Staying on track when attempting financial change

Loading...

Mark writes in:

I’ve been reading The Simple Dollar for a year or so and I’ve found it really inspirational. My problem is that I can’t get past the “inspirational” part.

Several times, I’ve started to try to implement your tips. I’ll make grocery lists and try out lots of free activities and give up my morning coffee and start watching less television and reading more. What I find, though, after a week or so is that I just get frustrated with all of it and I quit all of it and go back to doing exactly what I was doing before. How do you start changing if you can’t even tackle a handful of simple changes like this?

In order for change in your personal life to succeed, you need several elements. From what I can tell from your description here, Mark, you’re missing several of them.

First and foremost, you need a goal. Why are you doing this? Where do you want to be in five years? Will you be out of debt? What will you do with debt freedom? Will you have a family? A home? A better career?

Don’t spend your time worrying about specific money-saving tactics right now. Spend a week or so really thinking about your future and what you really want from it. Where do you want to be in a year? In five years? In ten years? What do you aspire to?

Flesh these goals out. Add lots of detail to them so that you can really get a sense of what it might take to get there.

Most importantly, write them down. Record these goals somewhere, along with all of the details you come up with.

Think of it this way: if you’re not working towards something better than where you’re at right now, why make sacrifices at all?

Once you have that goal in mind, you need a plan. What exactly needs to be done to get to the goal (or goals) that you’ve set for yourself?

One big part of this is often a debt repayment plan. A debt repayment plan basically organizes and orders your debts to maximize the effectiveness of your debt payments.

You might also want to come up with an educational plan or an exercise plan or a plan for improving yourself in some other fashion, whatever that might be.

Make the plan realistic. Never forget that the perfect is the enemy of the good. Your plan should be one that’s easily achievable, even if it means putting off your goal for a little bit longer. It should also allow you to go beyond the plan if you so choose on any given day.

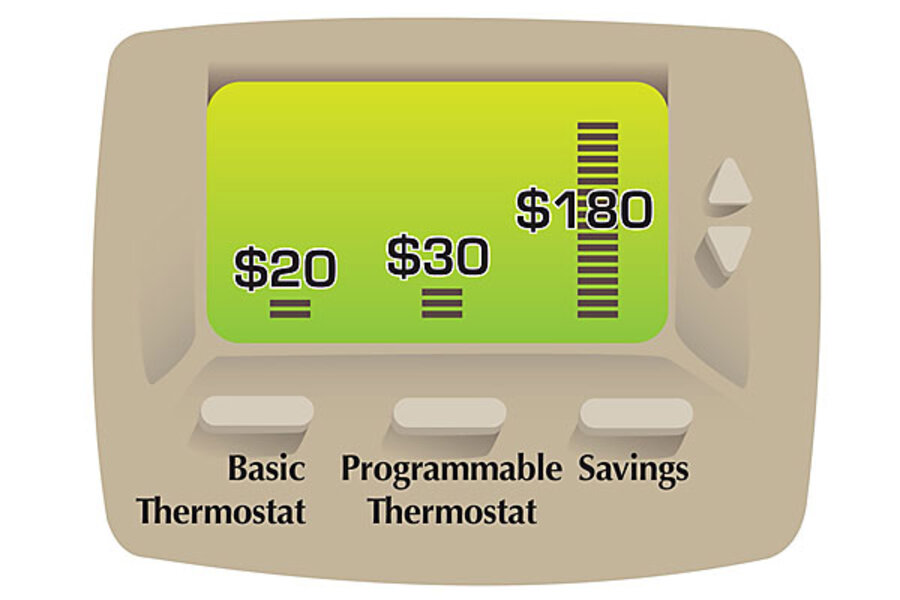

Once you’ve done that, do a lot of “one and done” financial changes. Fill your spare time with these things. Install a programmable thermostat. Air seal your home. Clean out your closets and sell off the stuff that you don’t use that has value. Trim down your DVD collection.

Spend your spare energy doing these things for a few days. Better yet, as you do them, calculate the results. How much will they reduce your energy bill? When you sell off that stuff and throw the cash straight into your debt repayment plan, how muh is that plan accelerated? Do you pay things off a few months faster now?

This is the first taste of success, and it’s usually an inspiring one. You’ve got goals and plans for getting there. You’ve done something that directly helps your plan along and it wasn’t all that hard, either. You’ve reached some success.

Once you’ve done this, now’s the time to start with the behavior changes. However, I’m going to suggest that you not just do a bunch at once. Instead, pick out one change and focus on maintaining only that one change for thirty days. If you decide to switch to “office coffee” instead of stops at the coffee shop, do that, but don’t force other changes.

Again, figure up how much you’re saving from that one behavior change and roll that savings into one of your plans for the future. If you’ve simply made a change that saves $10 over the course of a month, that’s just fine – add $10 more to your next debt payment or put $10 into a savings account.

Take it slow. Every step you take is a real improvement, and it’s far better than taking thirty steps at once, stumbling, falling down, and rolling back down the hill.

Good luck.

Add/view comments on this post.

------------------------------

The Christian Science Monitor has assembled a diverse group of the best economy-related bloggers out there. Our guest bloggers are not employed or directed by the Monitor and the views expressed are the bloggers' own, as is responsibility for the content of their blogs. To contact us about a blogger, click here. To add or view a comment on a guest blog, please go to the blogger's own site by clicking on the link above.