All The Simple Dollar

Freezer burn? No way. Freeze extra staples and save.

Freezer burn? No way. Freeze extra staples and save.Don’t throw extra food away. And don’t shove it into the back of the fridge. Instead, freeze them and use them later. Almost any extra ingredient that you have on hand can be frozen and used in the future. The trick is simply knowing how to freeze the item.

Retirement savings: Couple starts late. How much to put away?

Retirement savings: Couple starts late. How much to put away?Retirement savings are small for a couple that's turned 30. Save 10 percent of his salary, at a minimum. See question No. 7 in the reader mailbag.

Money as security (or other things)

Money as security (or other things)Money means a lot of different things to different people. Money can represent things, it can represent interesting potential experiences or places. It can represent power or social acceptance, corruption or evil. But for our personal finance expert, money represents security.

Stay fresh: Avoid frozen and prepackaged meals

Stay fresh: Avoid frozen and prepackaged mealsPrepackaged meals are certainly attractive due to convenience. But there are hidden costs as well. For starters, most frozen or prepackaged meals you buy are more expensive than their raw ingredients. Plus, there are important health issues.

Better in bulk: Buy staples in large quantities to save money

Better in bulk: Buy staples in large quantities to save moneyAnything that doesn’t have a quick expiration date, can be stored, and is something used on a regular basis is good in bulk. Items bought in bulk are less expensive per pound, and can also help squeeze out a few more meals before the next grocery trip.

Learning to love the leftovers

Learning to love the leftoversEvery time you choose to eat leftovers, you’re basically getting a free meal. If you’ve got it in your home, you’ve paid for it in some fashion. Throwing away leftover but still good food is no different than throwing money in the garbage.

Backyard to table: Get into the routine of gardening

Backyard to table: Get into the routine of gardeningA garden can be a great way to save money, providing your family with a bounty of delicious food. It can also be expensive, due to various startup costs. Follow these tips to make your first garden both a financial and culinary success.

401(k) plans: Is my company's default option the best?

401(k) plans: Is my company's default option the best?401(k) plans expense ratio offered through a reader's job is competitive, but not the best. What are his other options? Question 1 in this week's mailbag deals with how to get the most out of 401(k) plans.

Buying a new home? Consider downsizing.

Buying a new home? Consider downsizing.When you're buying a new home, especially your first, you probably don't need as much house as you think. A smaller fit might be a better (and cheaper) one.

Trim your grocery bill by sticking to the list

Trim your grocery bill by sticking to the listA list is your best defense against overspending at the grocery store.

Grocery store flyers: Your meal planning guide

Grocery store flyers: Your meal planning guideThose coupon sheets from grocery stores that you get in the mail? Don't thrown them away. Use them to your advantage.

If at first you don't succeed in the kitchen, try, try again

If at first you don't succeed in the kitchen, try, try againCooking is not easy for everyone, this is simply a fact of life. But just because crafting a delicious, homemade meal doesn't come easily doesn't also mean you should give up. Getting comfortable in the kitchen may take practice, but it's absolutely worth it.

Material world: Tips to help children grow up free of entitlement

Material world: Tips to help children grow up free of entitlementA large portion of a child's sense of right and wrong can come from early experiences. Help your children grow up free from the influence of material wealth and entitlement by encouraging them to volunteer, donate to charity and remember to stay thankful.

Eating before grocery shopping cuts down on impulse buys

Eating before grocery shopping cuts down on impulse buysOne of the biggest unnecessary costs when it comes to the grocery store is impulse buying. Cut down on this problem by always making sure to shop after you've eaten, this way avoiding delicious but unnecessary temptations, and saving you money.

Common dollars and sense: Eating less fast food does a body good

Common dollars and sense: Eating less fast food does a body goodWhen it comes to fast food, it's just common sense. The average American spends $232 per month eating meals prepared outside the home. With 18.2 meals eaten outside the home in an average month, these meals outside the home costs a person $12.75.

Pull that plug: Watching TV is more expensive than many assume

Pull that plug: Watching TV is more expensive than many assumeEvery calculated how much money it costs your family to feed your television habit? If the answer is no, don't worry, our personal finance expert has done it for you. And his findings might surprise the average television fan.

Student loans overwhelming? Make a chart to track your payment progress.

Student loans overwhelming? Make a chart to track your payment progress.Student loans can seem insurmountable, but tracking small steps in paying them down can help you feel as though you're making progress. Noting even $10 payments on student loans can motivate you to get the rest paid off.

Are you neglecting your air conditioner?

Are you neglecting your air conditioner?Air conditioning units can be rendered all but useless if too much dirt and dust accumulates. If you want your air conditioner to run effectively, and for a long time, you need to give it some attention.

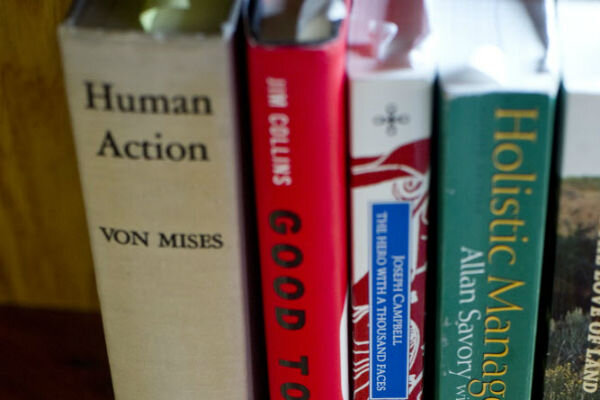

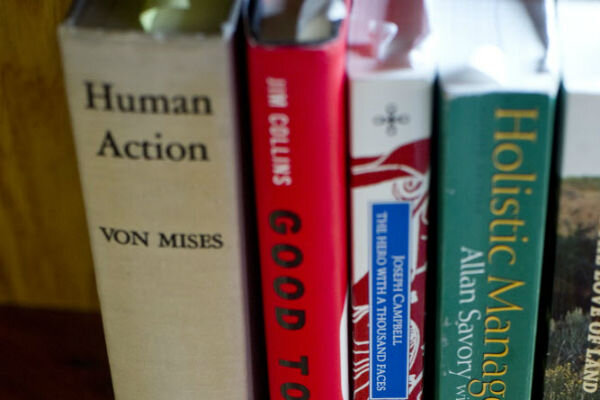

The perfect hobby? Reading books is fun, cheap and good for you

The perfect hobby? Reading books is fun, cheap and good for youA single good-sized book will provide you with many hours of entertainment, it will make you think about some aspect of the world around you and make you reconsider that aspect a little. And even better, that single book can be acquired for practically nothing.

Never pay to game again: 5 great free online games

Never pay to game again: 5 great free online gamesWith the wealth of excellent free games online, there's scarcely the need to pay for a game ever again. Here are five of the best, for free.