Will Romney's capital gains tax cut hurt with the GOP?

Loading...

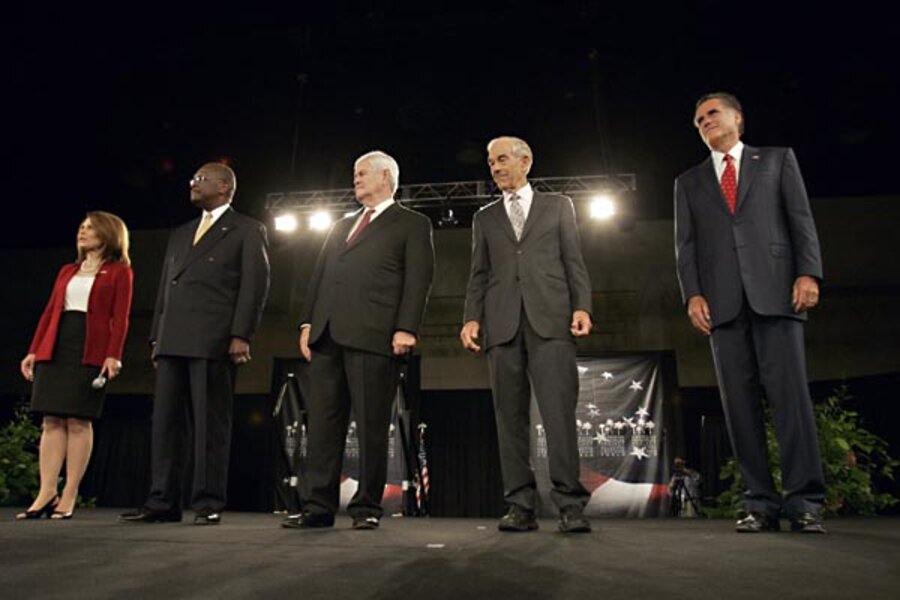

Welcome to the season of jobs plans. GOP presidential hopeful Jon Huntsman offered his last week. President Obama will propose his before Thursday night’s football game. But today is GOP presidential hopeful Mitt Romney’s day. And at least when it comes to tax policy, he veers a bit to the left of the new Republican orthodoxy.

To be sure, for someone hoping to win the party’s presidential nomination, he says nearly all the right things: He’s in favor of small government, less regulation, a Constitutional amendment to balance the budget etc. etc. But on tax policy, Romney strays off message a bit: Sure, he’d extend the 2001/2003/2010 tax cuts. But while many of his opponents would eliminate all taxes on capital gains and dividends, Romney would zero out taxes on investment income only for the middle class.

How heretical is this? Well, even Obama has proposed a zero capital gains rate for small business owners—many of whom Romney would also exempt. And Huntsman, considered the most moderate of Romney’s challengers, said he’d eliminate investment taxes for all.

Romney’s plan is interesting because, as it happens, relatively few middle-class households report capital gains, and those that do generally pay only a pittance.

For instance, the Tax Policy Center estimates that households making less than $50,000 pay an average of less than $10 in taxes on investments. That’s no surprise since most have no gains, and those few who do have been paying at a zero rate since 2008 (if you’re in the 10 or 15 percent brackets, gains are generally tax-free).

Even those making between $100,000 and $200,000 pay an average of just $400. And most of them would likely be better off if Congress extends the payroll tax holiday than if it eliminates their investment taxes.

The real beneficiaries of a zero rate on gains are the highest-income taxpayers. Those in the top 1 percent of the income distribution (who have an average pre-tax income of nearly $7 million) would enjoy a $350,000 tax cut thanks to such a change. As my colleague Bob Williams noted in a recent Tax Vox blog, 15 percent of people in that rarified income group make two-thirds of their money from gains. In current Republican parlance, they are the “job creators” who will pour that higher after-tax income into new American jobs.

That’s why former hedge-fund operator Romney will surely disappoint those in the GOP who argue for a zero rate on capital for all. For instance, in the initial version of his fiscal plan, House Budget Committee Chairman Paul Ryan (R-WI)would have eliminated all taxes on gains, dividends, and estates and repealed the corporate income tax (which he would have replaced with an 8.5 percent value added tax). By that standard, Romney is, well, practically Obama.

This leaves us with the always-flexible definition of “middle-class.” Even though the median household income in the U.S. is just $50,000, Obama defines middle-class as anyone who makes $200,000 or less. Romney appears to be using the same definition.

Will cutting investment taxes for middle-income households boost the short-term economy, as Romney claims? It is hard to see how. The extra ten bucks that goes to a typical family making less than $50,000 sure won’t create much new demand. The better question is whether extending a zero cap gains rate to higher-income (but not super- high-income) households would encourage more investment in the short run.

I suspect small business owners these days are worrying a lot more about making payroll than the promise of future tax-free gains. As for those of us who’ve been tossed around in the gut-wrenching swells of the stock market over the past few weeks, it will take a lot more than a zero gains rate to encourage another leap into those waters.