All Tax VOX

- Gleckman: Why doesn't the US Olympic Committee pay taxes?

The US Olympic Committee helps support American athletes compete on a worldwide stage every two years. But the organization helps promote athletes with endorsement deals and generates millions in revenue, prompting TaxVox' Howard Gleckman to ask why it should be exempt from paying taxes.

New Senate Finance Committee chairman aims to rewrite tax code

New Senate Finance Committee chairman aims to rewrite tax codeCalling the tax code a "dysfunctional rotting carcass", Sen. Ron Wyden (D-OR) has framed his tax agenda around issues like narrowing the gap between investment income and ordinary income tax, and increasing the standard deduction

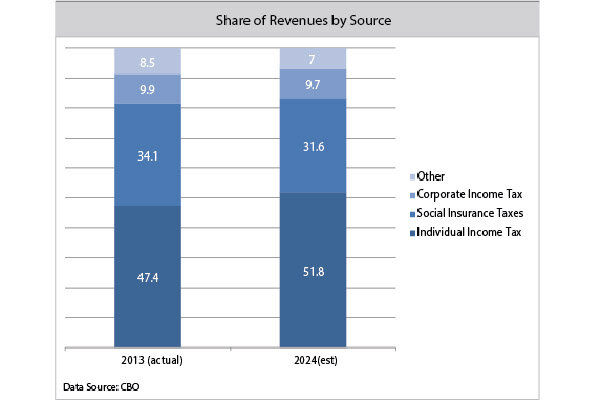

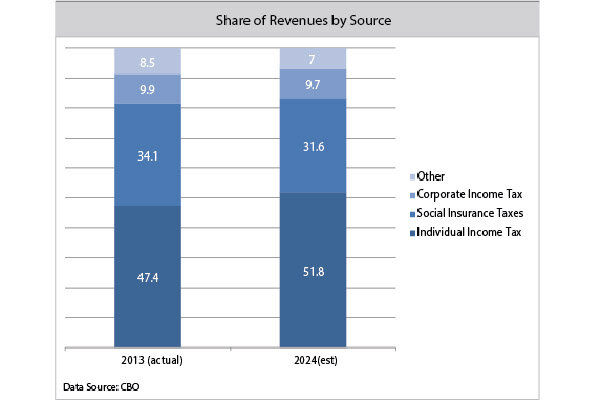

CBO: Individual income tax will fund half of federal revenue

CBO: Individual income tax will fund half of federal revenueThe US government is expected to increasingly rely on the individual income tax as a revenue source, according to the Congressional Budget Office, funding about half of federal spending a decade from now.

- Expanding the EITC for childless adults

The American Earned Income Tax Credit can reduce poverty rates among families with children. Expanding that benefit -- with some changes-- could help qualifying adults without children of their own, as well.

The deficit paradox

The deficit paradoxGleckman explains the tough politics of having, and reducing, a deficit.

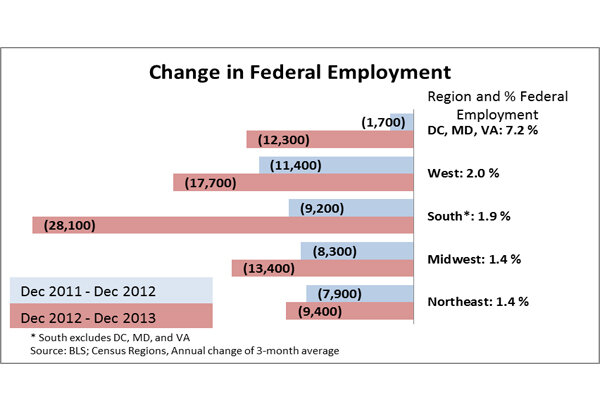

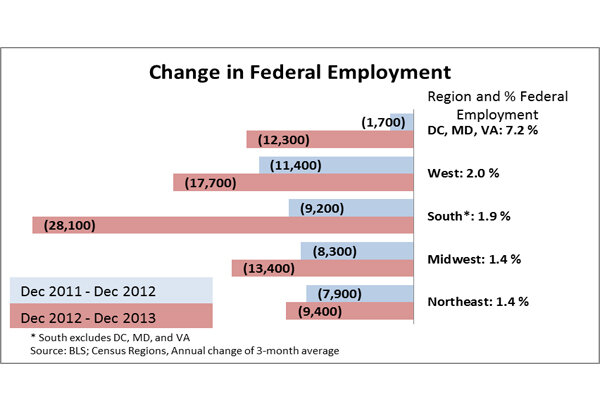

Federal job cuts hit the South and West

Federal job cuts hit the South and WestThe federal workforce has decreased 3 percent from last year, many cuts coming from the South and West.

- Demand for low income tax credit varies widely across country

Though the Earned Income Tax Credit has helped millions of Americans stay out of poverty, the take-up rate among taxpayers varies widely across the country, and even at a county-by-county level.

401(k) supplement, not substitute, at the heart of Obama's 'myRA'

401(k) supplement, not substitute, at the heart of Obama's 'myRA'401(k) plans will be supplemented by President Obama's proposed retirement plan, called 'myRA.' Only about half of US workers have access to a 401(k) or similar retirement savings plan at work.

More detail needed in Obama's tax proposals

More detail needed in Obama's tax proposalsDid President Obama's latest State of the Union speech offer enough specifics in his proposed changes in tax policy? TaxVox' Howard Gleckman writes that Obama needs to go further.

How Rubio's 'federal wage enhancement' could help reduce poverty

How Rubio's 'federal wage enhancement' could help reduce povertySenator Rubio's anti-poverty plan includes one creative piece: replacing the well-known and highly effective earned income tax credit (EITC) with a monthly “federal wage enhancement” for all individuals with qualifying low-wage jobs.

Pay for new highways with lower corporate taxes?

Pay for new highways with lower corporate taxes?Would a congressional proposal to fund public infrastructure like bridges and mass transit by easing taxes on corporations' foreign income be the right move? One thing is likely: the plan would be complicated.

Best Picture Oscar nominees got major tax breaks

Best Picture Oscar nominees got major tax breaksThink the movie business is profitable? Turns out it may be even more revenue from films than expected, especially when tax incentives for shooting locations is a factor, often at the cost of the state providing a subsidy.

The IRS was the big loser in the 2014 budget agreement

The IRS was the big loser in the 2014 budget agreementUnder the new budget agreement, the IRS would get just $11.3 billion, which is $526 million below its 2013 budget and $1.7 billion less than President Obama requested. It's political payback.

Married Utah same-sex couples can file joint tax returns

Married Utah same-sex couples can file joint tax returnsSame-sex couples in Utah may not have their marriages officially recognized by the state, but they can file their 2013 returns together--at least for now.

Taxes: the big weapon in the war on poverty

Taxes: the big weapon in the war on povertyOver the years, tax policy has been a key tool in keeping the safety net that protects the nation's poor intact.

Taxes get complicated for same-sex couples in Utah

Taxes get complicated for same-sex couples in UtahWhile courts hash out the legality of Utah’s same-sex marriages, gay couples who married in Utah must file state income tax returns as individuals but federal returns as married.

Pay to extend unemployment benefits? Why not tax breaks, too?

Pay to extend unemployment benefits? Why not tax breaks, too?One Republican talking points over long-term unemployment is: Sure, we’ll consider an extension, but it must be paid for. That’s a fine idea. Here’s another: In exactly the same way, Congress should offset the cost of restoring dozens of temporary tax breaks that expired on Dec. 31.

Bitcoin: How should it be taxed?

Bitcoin: How should it be taxed?Is bitcoin really money? Or is it a capital asset? How about a commodity? ? The IRS says it is studying the matter but has yet to issue any guidance. Until it does, it is anyone’s guess how bitcoin should be taxed.

Is there a better way to do homeowner tax breaks?

Is there a better way to do homeowner tax breaks?Instead of encouraging people to borrow, effective homeowner tax subsidies would create incentives for homeownership without tying tax breaks to mortgage debt. Tax Policy Center examines three possibilities.

Time to park the commuter tax subsidy

Time to park the commuter tax subsidyUnder new legislation, tax subsidies for mass transit commuters is cut in half for 2014, while drivers got a boost to their tax breaks. This makes no sense.