued in the Biden administration. The new Chinese tariff would be on top of that. It could just be an opening salvo, given that Mr. Trump has talked about a 60% tariff on China.

Mr. Trump said in Truth Social posts that the tariffs are meant to force these countries to crack down on border security, including fentanyl exports.

The tariff announcement was met with disquiet from abroad. Mexican President Claudia Sheinbaum Pardo warned the incoming president that “Neither threats nor tariffs will solve the issue of migration or drug consumption” and said in a letter that Mexico would retaliate in kind if the U.S. follows through. She pointedly reminded him that 70% of illegal weapons seized from criminals in Mexico are from the U.S. “Tragically, it is in our country that lives are lost to the violence resulting from meeting the drug demand in yours.”

In Canada, Ontario Premier Doug Ford called the plan “devastating.” Prime Minister Justin Trudeau phoned Mr. Trump in a brief call focused on border security and trade. His remarks to his Cabinet were measured: “This is a relationship that we know takes a certain amount of working on, and that’s what we’ll do.” Chinese Embassy spokesperson Liu Pengyu said that “no one will win a trade war” and flatly denied that China “knowingly” allows fentanyl precursors into the U.S.

Negotiating tools, but at what cost?

Mr. Trump’s use of tariffs to get what America wants jibes with Mr. Bessent’s comments that they are negotiating tools to achieve America’s economic and foreign policy aims. He rejects the claim that they are inflationary, saying there was “no discernible rise in inflation” after the first round of tariffs in Trump 1.0.

“Whether it is getting allies to spend more on their own defense, opening foreign markets to U.S. exports, securing cooperation on ending illegal immigration and interdicting fentanyl trafficking, or deterring military aggression, tariffs can play a central role,” Mr. Bessent wrote in a Nov. 15 opinion piece for Fox News.

America is the world’s largest importer, bringing in $3 trillion worth of goods from other countries. It needs to use that leverage to raise revenue, protect strategic industries, and work out deals with America’s trading partners, he wrote.

Mr. Lutnik sees things similarly. As he puts it, tariffs are “a bargaining chip” to force other countries to lower their import taxes and create a freer market.

Some economists see a solid rationale behind a more assertive U.S. trade policy, given that the current chronic imbalances suggest that “free trade” isn’t the status quo.

“Bessent is right. ... The global trading system is badly broken and needs to be fixed,” Michael Pettis, an economist at the Carnegie Endowment, wrote in a series of posts on the social media platform X Monday.

But many economists and other observers are skeptical.

Supply chains have grown more complex

Jack Zhang, the director of the Trade War Lab at the University of Kansas, says China has already accounted for coming tariffs. During his first trip back to China since the pandemic, he encountered a collective shrug as he traveled through that nation’s rust belt this summer.

To be sure, targeted tariffs can be effective, says the political scientist, but global supply chains have grown even more complex since the pandemic, meaning that tariffs have lost political potency while their impacts on consumers and producers remain steady.

“Trench economic warfare is where we are with tariffs and have been there for the last eight years, and the costs have mounted on businesses and consumers,” says Dr. Zhang.

Indeed, “China is a different animal” compared with Mexico and Canada, says Scott Lincicome, vice president of General Economics and Stiefel Trade Policy Center at the libertarian Cato Institute. “The Canada-Mexico thing is totally different. A 25% tariff on everything from Canada and Mexico would have substantial economic ramifications, including on produce. It defies belief that Trump, on the first day, would impose a guacamole tax right before the Super Bowl.”

At the same time, he says, “We should all step away from the ledge on this.” He says the once-and-future president tends to post tariff threats on social media fairly regularly, and then companies and governments “scramble around to find some sort of chit to give him that isn’t substantively important” but allows him to declare victory.

Nonetheless, he warns, “This kind of uncertainty is bad for investment, and it’s bad for the economy.”

Tax cuts, debt, and interest rates, oh my!

There’s an inherent tension in a tariff strategy, explains Kyle Pomerleau, an economist at the American Enterprise Institute. While Mr. Trump promises to lower consumer costs, he says that tariffs will increase prices. If that fuels inflation and triggers the Federal Reserve to raise interest rates to tamp it down, Americans might find it harder to afford mortgages and car loans.

Similarly, he sees problems with the president-elect’s promise to make permanent his first-term tax cuts – which expire at the end of 2025 – and to lower them further by eliminating taxes on tips, overtime pay, and Social Security. This would lead to more government borrowing, putting upward pressure on prices and higher interest rates – at a time when borrowing is more expensive, warns Mr. Pomerleau. Meanwhile, the nation is set to hit its national debt ceiling next year, with a new ceiling needed to be negotiated with Congress.

“Trump, his administration, and Congress need to tread lightly here,” says Mr. Pomerleau. Because of the incoming president’s campaign promises, “There’s going to be immense pressure to extend the individual tax cuts. There may be additional pressure to cut taxes even further. ... But the fiscal challenges currently make that quite difficult.”

Again, Mr. Bessent sees things differently. In interviews and writings, he argues that cutting taxes and deregulation lead to economic growth, which throws more revenue into government coffers. But he also wants to cut government spending, including subsidies for electric vehicle manufacturers.

He touts a “3-3-3” policy – cutting the budget deficit to 3% of gross domestic product, spurring economic growth to 3%, and producing an additional 3 million barrels of oil a day. He has said that boosting energy output would decrease oil prices, which are the lead driver of inflation expectations. The three-pronged plan is based on a similar one by the late Japanese Prime Minister Abe Shinzo.

The agency he would lead is the most powerful of the federal government’s economic policymaking agencies. The Department of the Treasury carries out tax policy, handles the national debt, leads financial regulators, and controls sanctions – though not directly tariffs, though it has influence (those are handled by the U.S. trade representative, a position not yet filled).

Other members of the president-elect’s named economic team want to drastically reduce the size of the federal government. Russell Vought was nominated to once again lead the Office of Management and Budget. A key figure in The Heritage Foundation’s conservative blueprint, Project 2025, Mr. Vought supports greatly expanded presidential powers, including the ability to withhold monies that Congress has allocated – an idea that Bobby Kogan, of the progressive Center for American Progress, described as “illegal.”

When impoundments like that were adjudicated in the 1970s, “Nixon lost every case that was decided on the merits,” he said in a statement.

Then there are Elon Musk and Vivek Ramaswamy, leaders of the Department of Government Efficiency. The DOGE, as Mr. Musk likes to call it for its allusion to cryptocurrency dogecoin, has no actual authority, though Mr. Musk has big ideas – like cutting about 30% of the federal budget of $6.75 trillion. Medicare and Social Security alone account for about a third of the budget, defense 13%, and 10% on interest for the federal debt. Whatever cuts the administration might propose would need to be worked out with Congress, as they control the nation’s purse strings.

And the American worker?

Economist Mr. Zandi says it’s too soon to tell whether all of this will add up to better lives for working Americans.

Mr. Trump’s nominee for labor secretary, Oregon Republican Rep. Lori Chavez-DeRemer, is staunchly pro-union. Her father was a Teamster, and Teamster President Sean O’Brien welcomes the nomination – even as he writes that it “remains to be seen what she will be permitted to do.”

How tariffs will work out for workers is “way too early” to call, says Mr. Zandi. Equally uncertain is the extent of mass deportations and how deeply they may impact migrant workers in the agriculture sector – and food prices.

“At the end of the day, it’s about jobs,” says Mr. Zandi. “That’s going to be how President Trump’s economic policies are ultimately going to be judged – whether he created more jobs, good paying jobs, union jobs.”

He’s skeptical that the administration’s policies will add up to that. But America is about to find out.