Economic recovery? US must solve its debt problem first

“Call it a nightmare,” says Dave Rosenberg.

Markets all over the world went down again yesterday. The Dow dropped below 10,000 in the morning trading…then came back to give up a modest 22 points by the closing bell.

The Wall Street Journal says it’s time to start worrying about a “double dip recession.”

We suspect that output will dip below zero again – giving us, technically, a ‘double dip’ recession. But calling it a recession misses the point. It’s not just a pause. It’s a change…a Great Correction.

There’s something else going on…something much more important and much harder to deal with than an ordinary recession. The feds have thrown everything into the battle to stop this downturn. No matter how you look at it, the ammunition spent in this fight has been spectacular.

And it hasn’t worked. Unemployment has actually gotten worse. Private sector credit has declined. And what’s this? “Falling home prices raise fears of new bottom,” says a headline.

People talk of ‘recovery,’ but it’s now three years after the crisis began and there is no recovery. Instead, there’s another crisis on the horizon.

And now the trouble is, the feds don’t have much ammunition left to fight this US debt crisis. Interest rates are already at zero; they can’t go lower. And the federal deficit is already as much as 10% of GDP.

Besides, it’s becoming clear that all that ammunition fired off so far was wasted! It got us nothing but more debt.

The problem was never a recession. It was too much debt in the private sector. But the feds misunderstood it. They thought it was a regular recession that they could ‘cure’ with more credit and more spending. So, they added trillions of new debt in the public sector!

They claimed to have spared the world economy a worse disaster. But now that worst disaster is happening anyway. The bad dream has turned into a nightmare. Because it’s not just the private sector going broke; governments are going broke too.

Not that we have any new information on the subject. And we wait to be proven wrong. But we can add and subtract. And when we add up the debt totals in the developed world – the US, Europe, and Japan – what we get are some pretty big numbers. Government debt alone is $32 trillion. That’s for a combined economy of about $34 trillion.

Right now, with the lowest interest rates in 30 years, it’s still possible for most ‘western’ governments to pay the interest and finance their deficits. But Europe has already run into trouble. Every government in Europe is scrambling to come up with a credible plan for budget cuts. David Cameron announced his plan just yesterday.

“Austerity plans multiply in Europe,” says the headline in yesterday’s Figaro. And those poor French bureaucrats! They’re supposed to cut expenses by 10% next year.

In Japan and America, on the other hand, deficit spending still looks easy. Aside from a few cranks, clairvoyants and Daily Reckoning readers, everyone seems to think things will be all right forever. There is no serious pressure to cut budgets – except at the state level. The Pentagon still has a blank check – it just fills in the amount each year. Health care expenses still grow like weeds without winter.

Few people realize that America’s finances are already no better than those of Greece. Fewer still care.

But heck, we’re not going to go around with a long face about it. Nope. So what if the stock market begins the terminal phase of its long bear market – the one that began ten years ago? So what if the real estate market takes the next stairway down towards more foreclosures and lower prices? So what if the feds go broke?

We’re not going to sweat it. Instead, we’re going to enjoy it.

But how? Ah… Well, first, we’re going to stay out of US stocks in the short run. Then, we’re going to get out of US bonds and the US dollar…too. We’re going to stay in cash and gold…

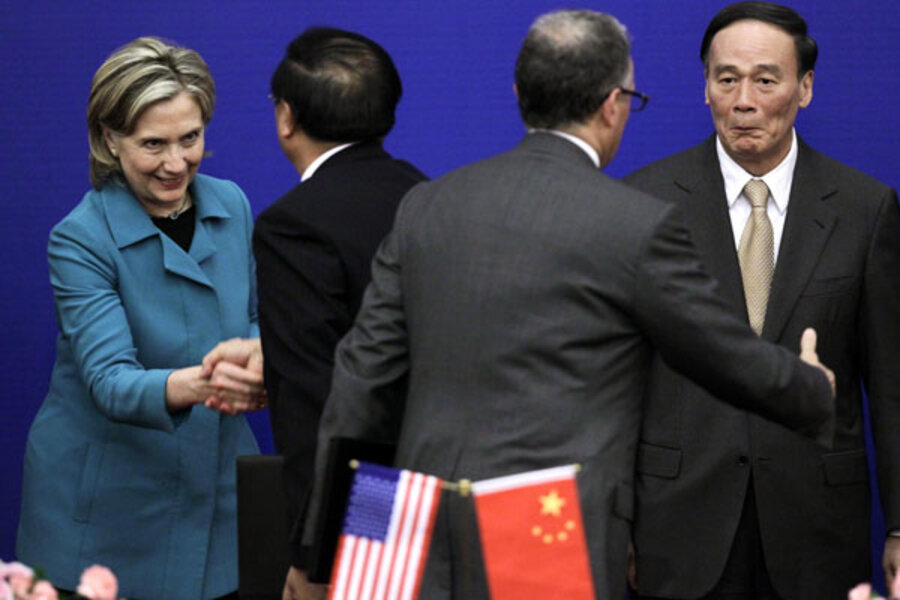

And maybe we’ll learn to speak Chinese…

Add/view comments on this post.

------------------------------

The Christian Science Monitor has assembled a diverse group of the best economy-related bloggers out there. Our guest bloggers are not employed or directed by the Monitor and the views expressed are the bloggers' own, as is responsibility for the content of their blogs. To contact us about a blogger, click here. To add or view a comment on a guest blog, please go to the blogger's own site by clicking on the link above.