Beware the Fed taper? Not quite.

Loading...

The taper talk that began earlier this summer has led to many investors racing away from dividend-paying stocks under the false impression that:

a) less QE means much higher interest rates

and

b) dividend stocks would underperform thanks to competition from bonds which would now be paying higher yields

This line of thinking is precisely backwards - because nominal yield is not the same thing as total return.

Ned Davis (via BlackRock) has run the numbers - it turns out that high-paying dividend stocks outperform non-paying stocks in both neutral rate environments and in rising rates - the opposite of what many people currently believe ...

From BlackRock:

Dividend paying stocks in the S&P 500 returned 2.2% annualized during such times of tightening (increasing rates), while non-dividend stocks in the S&P gained 1.8%, according to Ned Davis Research. On the other end of the spectrum, during periods of easing (declining rates) by the Federal Reserve, dividend payersgained 10.2% annualized and non-dividend payers lost 1.3%. During times of neutral Fed policy is when dividend payers have performed best, returning 12.3% versus 6.2% for non-dividend stocks. There is no guarantee that stocks will continue to pay dividends.

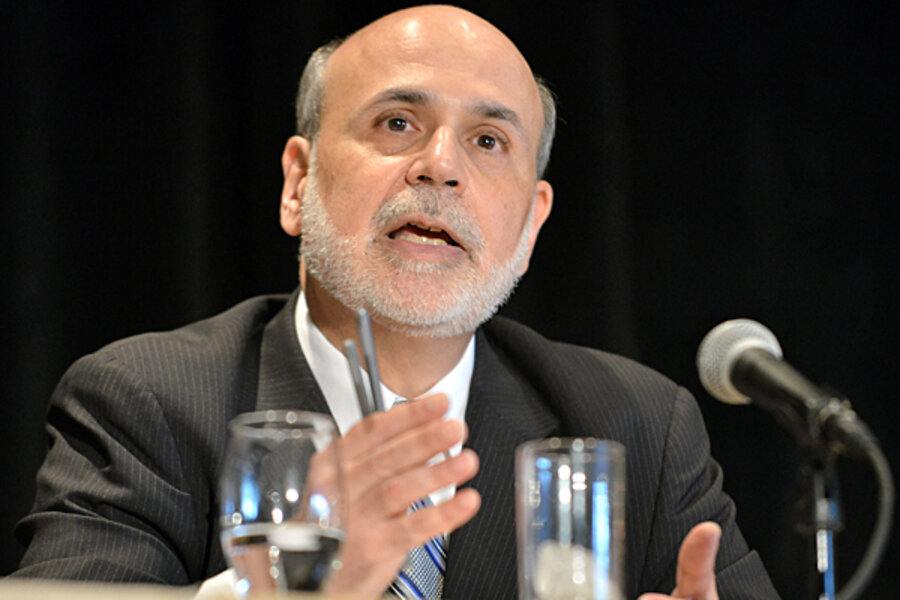

While I don't believe the excessively rich valuations people had been paying for utilities and telecom stocks made sense, I also don't believe the wholesale dumping of dividend stocks every time Bernanke made a hawkish statement was warranted either.