All Tax VOX

Americans think their income-tax share is fair, according to pollsCongress may be headed toward passing a tax cut the public is not demanding.

Americans think their income-tax share is fair, according to pollsCongress may be headed toward passing a tax cut the public is not demanding. Are Americans ready to get on board with tax reform? Not so much.So far, the early debate over a 2017 tax bill has been an inside-the-Beltway game. But what will happen once the tax debate gets out of Washington? Will it engage a highly polarized and often-confused public?

Are Americans ready to get on board with tax reform? Not so much.So far, the early debate over a 2017 tax bill has been an inside-the-Beltway game. But what will happen once the tax debate gets out of Washington? Will it engage a highly polarized and often-confused public? Does learning about taxes change people's views about fairness?What makes people think the tax system is 'fair'?

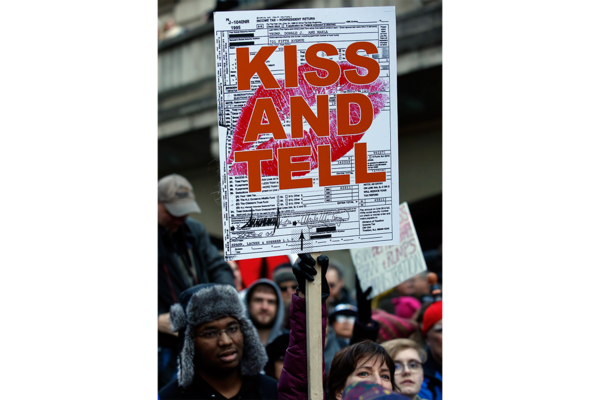

Does learning about taxes change people's views about fairness?What makes people think the tax system is 'fair'? What we learned from Donald Trump’s tax returnThe return is a case study for why the Alternative Minimum Tax, for all its flaws, serves a useful purpose. But it’s mostly strong evidence that the basic law desperately needs fixing.

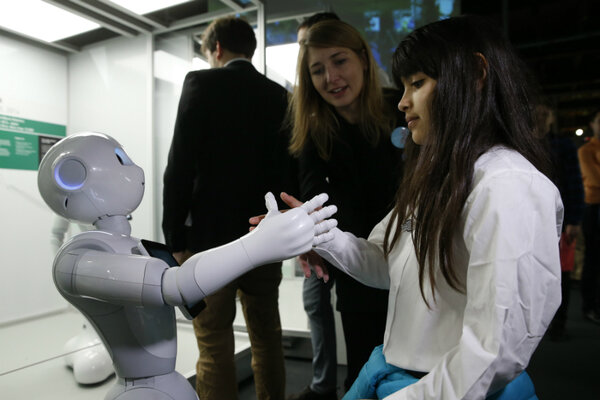

What we learned from Donald Trump’s tax returnThe return is a case study for why the Alternative Minimum Tax, for all its flaws, serves a useful purpose. But it’s mostly strong evidence that the basic law desperately needs fixing. Would taxing robots help the people whose jobs they'll take?Bill Gates recently offered a simple solution to the problem of automation: Tax the robots. But that premise raises several thorny issues.

Would taxing robots help the people whose jobs they'll take?Bill Gates recently offered a simple solution to the problem of automation: Tax the robots. But that premise raises several thorny issues. For ACA, a cautionary tale about rushing law changes through legislative short cutThis is a cautionary tale about the dangers of rushing a major change in health and tax laws through a legislative short cut – one that may prove timely in the current debate over the ACA.

For ACA, a cautionary tale about rushing law changes through legislative short cutThis is a cautionary tale about the dangers of rushing a major change in health and tax laws through a legislative short cut – one that may prove timely in the current debate over the ACA. Why EPA's science and tech office no longer has 'science' in its missionIts mission statement used to describe an agency responsible for developing 'sound, science-based standards.' But the word 'science' has recently vanished.

Why EPA's science and tech office no longer has 'science' in its missionIts mission statement used to describe an agency responsible for developing 'sound, science-based standards.' But the word 'science' has recently vanished. Here are the nuts and bolts of the GOP health planIn addition to major revisions to Medicaid and other parts of the health care system, the new American Health Care Act proposes a number of changes to tax law. Here's what they are.

Here are the nuts and bolts of the GOP health planIn addition to major revisions to Medicaid and other parts of the health care system, the new American Health Care Act proposes a number of changes to tax law. Here's what they are. Why Obamacare and Russia are undermining US tax changesWhat do Russia and the Affordable Care Act have to do with taxes? Everything.

Why Obamacare and Russia are undermining US tax changesWhat do Russia and the Affordable Care Act have to do with taxes? Everything. Before we reform tax policy, we need to know what's workingCongress and President Trump are embarking on what is likely to be a major rewrite of the federal income tax code. Yet no one knows whether the hundreds of tax preferences embedded in the law accomplish their purpose.

Before we reform tax policy, we need to know what's workingCongress and President Trump are embarking on what is likely to be a major rewrite of the federal income tax code. Yet no one knows whether the hundreds of tax preferences embedded in the law accomplish their purpose. Does Trump have a fiscal math problem?The spending plan Trump aides described this week will never pass Congress, not even one where both chambers are controlled by Republicans, says the Tax Policy Center.

Does Trump have a fiscal math problem?The spending plan Trump aides described this week will never pass Congress, not even one where both chambers are controlled by Republicans, says the Tax Policy Center. Dear lawmakers: Border-adjustable tax can’t shrink trade deficit while producing trillions in revenueSome lawmakers claim a border-adjustable tax will raise massive amounts of revenue to help pay for corporate tax cuts and give a powerful jolt to US-based manufacturers. But both cannot be true.

Dear lawmakers: Border-adjustable tax can’t shrink trade deficit while producing trillions in revenueSome lawmakers claim a border-adjustable tax will raise massive amounts of revenue to help pay for corporate tax cuts and give a powerful jolt to US-based manufacturers. But both cannot be true. Promised delays of federal tax refunds have delayed filing, tooFebruary 15 was the first day those who claim either the EITC or the ACTC could have received their 2016 tax refunds. This is several weeks later than in past years.

Promised delays of federal tax refunds have delayed filing, tooFebruary 15 was the first day those who claim either the EITC or the ACTC could have received their 2016 tax refunds. This is several weeks later than in past years. How should government spend carbon tax revenues?A high-powered group of Republicans and business executives proposed replacing regulations for reducing greenhouse gases with a carbon tax. The two most interesting things about this initiative are who proposed it and what they’d do with the money.

How should government spend carbon tax revenues?A high-powered group of Republicans and business executives proposed replacing regulations for reducing greenhouse gases with a carbon tax. The two most interesting things about this initiative are who proposed it and what they’d do with the money. For tax purposes, is it better to be single or married?Marriage gives most couples a tax cut but it can also boost a couple’s tax bill, sometimes by a lot.

For tax purposes, is it better to be single or married?Marriage gives most couples a tax cut but it can also boost a couple’s tax bill, sometimes by a lot. How much political activity could churches do if Trump can repeal the Johnson Amendment?On one hand, there are curbs that could not be ignored even if the US Congress changed the tax law. On the other, many clergy already engage in some campaigning. And for the most part, the IRS looks the other way.

How much political activity could churches do if Trump can repeal the Johnson Amendment?On one hand, there are curbs that could not be ignored even if the US Congress changed the tax law. On the other, many clergy already engage in some campaigning. And for the most part, the IRS looks the other way.- 5 landmines ahead for the GOP's corporate tax overhaulTax writers will have to resolve scores of legal and economic problems before enacting GOP's tax plan. Addressing any one will be a complex and time-consuming. Dealing with them all could be a policy nightmare.

Economists estimate the long-term consequences of big tax cutsPresident Trump and Congress are likely to consider an historically broad range of tax and spending changes over the next year. But they’ll be doing so in the face of unprecedented long-term fiscal challenges, according to new estimates.

Economists estimate the long-term consequences of big tax cutsPresident Trump and Congress are likely to consider an historically broad range of tax and spending changes over the next year. But they’ll be doing so in the face of unprecedented long-term fiscal challenges, according to new estimates. Why the prospects for tax reform in 2017 are dimmingMore than ever, it looks like Congress will settle for a big tax cut and abandon reform.

Why the prospects for tax reform in 2017 are dimmingMore than ever, it looks like Congress will settle for a big tax cut and abandon reform. How a corporate tax rate cut could help small stockholdersThe President wants US companies to stay put, and he vows to remember the “forgotten people,” or working class Americans. Some of those Americans are corporate shareholders. Are there ways to reform the US corporate tax system that benefits them?

How a corporate tax rate cut could help small stockholdersThe President wants US companies to stay put, and he vows to remember the “forgotten people,” or working class Americans. Some of those Americans are corporate shareholders. Are there ways to reform the US corporate tax system that benefits them?