Jerry Brown: Governor Moonbeam or Tiger Mom?

Loading...

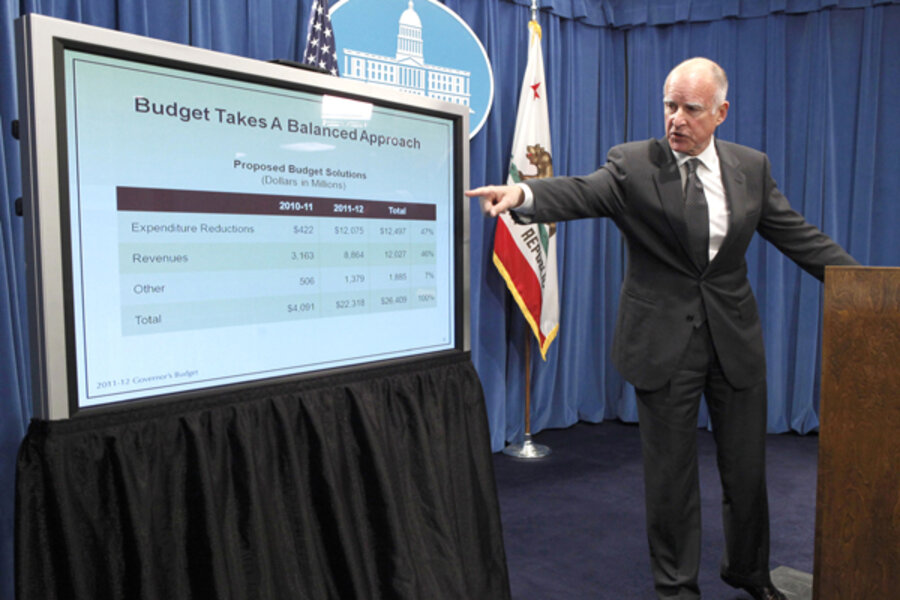

When Californians voted last fall to send Jerry Brown back to Sacramento, many commentators gleefully revived the Governor Moonbeam moniker. Now that he has submitted his first state budget, the governor is looking a lot more like a Tiger Mom. In particular, he is directing some tough love toward local governments.

Brown has proposed $12.5 billion in spending cuts to help close the state’s projected $25+ billion gap. He’d reduce Medicaid benefits and provider payments while raising co-pays (saving $1.7 billion). He’d impose stricter time limits for welfare while slashing cash grants and childcare services ($1.5 billion). His plan would cut university budgets ($1 billion) while sticking state workers not covered by collective bargaining agreements with a 10 percent pay cut ($400 million). And, by the way, the governor wants 48,000 cell phones back.

Perhaps most audaciously, the governor is proposing a major reorganization of the state-local fiscal relationship. Although this shift would be accompanied by revenues and therefore is not expected to reap big short-term gains, it would move some fast-growing health and public safety programs off the state’s books—and onto local budgets.

In the near term, Brown also wants to grab $1.7 billion from local governments by shutting down their redevelopment agencies. Little understood even within California where they originated, these agencies rely on a mechanism known as tax increment financing to build large projects.

Here’s how it works: A city manager or county administrative officer declares an area blighted and creates a redevelopment agency (usually the council or board of supervisors wearing a different set of hats). The agency is entitled to any increase in property taxes that occurs within its boundaries over 50 years, and sometimes longer. It can also issue bonds secured by these future revenues.

The catch is that the money has to come from somewhere. In California, the state is on the hook for property taxes that would have otherwise gone to schools. Other local governments lose out on property taxes that they would have received.

But the real problem is determining how much growth would have occurred anyway, without a designated redevelopment area. In most places, it’s hard to believe the answer is zero, but that’s what tax increment financing implies.

Another problem: Once redevelopment areas are born, they rarely die. For example, Los Angeles officials created the Hoover Redevelopment Project in 1966 to improve the area surrounding the city’s Memorial Coliseum. In 2004, 35 years before the project was due to end in 2039, state lawmakers extended it to 2051. Their reasoning: an NFL franchise might move to the area someday and funds would be needed for improvements. As a Senate staff analysis noted at the time:

Legislators know that the rehabilitation of blighted neighborhoods takes time and demands policymakers’ patience. But the Committee may wish to consider why it should [take] Los Angeles officials a century to redevelop the Hoover neighborhood.

To be fair, California requires redevelopment agencies to pass some funds through to other local entities. They also must set aside 20 percent of revenues for low and moderate income housing.

Still, it’s hard to see California redevelopment agencies as anything but a beggar-thy-neighbor response to Proposition 13 and other limits on local revenue raising authority. They are part of a larger dysfunctional system. Viewed through this lens, the governor’s proposal, along with a lower vote threshold for local infrastructure bonds and an openness to realigning responsibilities and revenues, is a step in the right direction.

Add/view comments on this post.

------------------------------

The Christian Science Monitor has assembled a diverse group of the best economy-related bloggers out there. Our guest bloggers are not employed or directed by the Monitor and the views expressed are the bloggers' own, as is responsibility for the content of their blogs. To contact us about a blogger, click here. To add or view a comment on a guest blog, please go to the blogger's own site by clicking on the link above.