The case against US oil abundance

Loading...

Back in March 1999 "The Economist" magazine carried a cover photo of two men drenched in oil as they attempted to close a faulty valve that was spraying a huge stream of crude skyward. Over the photo was the headline: "Drowning in oil." At the time it really did seem as if the world were drowning in oil.

The previous December crude oil on the New York Mercantile Exchange touched $10.72 per barrel. That month U.S. gasoline prices averaged 95 cents per gallon. "The Economist" opined that oil might go down to $5 per barrel.

But, of course, in retrospect the magazine's cover proved to be the perfect contrarian indicator, for oil had already begun its historic ascent toward $147 per barrel. The 2008 price spike was the culmination of a 10-year bull market that had begun in December 1998.

After dipping briefly to around $35 per barrel at the end of 2008 in the wake of the financial crisis, the new oil bull market sent world benchmark Brent Crude to a daily average of more than $100 per barrel for all of 2011, 2012 and 2013. Through October 27 the average daily price for this year has been $104.86, not all that different from the last three years.

The swift price decline of Brent Crude from $110 on July 1 to about $85 today has the media buzzing about a glut. But can oil which now trades at eight times its price in 1998--when there really was a glut--be said to be experiencing a glut now?

Certainly, there is more oil available than people are willing to pay $100 per barrel for. While there have been many explanations for the downward move in price, all we can say for sure is that recently there were more sellers than buyers; and so, the price slid as the buyers stepped away, waiting for the price to come down.

But, is this really a glut? In 1998, even what poor people were paying for oil and oil products was relatively affordable, making it easier for them to enjoy the power and comforts that cheap oil and cheap energy in general make available to individuals.

Now, the price of energy and oil, in particular, is leading some of the newly poor in Greece (made so by that country's ongoing economic depression) to seek out firewood--both legally and illegally obtained--to heat their homes instead of heating oil. The drop in vehicle miles traveled in the United States in recent years suggests that high gasoline prices are in part responsible for fewer miles traveled.

When it comes to total U.S. petroleum consumption, the top 10 weeks for consumption occurred from 2005 to 2007. The most recent consumption number (week ending October 24) remains 2 million barrels per day below the peak reading in 2005. European petroleum consumption remains in a downward trend as well. All this suggests a decline in the standard of living for most Americans and Europeans, at least, when it comes to oil and its benefits. (One colleague of mine now speaks of peak benefits from oil rather than peak oil.)

Yes, the price drop has only just occurred, and, of course, we can't expect that it will have an immediate affect on consumption. But, increased consumption would likely take the oil markets back above $100 per barrel since small changes in supply and demand tend to move the oil price sharply. At the $100 level no one would be calling the situation a glut.

The oil industry has been using the term "abundance" for years as a public relations ploy to prevent people from realizing that oil is neither cheap nor abundant anymore. But the word "glut" has produced night terrors in the minds of oil executives. "Glut" implies that investors should stay away from a market that cannot make them any money. "Abundance" is okay for industry television ads aimed at lulling the public and policymakers to sleep. But, "glut" is bad for business.

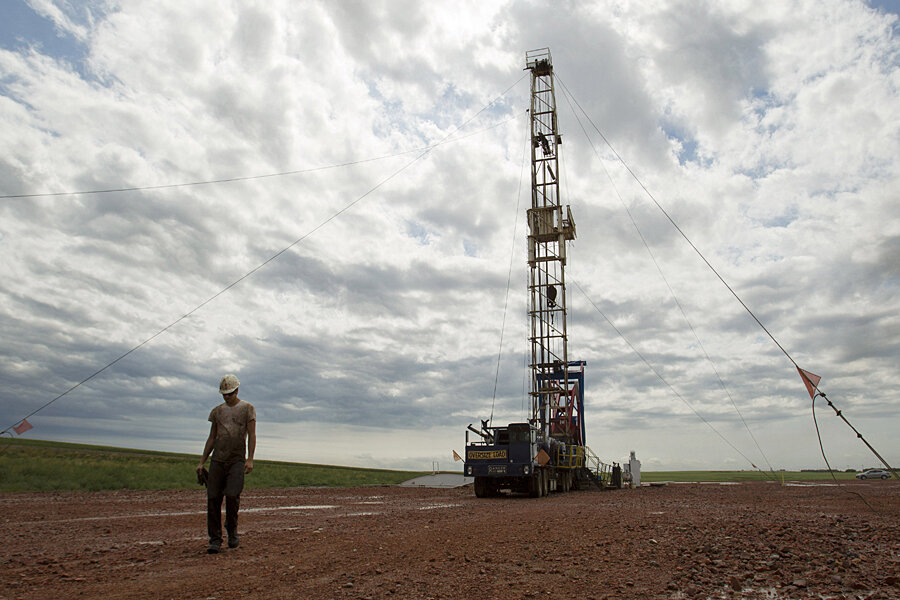

The real problem is that it is costing more and more to get the oil that remains out of the ground. Consumers will buy oil depending on their ability to pay, not on the price which the oil companies need to charge in order to cover the cost of producing it.

Ironically, the swoon in oil prices could easily lead to renewed price spikes as the price falls below the cost of producing the most expensive barrels of oil. Under such conditions, the industry will stop producing these barrels and supply will decline--leading to another price spike when demand picks up.

It turns out that between consumers who can't afford to pay higher and higher oil prices and companies which can't afford to produce the extra oil we'd like at lower prices, we are stuck in an ever-shrinking no man's land, a price band really--one that will eventually disappear as the average cost of producing the extra barrel of oil the world desires goes beyond what consumers including businesses can and will pay.

That will have us wondering why we allowed ourselves to sleepwalk through the last few years, even as continuing high prices and consumption declines sounded the alarm--one that told us we needed to speed up a transition to a renewable energy economy and reduce our energy use wherever possible instead of falling for talk of "abundance" and "glut."